Base is growing its underlying app activity, even after the slowdown of memes and AI agents. The growth of Morpho lending and overall DeFi value locked is driving the expansion of Base.

Base keeps growing based on DeFi lending, as its app activity is up by 129%. The chain carries more than 500 decentralized apps, though top DeFi hubs are trending in early 2025. Activity on the tokenless chain expanded to over 2M daily active users in January, as the chain increased its liveliness in the past three months.

Base app-based volumes reached an all-time peak after a boost from Morpho Labs and DeFi lending. | Source: DappRadar

The activity of the SynFutures DEX and Morpho DeFi lending is driving adoption. Base started out as a chain for fun NFT and meme experiments, but is now moving forward with DeFi, with a growing turnover of cbBTC trading. Morpho expanded after being promoted by Coinbase as a source of crypto-backed loans. The app offers access to Coinbase users, to borrow against a collateral of Bitcoin (BTC).

The other factor boosting Base was its addition to Phantom Wallet, which was used to onboard more new users in the last quarter of 2024.

Base app volumes reached an all-time high in January, after months of accumulating users. Initially, Base was producing mostly low-value traffic, with accessible transactions and meme-based activity. Currently, Base also carries $2.27B in cbBTC, further boosting liquidity for DeFi activities.

Over time, Base locked in $3.47B in total value, though other reports count higher value locked in smart contracts. Morpho Blue, the Base version of the lending protocol, locks in a total of $3.56B on all chains, making up a significant part of the Base inflows. The lending protocol recently expanded its assets and loans to a new all-time high.

Decentralized app activity and complex interactions with DeFi protocols are increasing throughput for Base or gas spent on each transaction. Base is ahead of other L2 in the throughput metric, with constant growth since the chain’s launch.

Top DeFi apps boost Base revenues

Based on DappRadar reports, Base carries $2.44B in its top DeFi apps, or $1.59B in adjusted value. The chain’s top apps include Uniswap V2 and V3, Aerodrome, Morpho, and Moonwell. The path of development chosen by Base is capable of competing with Solana, though the chain still lags in most metrics.

The increased app activity also translated into higher fees for the chain. Base achieved over $12M in fees for December, and over $11.48M for January to date. Base is one of the few chains with a relatively low cost of revenues, managing to retain most of its on-chain earnings. For the past three months, Base has achieved more than $8M in retained earnings after paying out incentives.

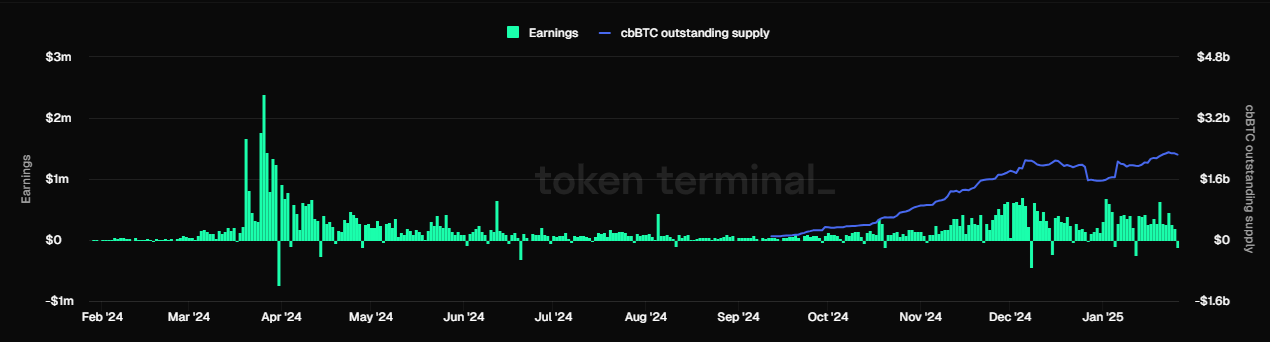

Base earnings increased as the supply of cbBTC grew in the past three months. | Source: Token Terminal

Base revenues grew again in the last quarter of 2024, though not reaching the peak levels from April. The chain’s activity is now more sustainable, coinciding with the expansion of cbBTC. The recent Base expansion follows a period of deliberate marketing, which however produced much lower traffic.

Base only pays a few thousand dollars to verify its transactions on Ethereum, hardly cutting into the chain’s earnings. Base remains one of the cheapest L2 to transact. The current app activity may be more organic, as Base has not hinted at airdropping a token. The chain carries some low-value or zero-cost transactions, but there is no immediate expectation of airdrop farming.

Base picks up Ethereum’s activity

After the initial success of Arbitrum, Base looks like the chain that is taking up activity and liquidity from Ethereum. Arbitrum retained its status as the chain for DEX swaps and risky trading, while retaining its relatively high inflows from the L1 chain. Arbitrum is still the leader with $5.6M in stablecoin liquidity, while Base is slowly catching up with $3.6B in stablecoins.

Movements of liquidity from Ethereum into Base reached $3.44B, with a 5% share of stablecoins and the inclusion of ETH and bridged tokens. A total of 612,691 ETH have been bridged on Base for liquidity and DEX trading.

Base is still one of the leading chains for DeFi and CeFi activity, but with Coinbase’s efforts to offer consumer crypto products. Base still relies on Coinbase’s regulated status, and the reputation of USDC, its most widely used stablecoin. Base is one of the leading chains for token transfers and general on-chain utility.

Read the full article here