In light of the Securities and Exchange Commission dropping its probe into Paxos over its branded Binance stablecoin (BUSD) — after it was almost completely unwound — one wonders whether there was any material impact on Binance.

It turns out, not so much, at least going by how much crypto users are keeping there.

Collating Binance’s monthly proof of reserves reports shows the firm disclosing $115 billion in user funds at the start of July, up from $61 billion one year ago.

When reports first surfaced of a years-long Department of Justice investigation into Binance in December 2022, there was $45.6 billion. That’s 150% growth as US agencies rained down on Binance, then-CEO Changpang Zhao and, apparently, at least one company that supported them.

Read more: IRS, Justice Department probing Binance

BUSD was the seventh largest cryptocurrency by market cap, worth $16.1 billion before the SEC sent its Wells notice to Paxos in February 2023.

Paxos stopped minting new tokens and over the next month, BUSD holders redeemed about half the supply. By January this year, there was only $100 million in circulation.

Read more: SEC triggers billion-dollar ‘bank run’ on Binance’s BUSD

Other stablecoins including TrueUSD, USDT and FDUSD plugged the gap left by BUSD, with the latter two headquartered outside the US. TrueUSD meanwhile fell out of favor, leading to a number of delistings earlier this year.

The dollar value of user deposits obviously rises alongside prices, but the purple area and the orange line would decouple if there were any meaningful user exodus. It could also be that US intervention actually boosted confidence in Binance overall.

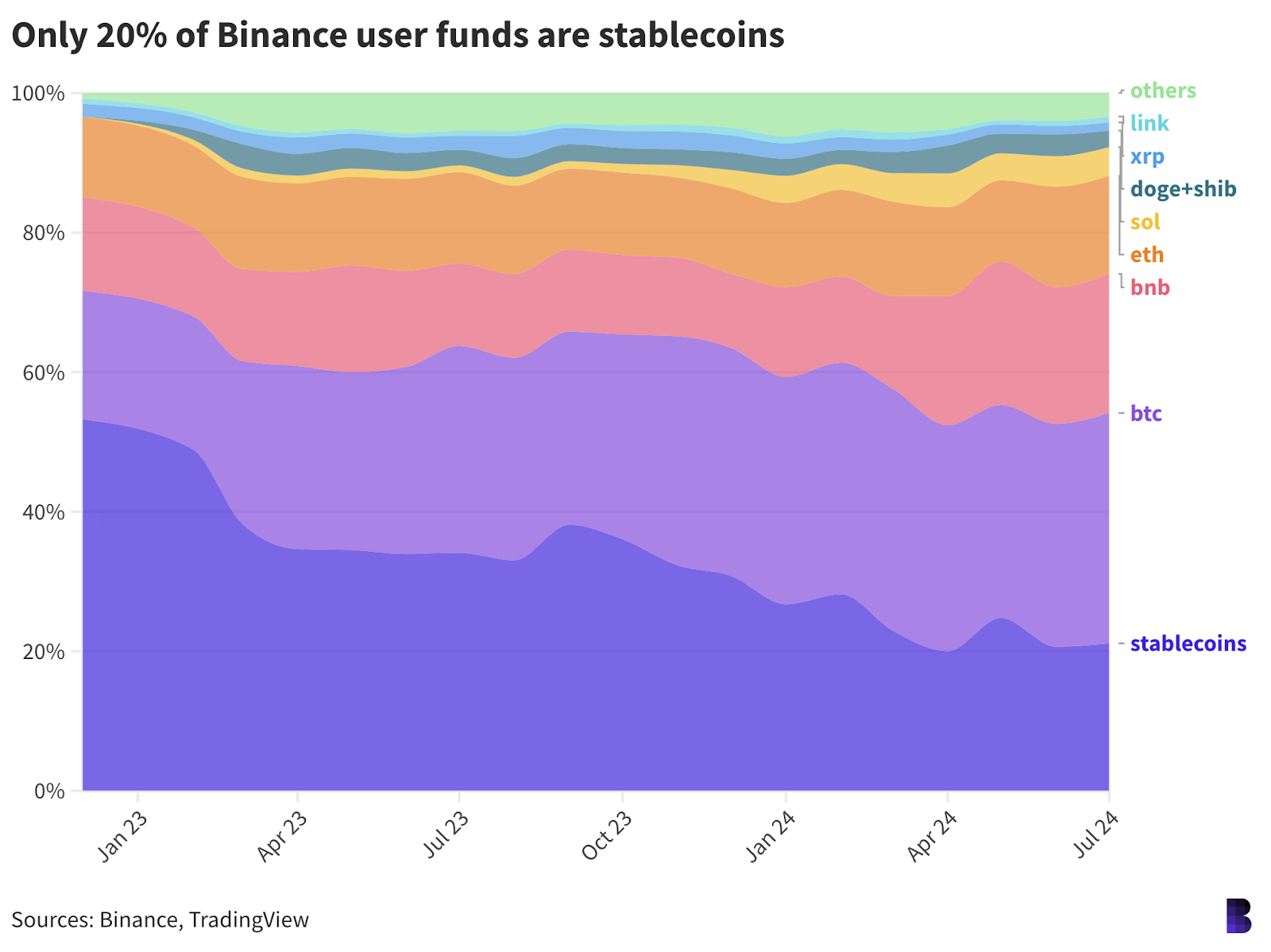

In any case, as Zhao waits out the rest of his sentence, the makeup of user funds on the platform is morphing, with the data indicating that the general consensus is to hold.

