Bitcoin declined 5.5% last week, falling from $110,000 to below $106,000 after escalating geopolitical tensions between Israel and Iran sparked a “risk-off” mood in the markets.

Despite the price dip, on-chain data reveals a powerful counter-narrative. While headline prices dipped, institutional and corporate demand for Bitcoin and altcoins remained exceptionally strong, signaling high conviction from the market’s largest players.

4H Chart With DMI and EMA50. Source: TradingView

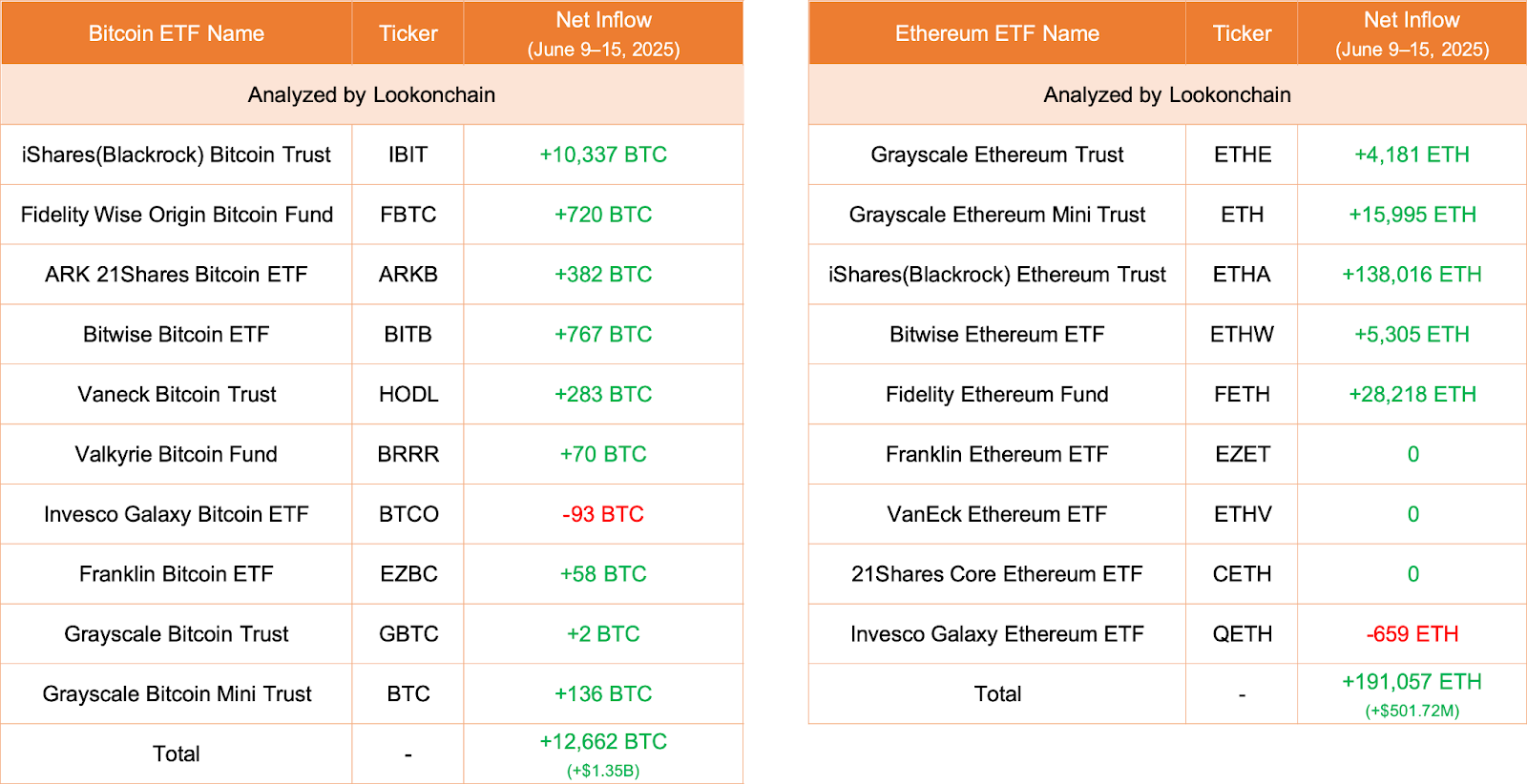

Institutional ETF Inflows Continue Unabated

Data from Lookonchain shows that spot Bitcoin ETFs saw another massive week of inflows. Ten Bitcoin ETFs added a combined 12,662 BTC worth $1.35 billion. BlackRock’s iShares Bitcoin Trust led with 10,337 BTC ($1.1B) added. Ethereum ETFs also saw inflows of 191,057 ETH ($501.72M). Again, iShares dominated with 138,016 ETH ($362.43M).

Bitcoin and Ethereum ETF Inflows (June 9–15, 2025). Source: Lookonchain

These large allocations from major firms signaled continued demand from institutional players, even as crypto prices pulled back.

Related : Profit-Takers Loom as Bitcoin Tests $110K Ceiling

Whales Accumulate Bitcoin and Ethereum

Strategy (MSTR) acquired 10,100 BTC ($1.05B), while Metaplanet added 1,112 BTC ($116.5M). On the Ethereum side, SharpLink purchased 176,271 ETH ($462.95M). A previously successful whale also bought 67,408 ETH worth $136 million.

