HashKey Global, a leading figure in the cryptocurrency sector, has inaugurated its latest venture, a global exchange located in Bermuda. This development positions HashKey alongside Coinbase, marking a significant expansion from its origins in Hong Kong to the international stage.

During a discussion on April 8 with Bloomger, Ben El-Baz, the Managing Director of HashKey Global, shared insights into the company’s decision to establish its exchange in Bermuda. The decision came after witnessing Coinbase’s successful acquisition of a Bermuda license, showcasing the island’s favorable and robust regulatory environment for cryptocurrency exchanges. This move is seen as an essential step for HashKey in its quest to broaden its global footprint.

The catastrophic downfall of FTX in 2022 has led to a heightened awareness among exchange users about the risks associated with counterparties. El-Baz believes this shift in user sentiment opens up an opportunity for HashKey Global to amalgamate Binance’s superior user and product experience with Coinbase’s stringent regulatory and security framework.

HashKey Global sets an ambitious target to become the “largest globally compliant exchange in the world” within the next five years, aiming to outperform its competitors, including Coinbase International, which reported significant trading volumes in derivatives.

Differing from its Hong Kong-based counterpart, HashKey Global will not cater to markets in Hong Kong, China, the United States, and several others. This move follows the Hong Kong-based exchange’s achievement of unicorn status earlier this year after a significant Series A funding round propelled its valuation to over $1.2 billion.

The new funds are earmarked for expansion across the company’s various business domains, including asset management and blockchain-based services.

Over the forthcoming six months, HashKey Global will offer a suite of services, including spot and futures trading, staking, and a project launchpad. The exchange also plans to ensure deep market liquidity from the outset, thanks to partnerships with liquidity providers and market makers.

While specifics regarding the financial investment in HashKey Global’s Bermuda venture were not disclosed, El-Baz emphasized the exchange’s robust capitalization and acknowledged Bermuda’s stringent capital requirements for licensed entities. This approach underlines HashKey Global’s commitment to meeting and exceeding regulatory standards, positioning itself as a secure and innovative platform in the global cryptocurrency market.

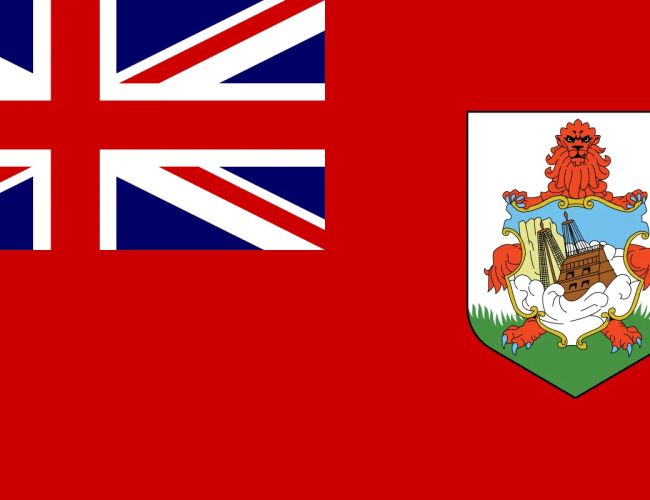

Cryptocurrency in Bermuda

In 2024, Bermuda has emerged as a leader in the regulation of blockchain and cryptocurrencies, as detailed in the latest chapter authored by Partner Steven Rees Davies, counsel Charissa Ball, and associate Alexandra Fox in the Global Legal Insight’s guide. Bermuda’s approach has been comprehensive, treating all cryptocurrencies, digital coins, and tokens under the umbrella term of “digital assets” and introducing significant legislation to govern the burgeoning industry.

The Bermudian government, underpinning its positive stance towards the sector, has rolled out two key pieces of legislation: the Digital Asset Business Act (DABA) and the Digital Asset Issuance Act (DAIA). These laws aim to provide a legal and regulatory framework for businesses and issuances in the digital asset space, offering clarity and security to participants while maintaining high international standards for regulation and compliance.

The DABA, enacted in 2018, outlines a licensing regime for entities engaged in the digital asset business. This regime encompasses a wide range of activities, from operating digital asset exchanges to providing custodial wallet services. This act necessitates obtaining a license from the Bermuda Monetary Authority (BMA) and meeting various operational and compliance standards.

On the other hand, the DAIA, effective from May 2020, regulates digital asset issuances, mandating authorization from the BMA for undertakings seeking to conduct such issuances. This act aims to protect acquirers of digital assets and ensure the integrity and transparency of the issuance process.

Furthermore, According to Carey Olsen, Bermuda has innovated with the introduction of the Insurtech Sandbox and a unique digital asset bank licensing regime, with Jewel Bank being the first recipient. These initiatives facilitate the testing of new technologies and offer traditional banking services to the digital asset sector, reflecting Bermuda’s commitment to fostering innovation while ensuring regulatory compliance.

The government’s proactive approach includes launching a blockchain-based stimulus token for retail use and ongoing development of technology projects, such as a digital ID system and submarine cabling legislation. These efforts underscore Bermuda’s ambition to enhance its digital infrastructure and secure its position as a global hub for blockchain and cryptocurrency.

The BMA, integral to these regulatory efforts, engages actively with the global financial innovation community through its membership in the Global Financial Innovation Network. This participation facilitates a collaborative approach to innovation, allowing Bermuda to adapt and thrive in the rapidly evolving digital asset landscape.

Read the full article here