Bitcoin price dropped to $99,800 after Iran’s parliament approved a proposal to close the Strait of Hormuz. The move follows the US bombing of Iran’s nuclear sites yesterday.

With final approval pending at the Supreme National Security Council, markets brace for heightened energy disruption risk. As Hormuz is critical to the world’s oil supply, a macro shock of this level could notably disrupt the crypto market.

Impact of Potential Hormuz Shutdown

In addition to Bitcoin, Ethereum fell 4% under $2,200, and XRP dropped below $2 for the first time since April. Crypto liquidations hit $950 million in the past 24 hours, reflecting deep risk-off sentiment.

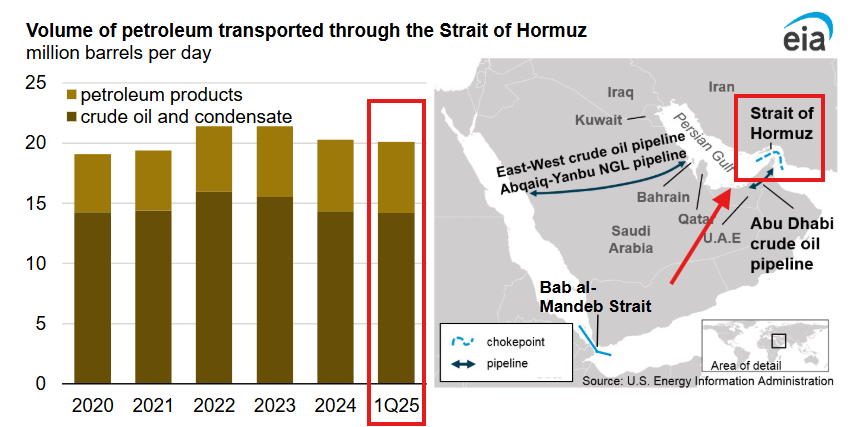

But why? The Strait of Hormuz channels nearly 25% of global oil shipments. Closing this chokepoint would tighten global energy supply immediately.

Oil prices could surge, stoking inflation and delaying central bank rate cuts.

Consequently, higher energy costs would ripple through economies. Consumers face steeper fuel bills, while businesses grapple with rising transport and production expenses.

In response, investors typically flock to safe-havens like US Treasuries and the dollar, draining capital from risk assets such as crypto.

Moreover, energy-driven inflation pressures would challenge the Federal Reserve’s 2% target. If the Fed signals further tightening, real yields could rise.

Historically, higher real yields weigh on Bitcoin by raising the opportunity cost of holding non-yielding assets.

Crypto Market Risks and Macro Linkages

Crypto’s recent sell-off reflects broader market stress. Liquidations concentrated in long positions across Bitcoin and Ethereum. Rising VIX and widening Treasury yield spreads signal tightening risk budgets.

Additionally, hedge funds and retail traders often use leverage in crypto. Sharp price moves trigger margin calls, amplifying declines.

With current leverage metrics elevated, further downside remains likely if uncertainty persists.

At the same time, dollar strength usually correlates with crypto weakness. A surge in the US Dollar Index could deepen Bitcoin losses, potentially pushing it towards $95,000.

Outlook and Key Indicators

Traders should watch three developments closely:

- SNSC Decision: Final vote on Hormuz closure.

- Oil Prices: Breaks above $100/barrel could exacerbate inflation.

- Fed Signals: Comments on rate policy in response to energy shocks.

In sum, Iran’s potential closure of the Strait of Hormuz elevates macro risks for crypto.

If approved, expect sustained pressure on Bitcoin and broader digital-asset markets until geopolitical clarity and energy stability return.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here