Key takeaways:

-

President Trump’s One Big Beautiful Bill could add over $2.4 trillion to the US debt, accelerating a looming debt crisis and spiking inflation.

-

Inflation and dollar devaluation remain the path of least resistance in the US economy, eroding the real value of cash and bonds.

-

Bitcoin can offer a hedge, but only if held in self-custody, as custodial platforms may not survive a lengthy phase of financial repression.

“Devaluations typically occur fairly abruptly during debt crises.” This quote from Ray Dalio’s book, “The Changing World Order,” hits harder today than when the billionaire hedge fund manager first wrote it in 2021. And for good reason: the US may be walking straight into one.

The US budget deficit exceeded $6 trillion in 2024, and Elon Musk, the former head of the Department of Government Efficiency (DOGE), saw his efforts to cut federal spending fail, with just $180 billion trimmed out of the $2 trillion that he promised. Interest rates remain at 4.5%, as the Federal Reserve worries about the trade war’s impact on inflation. Currently, the yield on 10-year Treasurys still hovers above 4.35%.

Let’s be honest: the US debt spiral is deepening. What’s more, its likely catalyst passed the House on May 22 and is now pending in the Senate.

The Big Beautiful Bill will prompt higher inflation

The Big Beautiful Bill has been making headlines and breaking celebrity bromances since early May. At over 1,100 pages, the bill gathers the greatest hits of past GOP policies: extended 2017-era tax cuts, elimination of former President Biden’s green energy incentives, and tighter eligibility for Medicaid and SNAP benefits. It also authorizes a major expansion of immigration enforcement and raises the debt ceiling by $5 trillion.

According to the nonpartisan Congressional Budget Office (CBO), the bill would cut federal revenue by $3.67 trillion over a decade while reducing spending by only $1.25 trillion. That’s a net addition of $2.4 trillion to the already jaw-dropping debt pile of almost $37 trillion. Another nonpartisan forecaster, the Committee for a Responsible Federal Budget, added that when taking interest payments into account, the bill’s cost could rise to $3 trillion over a decade or to $5 trillion if temporary tax cuts were made permanent.

Some of the bill’s supporters argue that tax cuts would stimulate the economy and “pay for themselves.” However, the experience of the 2017 tax cuts showed that, even including positive economic effects, they had increased the federal deficit by almost $1.9 trillion over a decade, according to the CBO.

The numbers matter, but what’s unfolding is bigger than a trillion here or there. As Republican Senator Ron Johnson of Wisconsin put it,

“The CBO score is a distraction. You’re arguing over twigs and leaves when you’re ignoring the forest that’s on fire.”

The spiral of budget deficits and debt has already sucked in the US economy, and there is no credible plan to reverse it.

The US cannot “grow its way out” of debt

Some argue the US will magically “grow its way out” of this problem. But as Sina, the co-founder of 21st Capital, noted on X,

“To grow out of this debt without spending cuts or tax increases, the US would need real GDP growth of 20%+ per year for a decade.”

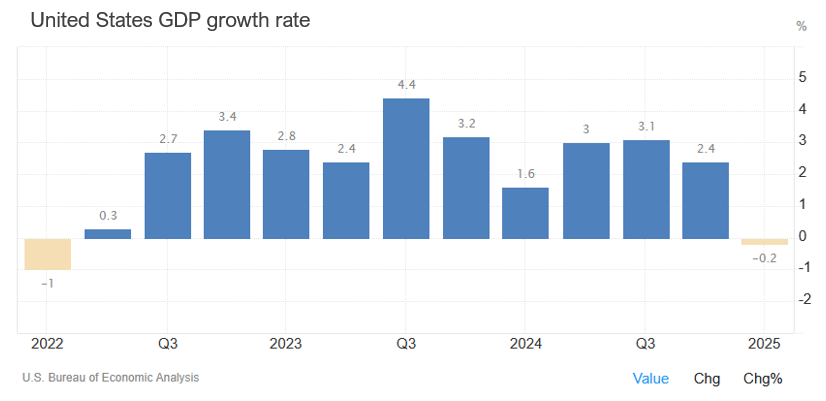

With Q1 2025 registering -0.3% real GDP growth, and the US Federal Reserve estimating the Q2 2025 growth at 3.8%, such a scenario remains unrealistic.

As Harvard economist Kenneth Rogoff wrote in the Financial Times, deficits are projected to exceed 7% of GDP for the remainder of Trump’s term, and that’s without a black swan event.

This means that the only growth possible now is nominal.

In his book, Ray Dalio outlined the four tools governments have in a debt crisis: austerity, defaults, redistribution, and printing money. The first three are painful and politically costly. The fourth, printing and devaluation, is by far the most likely. It’s silent, opaque, and easily disguised as a stimulus. It also wipes out savers, bondholders, and anyone dependent on fiat. Dalio writes,

“Most people don’t pay enough attention to their currency risks. Most worry about whether their assets are going up or down in value; they rarely worry about whether their currency is going up or down.”

Related: Older investors are risking everything for a crypto-funded retirement

Not your keys, not your coins

This is where Bitcoin enters the picture—not as a speculative trade, but as a monetary insurance policy against the US debt crisis.

If, or when, the US chooses to inflate its way out of debt, nominal Treasurys and cash will see their real value erode. Artificially suppressed interest rates and forced bond purchases by institutions could further drive real yields into negative territory.

Bitcoin is engineered to resist this outcome. With its fixed supply and independence from government monetary policy, it offers what fiat cannot: a refuge from financial repression and currency debasement. Not to mention a yield that can put bonds to shame. As Bitwise analysts have noted, Bitcoin’s scarcity and resilience position it uniquely to benefit from fiscal instability.

However, not all Bitcoin exposure is equal. In a crisis scenario, when the government can justify financial repression in the name of “economic stability,” custodial risks are high. ETFs and any other custodial services may simply fail to honor redemptions. The only true protection comes from self-custody, cold storage, private keys, and full control.

Rogoff put it plainly:

“US fiscal policy is running off the rails, and there seems to be little political will in either party to fix it until a major crisis occurs.”

So far, the Republican-controlled Congress hasn’t rejected a single Trump proposal, making the odds of the Big Beautiful Bill becoming law high. So is the likelihood of a full-blown debt crisis. In that world, hard assets in self-custody will matter more than ever.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Read the full article here