Key points:

-

Shorts looked primed to be taken out, analysis argues, with a long-term resistance trend line in focus.

-

Fed Chair Jerome Powell is due for replacement, leading to hyper-bullish bets on risk assets.

Bitcoin (BTC) dipped toward $107,000 after the June 30 Wall Street open as analysis eyed a major new “short squeeze.”

BTC price surfs liquidity into crunch candle closes

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reversing gains made into the weekly close, down 1.1% on the day at the time of writing.

With hours to go until the monthly and quarterly closes, traders expected volatility, while exchange order-book liquidity grew.

“With BTC spot edging toward $108k, we’re beginning to see a build-up in leveraged longs as perpetual funding rates flip from flat to positive across major exchanges,” trading firm QCP Capital noted in its latest bulletin to Telegram channel subscribers.

“Positioning appears to be chasing the move, as participants lean into directional bets ahead of quarter-end.”

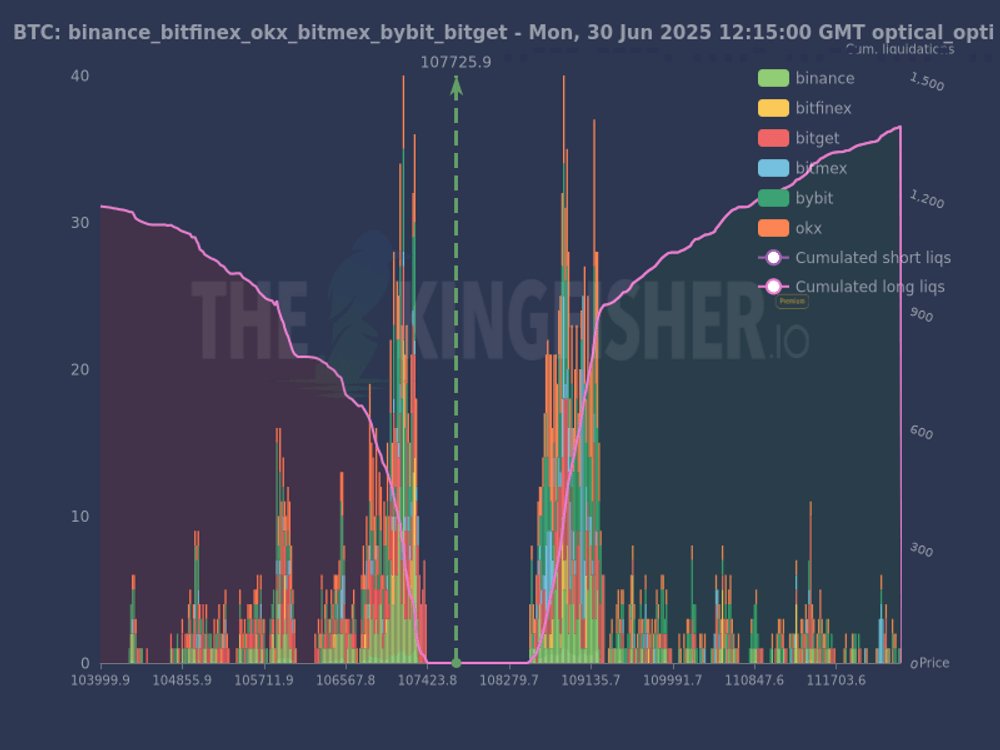

Discussing likely BTC price reactions, popular X trading account TheKingisher favored shorts feeling the heat — something which would ensue with only minor upside.

“Below us, a cluster of long liqs around 106k-107k. But above? A HUGE wall of short liquidations immediately above current price, peaking fiercely around 108k-108.5k!” part of a post summarized alongside cross-exchange liquidity data.

“That’s a strong magnet. Short squeezes can be brutal if price pushes through 107.5k.”

Continuing, popular trader and analyst Rekt Capital had mixed news for bulls. BTC/USD, now faced an important final resistance battle to open the door to price discovery.

“After having launched from this local green area of support… Price is now pulling back into this region for another retest,” he added about the daily chart.

“Continued stability here would enable another challenge of the Main Downtrend dating back to late May (black).”

Fed’s Powell replacement may trigger “one of the biggest runs” for stocks

Ahead of a quiet four-day TradFi week in the US, bullish crypto cues nonetheless came thick and fast on the day.

Related: Record Q2, monthly close next? 5 things to know in Bitcoin this week

A recommendation of a 40% crypto allocation by Ric Edelman, founder of $300 billion fund Edelman Financial Services, combined with news that Washington was set to seek a replacement for Jerome Powell, Chair of the Federal Reserve.

As Cointelegraph reported, Powell continues to field public criticism from US President Donald Trump over his refusal to lower interest rates, with the latter demanding that these fall from the current 4.25% to just 1%.

“If the new Fed Chair actually cuts rates to 1%, we are going to witness perhaps one of the biggest runs of all time in stocks and real estate,” trading resource The Kobeissi Letter predicted on the day.

“There has never been a time in history where the Fed cut rates to 1% with the stock market and home prices at all time highs.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here