- ASIC sued Binance Australia Derivatives for not protecting consumer information.

- Binance reportedly misclassified retail investors as wholesale clients.

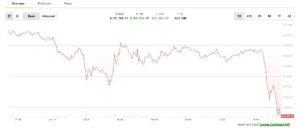

ASIC filed a lawsuit in the Federal Court complaining Binance is not focusing on its consumers protection. Based on the latest media release from its organization, more than 500 retail clients were misclassified and treated as wholesale clients. In the middle of a booming crypto market, Binance facing a lawsuit might affect its capability to capture large trading volumes.

The latest media release from ASIC reported that more than 500 retail clients of Oztures Trading Pty Ltd, which is trading as Binance Australia Derivatives, were not protected and misclassified. As per ASIC allegations, Binance offered crypto derivatives products to retail investors from 7 July 2022 to 21 April 2023. Around 505 retail clients, representing 83% of its Australian client base, were misclassified as wholesale clients.

According to Australian financial services laws, retail clients have “important rights and consumer protection” obligations to trade financial products. A product disclosure statement and access to a compliant dispute resolution are some of the rules under the financial services laws of the country. In addition, Binance had to make a target market determination under design and distribution obligations.

Binance Failed to Comply With Australian Financial Services Laws

In the period from July 2022 to April 2023, Binance failed to give a detailed product disclosure to clients and comply with conditions of its Australian financial services license. It also didn’t have a complaint internal dispute resolution system and neither made a target market determination. Overall, Binance didn’t ensure that financial products were not offered efficiently, fairly, and honestly.

ASIC Deputy Chair Sarah Court said that Binance exposed more than 500 clients to high-risk and speculative products without the right consumer protections in place. Since many of the clients faced significant financial losses, ASIC oversaw around $13 million compensation payments from Binance to affected clients.

The ASIC will be seeking penalties, declarations, and adverse publicity orders for its consumer protection failures. They are going to use their full range of regulatory and enforcement tools to safeguard consumers in the digital asset sector. Furthermore, they are consulting with the sector to improve regulatory clarity in the crypto industry.

Read the full article here