As the new year kicks off, Bitcoin’s price continues to consolidate below the psychological $100K barrier. After an explosive bull run in 2024 that took BTC from $40K to $108K, the cryptocurrency has failed to reclaim its previous highs. Many investors are now questioning what lies ahead for Bitcoin in 2025. Could this be the beginning of a larger market adjustment?

Bitcoin Price Performance in 2025

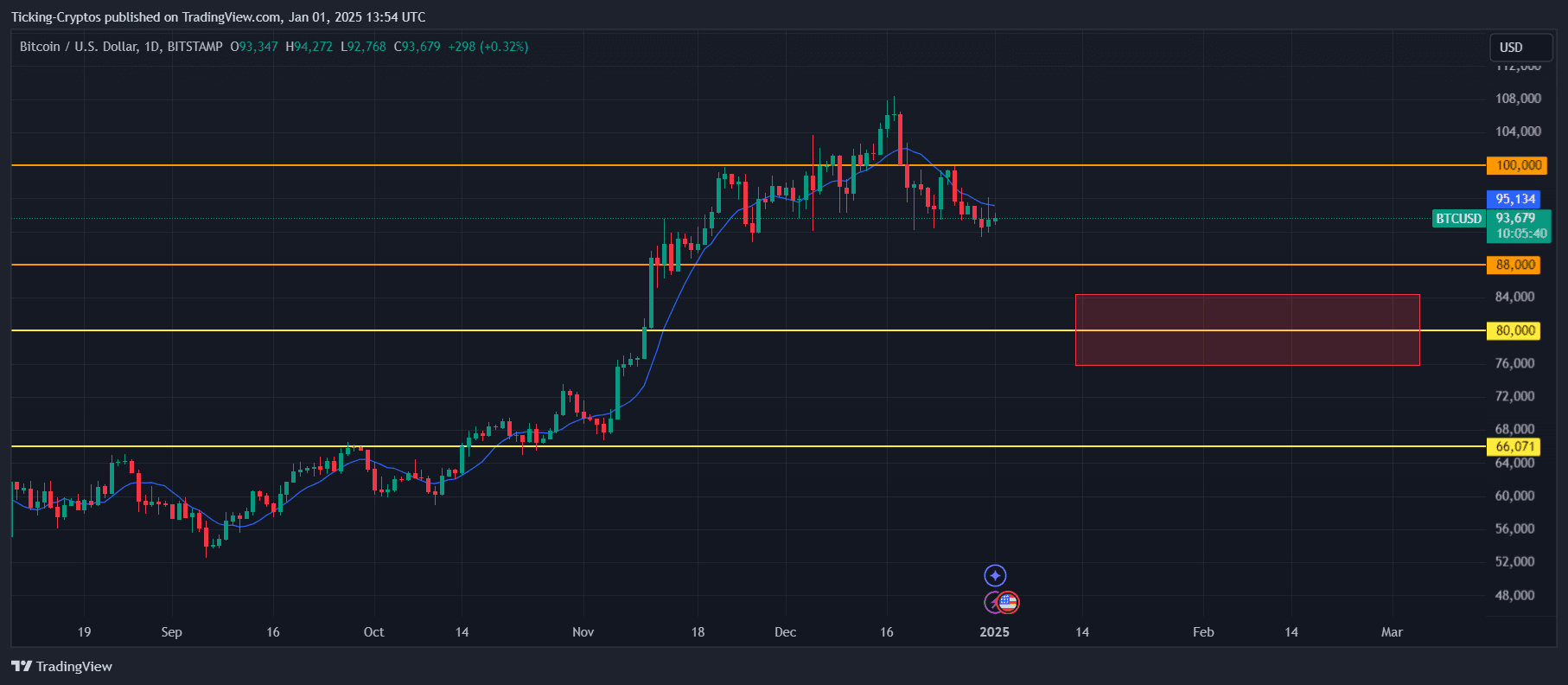

Bitcoin opened the year trading at approximately $93,300, following a two-week period of prices lingering below the $100K mark. Historically, the start of the year tends to bring subdued market activity as global trading volumes slow down due to holidays and reduced investor participation.

BTC/USD 4-hours chart – TradingView

This consolidation phase has left Bitcoin range-bound, unable to regain its upward momentum. While some view this as a momentary pause, others believe it signals the start of a broader correction after an unprecedented rally in 2024.

Why Bitcoin’s Momentum Has Slowed

Seasonal Trends

Historically, January often brings lower activity for asset classes, including cryptocurrencies. The holiday season sees reduced market participation, leading to decreased volatility and lower liquidity.

Psychological Resistance

Bitcoin’s inability to break back above $100K has created psychological resistance among traders, making it harder for prices to regain upward momentum.

Post-Bull Run Effect

After a massive bull run that saw Bitcoin prices surge from $40K to over $108K in 2024, the market appears to be in a consolidation phase. This often precedes a more significant correction, especially when prices fail to make new highs.

Bitcoin Price Prediction for 2025

Analysts are divided on where Bitcoin might head next, but most agree on the possibility of a downward adjustment:

Short-Term Outlook

Bitcoin’s current consolidation suggests a lack of strong buying interest. If prices continue to stagnate, a dip toward $85K could be on the horizon.

Medium-Term Outlook

Analysts predict that Bitcoin could drop further into the $75K–$85K range. This potential decline would represent a natural correction after the significant gains of 2024.

Bullish Recovery Potential

Despite the bearish outlook, Bitcoin’s long-term prospects remain intact. Many see the current dip as an opportunity for accumulation before the next major cycle begins.

BTC/USD 1-day chart – TradingView

What Lies Ahead for Bitcoin in 2025?

Bitcoin’s performance at the start of 2025 reflects a market taking a breather after an explosive bull run. While prices remain below the $100K level, the potential for further declines to the $75K–$85K range has become a key focus for analysts.

For long-term investors, this period of consolidation may offer a chance to accumulate Bitcoin at lower prices. However, traders should remain cautious and monitor key support levels as the market navigates through its next phase.

Read the full article here