Bitcoin made up 18% of user funds in December 2022 — now it’s over one-third. Similarly, BNB went from 14% to 20%, while ETH has stayed largely unchanged at about 14%, presumably on account of lackluster price growth compared to bitcoin and BNB.

The real tell is that only one-fifth of all user funds on the platform are currently stablecoins — $24.4 billion — down from more than half before Zhao’s troubles really began.

That means 80% of Binance user funds are held in non-dollar-pegged crypto assets, practically the highest point on record (which, unfortunately, only began post-FTX).

A similar distribution is seen on OKX’s latest proof of reserves report, dated last month.

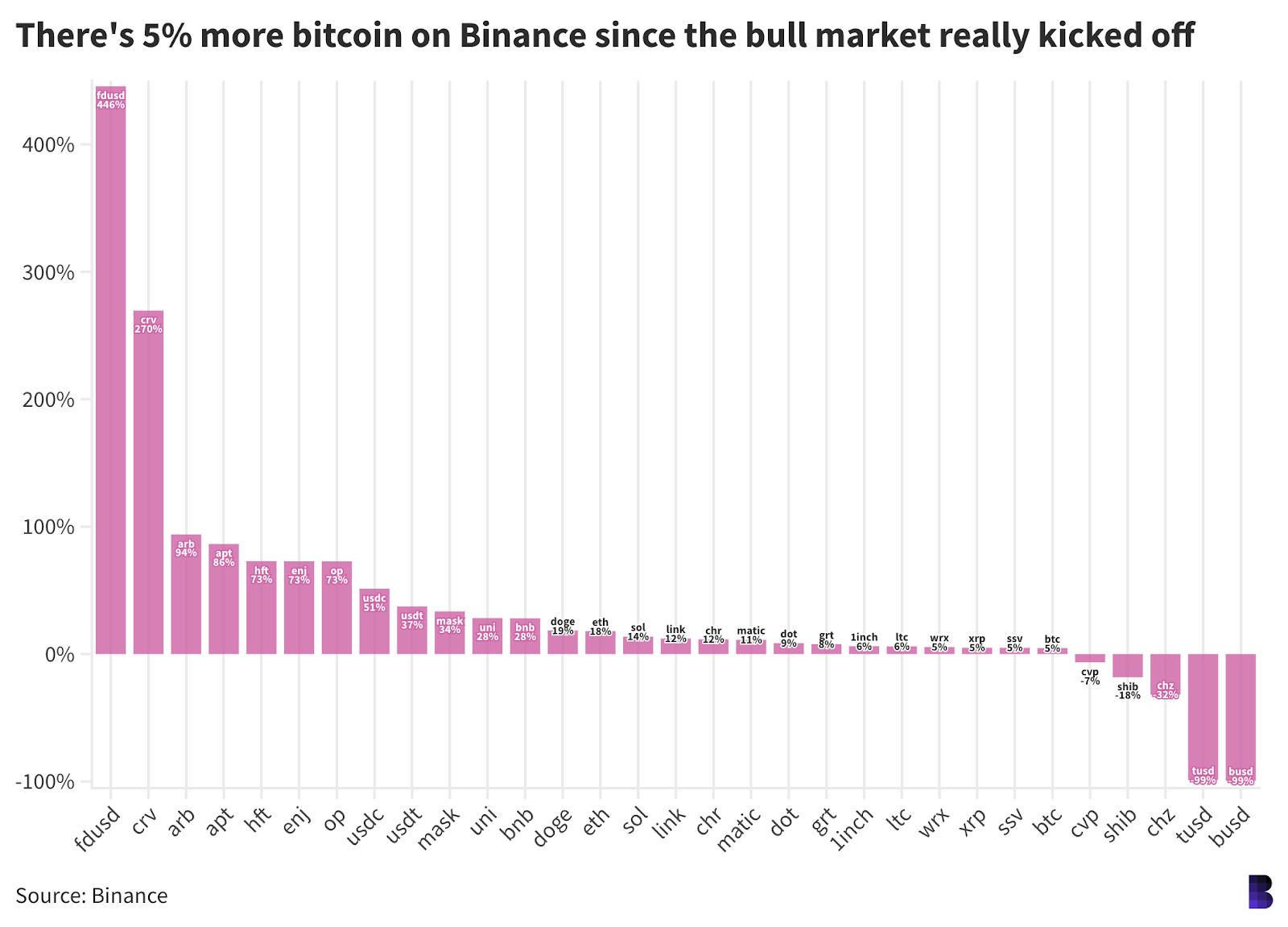

As for which cryptocurrencies Binance users are gravitating towards, comparing the most recent number of base units (as in, individual tokens) they held to how many were held in October 2023 can offer some insight. Bitcoin markets really picked up around then.

The tokens with the largest balance increases were curve DAO, arbitrum, aptos, hashflow, enjin and optimism, all growing by more than 70% (and in CRV’s case, 270%).

Chiliz and shiba inu were on the other end of the table, losing 32% and 18%, respectively. USDT and USDC balances meanwhile grew by 51% and 37%.

That could also just mean CHZ and SHIB holders pulled their tokens off Binance for long-term cold storage.

Either way, the data suggests that Binance users are confident after the SEC and DOJ’s actions that not only is everything at Binance above board, but that prices will widely rise from here.

A shorter version of this article first appeared in Friday’s Empire Newsletter. Sign up here to never miss an issue.

Read the full article here