Author: News Room

March was an exceptional month for the crypto market as investors witnessed Bitcoin prices hitting all-time highs as well as the rise of multiple major altcoins. However, despite the bullishness, some altcoins missed the mark. These altcoins will likely print new all-time highs in the coming month of April, when the second quarter of 2024 begins. SUI Will Be the First to Shatter the Record Sui is the altcoin in the top 100 cryptocurrencies list that is the closest to printing a new all-time high. The altcoin made an attempt last month but failed only to witness a 21% rise…

Many of Goldman Sachs’ largest clients are ramping up their activity in the crypto space following spot bitcoin exchange-traded fund (ETF) approvals and BTC price recovery. “The recent ETF approval has triggered a resurgence of interest and activities from our clients,” said Goldman Sachs’ Asia Pacific head of digital assets. Goldman Sachs’ Clients Getting Active […] Read the full article here

A widely followed crypto analyst says that smart contract platform Solana (SOL) looks bullish on multiple timeframes. In a new video update, Guy Turner, the host of Coin Bureau, tells his 2.45 million YouTube subscribers that Solana’s weekly and monthly charts foreshadow a 35-45% breakout for the Ethereum (ETH) rival above the $300 price tag. According to Turner, Solana is also breaking out against Bitcoin (BTC), and he says that since the flagship digital asset is itself on the cusp of a rally due to its upcoming halving event in April, Solana could go even higher. 12:30 “In SOL’s case,…

Grayscale Optimistic That Spot Ethereum ETFs Will Be Approved Amid ‘Lack of SEC Engagement’

Grayscale’s chief legal officer still believes the U.S. Securities and Exchange Commission (SEC) could greenlight spot Ethereum (ETH) exchange-traded funds (ETFs). Craig Salm says the Ethereum ETFs “should be approved” and notes that he’s not deterred by the negative chatter surrounding the proposed financial products. He also says the SEC’s perceived lack of engagement on the spot ETH ETF applications shouldn’t necessarily be viewed as negative. “In the final months leading up to Bitcoin ETF approval, Grayscale and others received positive and constructive engagement from the SEC. We had thoughtful conversations and discussed the finer details of creation/redemption procedures, cash…

FTX’s bankruptcy estate is primed to pay its creditors more than the value of their original claims, according to the Financial Times. Citing two people “with knowledge of the restructuring negotiations,” FT reports that the imploded crypto exchange will likely pay its former customers 120-140% of the value of their holdings on the day FTX filed for bankruptcy in November 2022. The increased payouts are thanks to soaring crypto prices and FTX’s 8% stake in the AI (artificial intelligence) safety and research company Anthropic. The bankrupt exchange’s administrators reportedly plan to sell two-thirds of that Anthropic stake to a group…

Fidelity Investments has taken another step in its effort to launch a spot Ethereum ETF, filing a registration statement on March 27 despite the uncertain regulatory landscape. The move follows a previous filing by Cboe, the exchange planned for this ETF, which submitted a form 19b-4 to the SEC on Fidelity’s behalf in November 2023. Fidelity’s actions, alongside those of other firms aiming to introduce spot ether ETFs, illustrate the growing interest in integrating digital assets into traditional financial products. Yet, obtaining regulatory approval presents a notable challenge, highlighting the evolving and uncertain nature of crypto regulation. S-1 filing The…

Munchables recovers $62.5 million in user funds after exploit linked to North Korean hacker

Munchables, a web3 game operating on the Ethereum layer-2 network Blast, has successfully recovered the $62.5 million it recently lost to an exploit. The platform disclosed that the attacker voluntarily provided all relevant private keys to facilitate the return of user funds. The keys holding the $62.5 million worth of ETH, 73 WETH, and the main owner key were shared. Pacman, the founder of the layer-2 network, corroborated this development, stating that the hacker returned all stolen funds without demanding any ransom. Furthermore, Pacman announced that $97 million had been safeguarded in a multisig account controlled by Blast’s core contributors.…

Wladimir van der Laan – the former lead maintainer of Bitcoin Core – is mulling a comeback to Bitcoin development after the high-profile industry lawsuit, COPA v. Wright, came to a close earlier this month. In a blog post last Friday, the Bitcoin pioneer expressed relief and disbelief over the prosecutors’ victory, which saw London high court judge Edward James Mellor declare that self-styled Bitcoin creator Craig S. Wright is not, in fact, Satoshi Nakamoto, nor the author of Bitcoin’s whitepaper. Freedom From Craig Wright’s Pressure In agreement with the ruling, van der Laan asserted that Wright is an outright…

As the world gets into a frenzy around the coming Bitcoin halving – and the price of bitcoin (BTC) as a result – it’s important to take a moment for a reality check. This feature is part of CoinDesk’s “Future of Bitcoin” package published to coincide with the fourth Bitcoin “halving” in April 2024.David Bailey is chief marketing officer for Azteco. The halving is a non-event for the vast majority of the world. At its core, it’s a simple evolution in how much the people who process bitcoin transactions get paid. All electronic payments, whether made via credit card, Venmo…

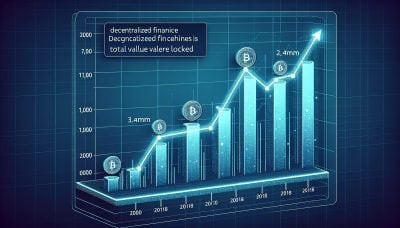

The decentralized finance (DeFi) ecosystem is undergoing a shift towards more rational investments and maturing confidence, according to Exponential.fi’s latest report “The dawn of a new era in DeFi: From winter chills to summer thrills.” As the ‘DeFi Winter’ weakens its grip, the report states that the path ahead is a ‘hot bull summer’. Investors are now showing a marked preference for security, with a significant 75% of DeFi’s total value locked (TVL) flowing into pools offering a modest annual percentage yield (APY) of up to 5%. This conservative shift is particularly noticeable in Ethereum staking pools and highlights a…