According to Prime Minister Justin Trudeau, tariffs between the US and Canada have been postponed for 30 days. Bitcoin recovered from its earlier plunge to $92,000, and MicroStrategy’s stock price rebounded 4%

The proposed trade war between the US and its closest neighbors has apparently been resolved (or delayed), but the tariffs against China still stand. This is an active and underreported component of possible future market actions.

Canada and US Halt Tariffs

The threat of US tariffs against Canada, Mexico, and China has played a chaotic role in crypto markets today. Tech stocks were already wobbling due to DeepSeek, but the implementation of tariffs caused a reported $2 billion wipeout. These reports may have underestimated the real damage, which could have gone as high as $10 billion.

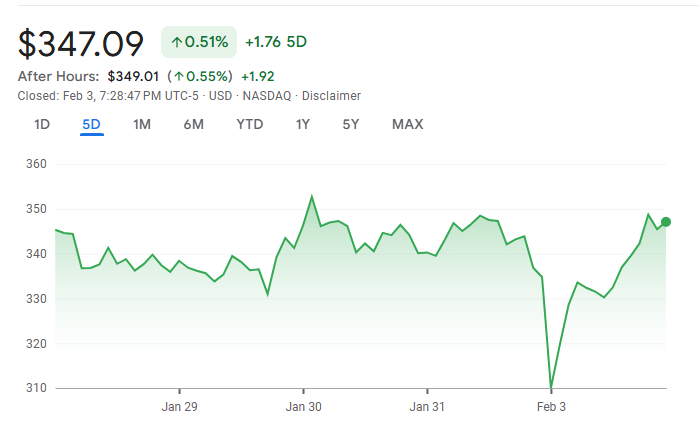

Earlier on Monday morning, Bitcoin dipped to $92,000, and crypto-related stocks saw notable liquidations. Notably, MicroStrategy’s MSTR lost 8% following tariff announcements.

However, Mexican President Claudia Sheinbaum reached an agreement with Donald Trump, postponing a possible trade war. According to an announcement from Prime Minister Justin Trudeau, Canada has reached a similar agreement that will pause all tariffs for 30 days.

“I just had a good call with President Trump. Canada is implementing our $1.3 billion border plan — reinforcing the border with new choppers, technology and personnel, enhanced coordination with our American partners, and increased resources to stop the flow of fentanyl. Proposed tariffs will be paused for at least 30 days while we work together,” he said.

In other words, these tariffs have caused substantial trauma to the markets, but Canada and Mexico have already negotiated a deal. This is a particular relief because Canada is well-integrated in the crypto economy and may play an outsized role in crypto values.

Since the agreement, however, all the main “Made in USA” cryptocurrencies have bounced. Bitcoin and XRP, in particular, have mostly recovered from earlier liquidations. At the time of reporting, BTC surged back to $102,000.

Crypto Stocks Bounce Back

MicroStrategy and other Bitcoin mining stocks, such as MARA, have further substantially recovered from earlier losses following Canada’s deal on tariffs.

Earlier today, MicroStrategy surprised the market by breaking its 12-week streak on Bitcoin purchases. Michael Saylor did not directly comment on the reason for this pause, but its stock dropped substantially today.

However, this incident is far from a case of “all’s well that ends well.” Simply put, the US threatened one of its closest allies with major tariffs and severely damaged their working relationship.

That will certainly have consequences. It is unclear how this incident may impact US-Canada trade, but there are several worrying signs. Also, if the tariffs are enforced again after a month, a similar impact on the crypto market could be expected.

Additionally, while Canada and Mexico have negotiated with Trump, China has been quiet. The PRC has clearly demonstrated its recent ability to disrupt the US stock market, as illustrated by DeepSeek. Its response could be pivotal.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here