On-chain transfer data showed ETH movements between Coinbase and Wintermute wallets, including a 26,000 ETH ($69M) transaction. These signals point to active accumulation from large holders despite recent volatility.

Related : Ethereum (ETH) Price Prediction For June 18, 2025

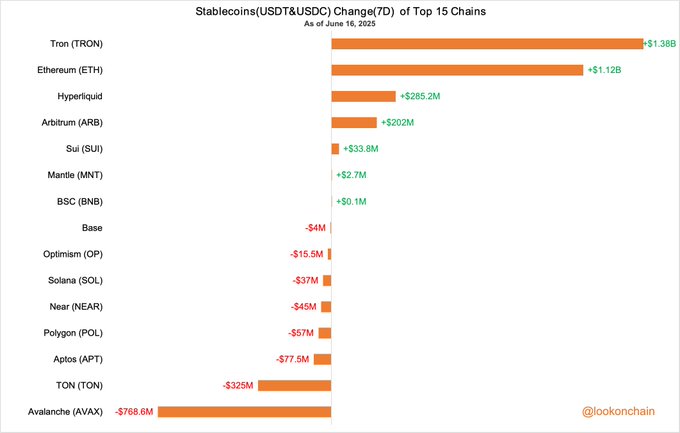

The total stablecoin market grew by $1.27 billion over the week. Tron led with a $1.38B increase in USDT and USDC, while Ethereum added $1.12B.

Stablecoin (USDT & USDC) 7-Day Change by Chain – June 16, 2025. Source: Lookonchain

Conversely, Avalanche saw the largest outflow, losing $768.6M. Other networks like TON and Aptos followed with $325M and $77.5M outflows, respectively.

A Mixed Picture for On-Chain User Activity

An analysis of on-chain user activity shows a more mixed picture across different blockchain ecosystems. The Layer-2 network Base recorded a 77.35% increase in daily active addresses and a 5.84% rise in daily transactions. Avalanche also saw a 74.94% jump in transactions, although its active addresses dropped 18.77%.

Hyperliquid’s TVL climbed 12.85%, the highest among top chains. However, it faced a 30.14% drop in active addresses and a 53.89% decline in transaction volume.

Ethereum’s TVL remained steady at $61.4B, but it saw a 3.32% decrease in daily active addresses. Solana gained 1.44% in TVL and saw a 9.62% rise in users, showing strong network engagement.

Despite the price-driven fear, institutional interest, stablecoin expansion, and selective network growth continued to support the broader crypto ecosystem.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here