Binance’s BNB Chain became the leader for on-chain activity linked to distributed apps. The chain has moved ahead of Ethereum, getting a boost from a recent upgrade that further lowered fees.

BNB Smart Chain is quickly turning into the venue for decentralized apps, stepping ahead of Ethereum in terms of dApp-based on-chain activity. Despite the dominance of Solana in the meme token narrative, BNB Smart Chain is carving its own share of the meme market, as well as curated incentives for Binance Wallet users and BNB holders.

The Binance ecosystem is still attempting to revive its activity after two years of bear markets and low transaction levels, working with both large-scale funds like World Liberty Fi, and incentivizing retail users.

BSC benefits from ecosystem activity

Based on the DappRadar leaderboards, BNB Chain apps moved ahead in the past few weeks with growing economic activity. In the past day, BNB Chain posted over $80B in app volumes. The rankings can shift on a daily basis, and may reflect temporary growth for some chains, or one-off events that boost traffic.

BNB Chain preserved its app trend for the whole of the past week, with a long-term competition against Ethereum. The competition reflects the different use cases for some chains, ranging from large-scale whale movements to low-cost on-chain fun, airdrop hunting, or meme token speculation.

BNB Smart Chain still carries the major share of on-chain activity. | Source: Dune Analytics

The chain also carries over 697K daily active users, above the 450K active wallets on Ethereum.

BNB Chain has even surpassed Solana in dApp activity, with highly active decentralized trading. The recent incentives for trading on PancakeSwap are boosting overall volumes. The DEX is also the top app with over 62K daily active users.

PancakeSwap benefits from several campaigns, including the competition for airdrop points on Binance Wallet. PancakeSwap is also the main venue for USD1 trading and the meme tokens that trade against the stablecoin.

The recent recovery of BNB Smart Chain shows on-chain activity and the existing Web3 infrastructure are highly usable, but require incentives to bring in users and traders.

Binance trading still dominates the crypto market

The recent dominance of the Binance ecosystem is seen as relatively bullish. In general, activity on the ecosystem coincides with crypto exuberance and more active token trading.

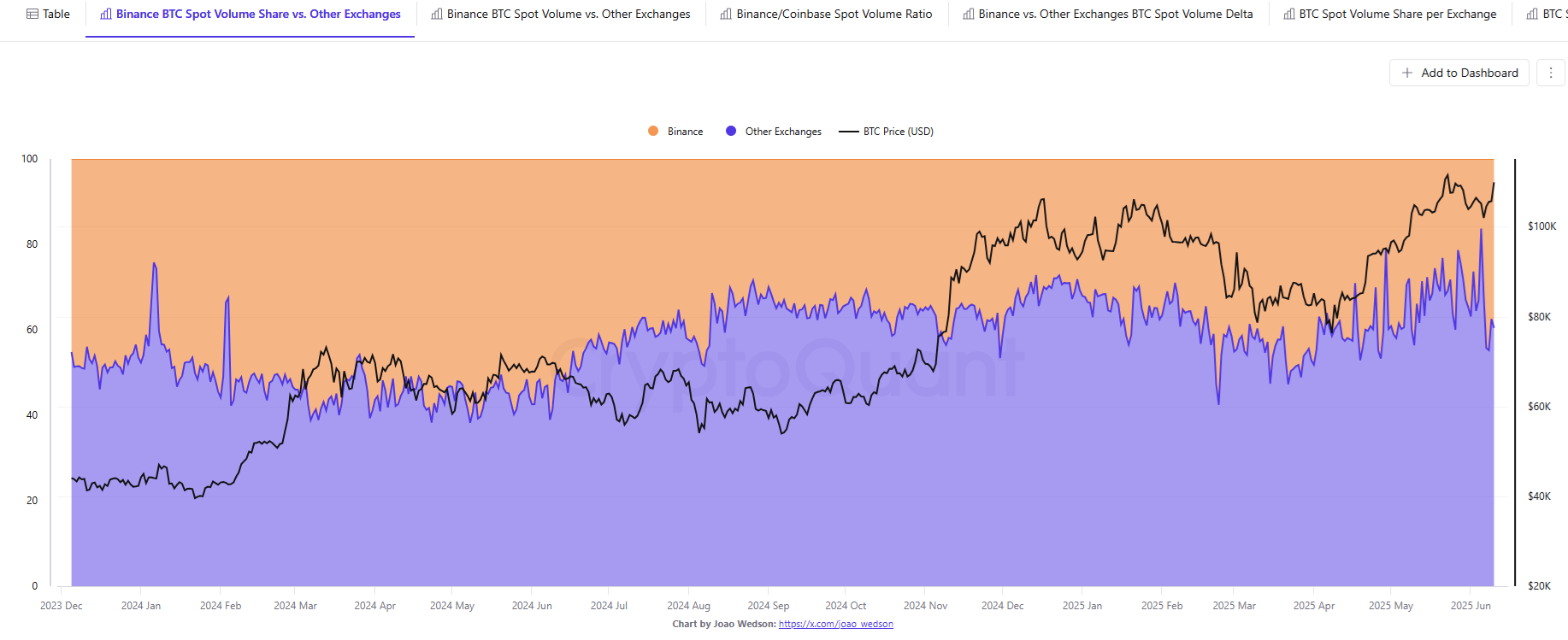

Binance’s share of trading is increasing again, suggesting a bullish direction for crypto markets. | Source: Cryptoquant

The dominance of Binance on centralized markets rose again, displacing all other exchanges. Based on CryptoQuant data, the exchange now carries over 39% of centralized trading volumes.

Historically, a share of over 30% for Binance has been linked to bullish periods on the crypto market. Binance allows for concentrated liquidity, often leading to coin and token rallies. While new listings on the exchange sometimes lead to selling pressure, tokens listed on the exchange have access to more significant liquidity and often have return rallies.

Binance’s dominance also signals the inflow of big players. The inverse indicator is when the CEX hosts below 30% of trading activity, suggesting an outflow of traders. Binance is constantly fending off competition from platforms like Pump.fun and Hyperliquid, but remains a key venue for liquidity.

BNB, the ecosystem’s native token, remains relatively stable, trading at $622.70.

Read the full article here