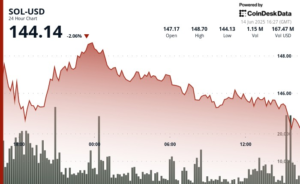

In April, derivatives trading volume on the largest exchanges decreased by 1.4% month-on-month.

However, futures trading volumes on Binance, the largest centralized exchange (CEX), rose more than 72% in April compared to March.

According to the Wu Blockchain team, the sharp increase in trading volume is due to Binance introducing a time-limited fee discount for USDC perpetual contracts, which led to a rise in trading volume for perpetual agreements.

However, excluding this, the total trading volume in April decreased by 26.6% compared to the previous month. The three largest declines in futures trading volumes were the exchanges Bitget at 16.1%, Crypto.com at 15.6%, and HTX at a 13.4% decline.

Source: Wublockchain

Spot trading volume fell even further, down nearly 38% month-on-month. Of all exchanges, Gate was the only one to see an uptick in activity at 13.7%. The exchanges that took the biggest hits were Kucoin at 70.8%, Upbit with a 57.5% decline, and Bitfinex with a 47.7% decrease.

In early April, Binance Futures introduced a trading fee discount for all USDC-margined perpetual contracts. During the promotion, all Binance users received discounts when trading any USDC-margined perpetual contracts.

The promotion began shortly after Binance founder Changpeng Zhao was sentenced to four months in prison due to violating the Bank Secrecy Act, and the exchange was fined $4.4 billion as a result.

Zhao pleaded guilty and made a deal with the investigation, resigning as CEO of Binance and agreeing to pay a $50 million fine.

You might also like: Too harsh or too lenient? Changpeng Zhao’s sentence divides opinion

Read the full article here