The Arbitrum (ARB) price is navigating through a challenging period, highlighted by several indicators suggesting investor interest might be waning.

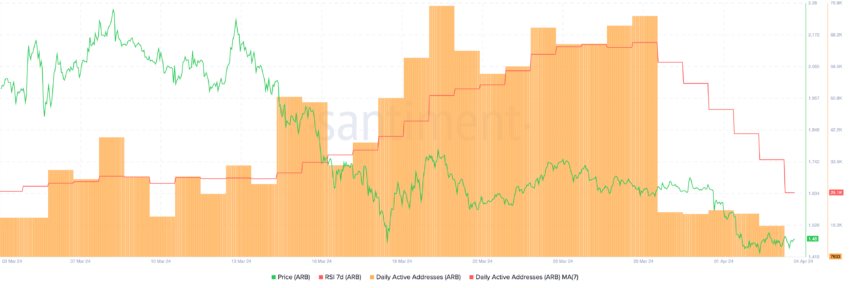

The most striking is the Relative Strength Index (RSI) sliding to its lowest since November 2023, combined with a steep decline in daily active addresses. This confluence of factors points to a complex landscape for ARB, raising questions about its near-term price trajectory.

ARB Metrics Indicate Cooling Interest

The RSI, a momentum oscillator that measures the speed and change of price movements, has shown a noticeable decline from a high of 75 on March 13 to 51. This indicates a shift from previously strong buying pressure to a more neutral stance.

Despite being in the neutral range, this gradual decline hints at a slowdown in market activity and potential challenges in price appreciation if the trend of diminishing interest continues.

ARB RSI. Source: Santiment.

Moreover, daily active addresses on the Arbitrum network have fallen to one of the lowest levels since January. This suggests a notable decrease in user engagement and transactions.

Indeed, this decline, particularly sharp since March 29, is a bearish signal, reflecting waning interest or use that could negatively affect ARB’s demand and price.

Read More: A Guide to Arbitrum Blockchain Explorer

ARB Active Addresses. Source: Santiment.

Arbitrum Price Prediction: Lower Lows

March saw a death cross occurrence in ARB’s Exponential Moving Averages (EMAs), a bearish signal typically heralding a potential bear market. Since this event, Arbitrum’s price has faced a sharp 44.62% correction.

If the current downtrend exacerbated by competition among Ethereum scaling solutions continues and critical support levels at $1.22 and $1.03 are breached, ARB could potentially fall to as low as $0.98.

ARB Price Chart. Source: TradingView.

Conversely, a shift in market sentiment could propel ARB to recovery targets of $1.75 or $1.80, offering hope for a bullish reversal amidst current market challenges.

Read the full article here