Bitcoin

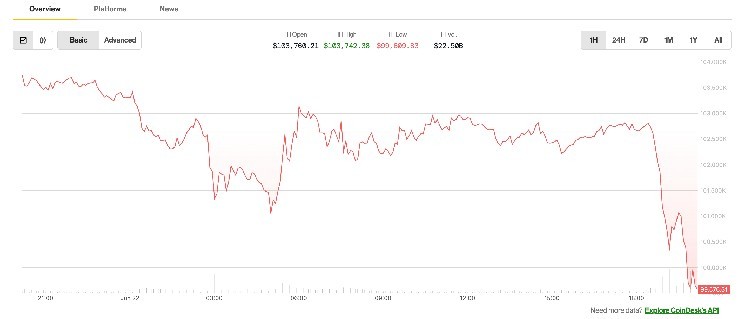

BTC$99,336.02

fell below $100,000 on Sunday, its lowest point since May, signalling risk aversion on Wall Street on Monday amid reports that Iran is leaning towards blocking the Strait of Hormuz.

The Strait, located between Oman and Iran, connects the Persian Gulf with the Gulf of Oman and the Arabian Sea, handling roughly 20% of the global oil trade.

Reports of Iranian politicians mulling the closure of the Strait had observers worried about a significant spike in oil prices early Monday.

“After US strikes on Iran last night, 50+ large oil tankers were scrambling to leave the Strait of Hormuz. Markets have been closed, but an immediate drop in supply is expected to send prices higher. JP Morgan described this as their worst-case scenario in the Israel-Iran war,” The Kobeissi Letter said on X.

According to JPMorgan, oil could surge to $120-$130 per barrel in that scenario. That could potentially lift the U.S. inflation rate to 5%, the highest since March 2023. At the time, the Federal Reserve was raising interest rates.

The losses in BTC weighed heavily over the broader crypto market, as usual, dragging major altcoins such as XRP, SOL, and ETH lower. The payments-focused XRP slipped 6% to $1.935, the lowest since April 10. Ethereum’s ether token slipped to levels seen in early May, according to CoinDesk data.

Read the full article here