Bitcoin’s price has seen an ongoing battle to close above the critical $70,000 mark, with recent attempts falling short. This inability to secure a solid close has led to a hit for long traders, who have experienced substantial liquidations.

Despite this, overall market sentiment remains highly optimistic, as traders retain a bullish outlook on Bitcoin’s potential for further gains.

Bitcoin Bulls Lose

Over the last 24 hours, Bitcoin experienced long liquidations totaling $50 million, following a 2% price decline. These liquidations mark the largest losses for long traders in the past two weeks, reflecting the challenges of maintaining price support near the $70,000 level. The recent pullback has impacted investor sentiment, as some traders begin to weigh the potential for further downside.

This wave of long liquidations highlights the volatility inherent in Bitcoin’s price action, as even minor drops can trigger significant market reactions. Despite this, the persistence of long traders is noteworthy.

Many are holding their positions, suggesting a belief in Bitcoin’s ability to overcome these challenges and resume its upward trajectory. This resilience indicates that market confidence remains largely intact, even amid short-term setbacks.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

Bitcoin Liquidations. Source: Coinglass

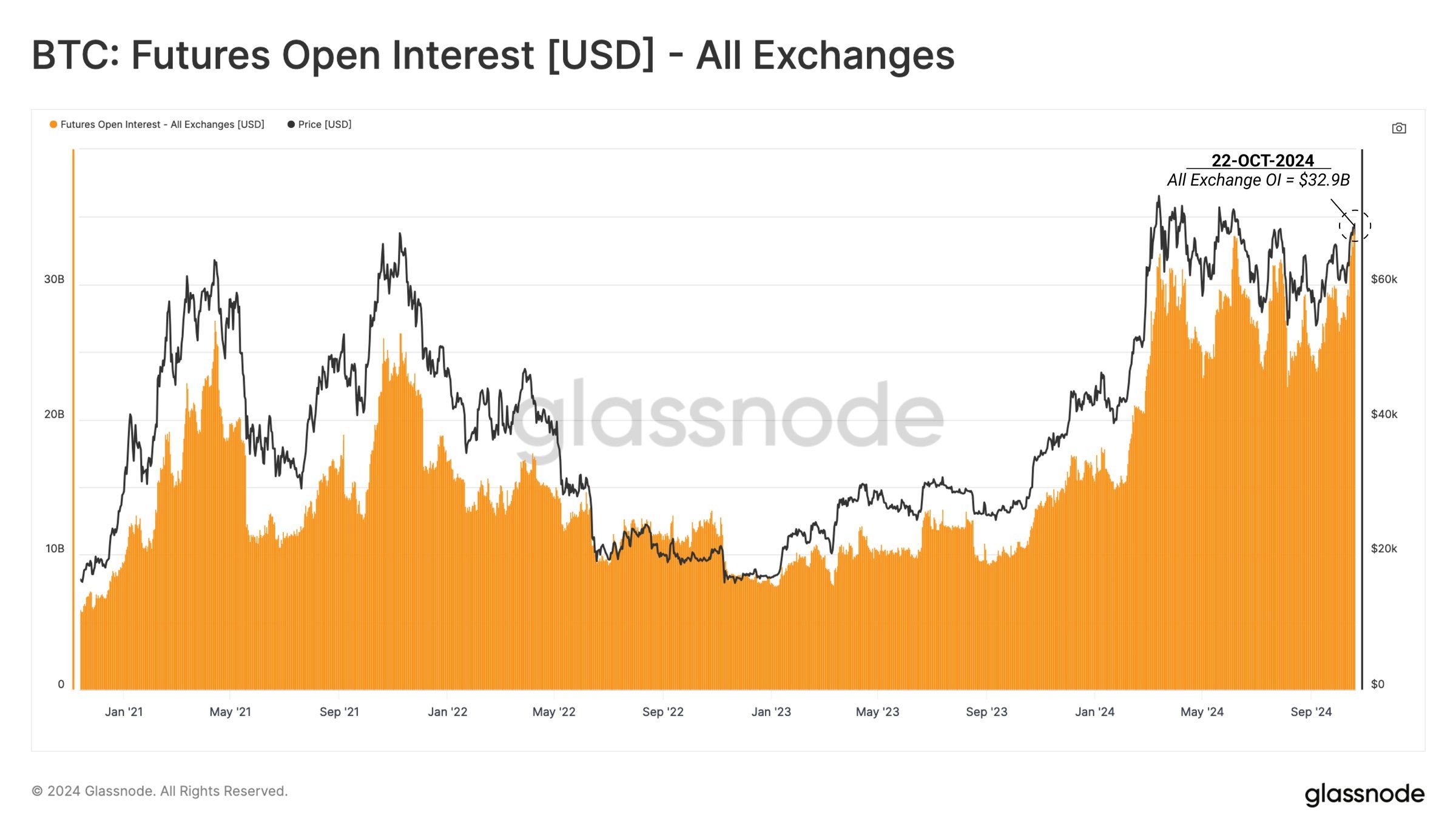

Bitcoin’s macro momentum appears strong, with Open Interest (OI) reaching an all-time high of $32.9 billion. This peak signals a high level of engagement among traders as more capital flows into Bitcoin despite recent liquidations.

This elevated Open Interest suggests that Bitcoin’s recent volatility has not deterred trader confidence. Instead, it signals that both institutional and retail investors are backing Bitcoin with substantial capital, reflecting belief in the long-term potential of the asset.

Bitcoin Open Interest. Source: Glassnode

BTC Price Prediction: Aiming for a Breakout

Bitcoin is currently trading at $67,007, which is about 10% below its all-time high of $73,800. At this level, BTC is also approaching a potential breakout from a descending wedge pattern, a technical setup known to precede significant price movements. Breaking out of this pattern could position Bitcoin for a strong rally toward the $73,000 mark.

The wedge pattern presents a potential 27% rally, which would place Bitcoin’s target price at $88,185. While this ambitious target is achievable, the more immediate goal remains for BTC to breach its all-time high of $73,800 as it solidifies its upward trajectory.

Read more: Bitcoin Halving History: Everything You Need To Know

Bitcoin Price Analysis. Source: TradingView

However, Bitcoin is still struggling to achieve a clear breakout, making $67,000 a critical support level. Failing to hold this support could push BTC down to $65,000, potentially delaying the anticipated breakout and challenging the bullish outlook.

Read the full article here