Ethereum’s price has been stuck in a consolidation phase, trading between $2,700 and $2,340, without a clear breakout in sight.

Despite recent dips below its uptrend line, a historical pattern suggests the possibility of a future rally. If Ethereum can maintain key support levels, a breakout may be on the horizon.

Ethereum Repeats History

Analyst CryptoBullet recently highlighted that the ETH/BTC chart may be forming a bottom, resembling a pattern seen in late 2016. At that time, Ethereum rallied 2,738% over the following months. While such a spike is unlikely in today’s market, the formation is encouraging for investors.

However, expecting a 2,738% surge for ETH in current conditions would imply a climb above $66,000, which is unrealistic. Still, even a fraction of this historical rally could produce significant gains. If Ethereum’s ETH/BTC pair successfully establishes a bottom, it could pave the way for a sustainable rise over the coming months, supported by strong market sentiment.

Read more: How to Invest in Ethereum ETFs?

ETH/BTC Bottom Pattern. Source: CryptoBullet

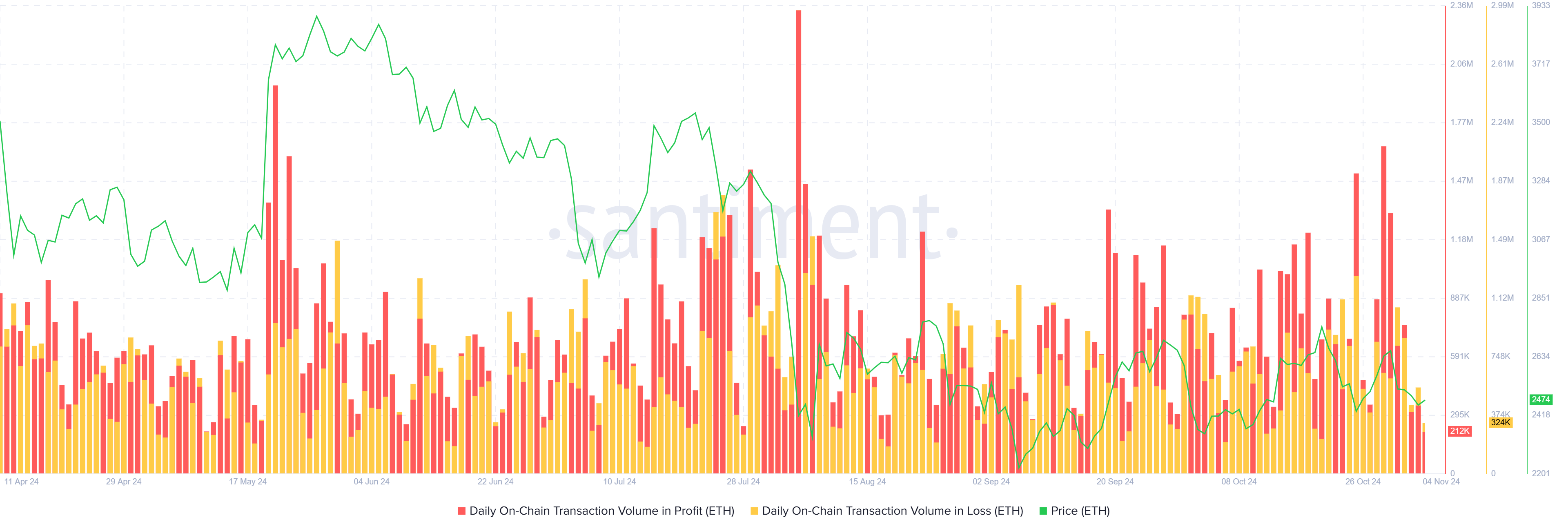

Ethereum’s macro momentum also points to potential upside. The daily on-chain transaction volume in profit has been consistently outpacing transactions in loss, signaling an underlying strength in Ethereum’s market conditions. This suggests that a large portion of ETH holders are in profit, which could support a breakout from the ongoing consolidation.

Higher volumes in profitable transactions typically hint at bullish sentiment. When more transactions generate profit, it can reinforce Ethereum’s price resilience, especially as traders anticipate further gains. This momentum positions Ethereum well for an eventual escape from its current range, as demand could increase if ETH approaches its upper limits.

Ethereum Transaction Volume in Profit/Loss. Source: Santiment

ETH Price Prediction: Short-Term Goals

For Ethereum’s consolidation to break, flipping $2,700 into support will be critical. Achieving this level would affirm a bounce from $2,546, helping ETH maintain its uptrend line established in September. Holding above these support levels would signal a continuation of Ethereum’s strength.

If ETH successfully turns $2,700 into a support level, the next target would be $3,000. This is a realistic outlook compared to the more speculative gains seen in the past. Achieving $3,000 could encourage new buying, potentially extending Ethereum’s rally.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Ethereum Price Analysis. Source: TradingView

However, this bullish scenario could be negated if Ethereum loses support at the uptrend line and drops to $2,344. Such a decline would increase bearish pressure, challenging Ethereum’s ability to regain upward momentum in the near term.

Read the full article here