Bitcoin has experienced significant volatility recently, largely driven by geopolitical tensions. However, over the last 48 hours, those concerns have begun to dissipate, leading to a recovery in Bitcoin’s price.

While some investors panicked and exited the market, others remained unbothered, aiding the asset’s recovery.

Bitcoin Finds Institutional Backing

Bitcoin ETFs saw a remarkable $588 million in inflows over the last 24 hours, marking the highest level in over a month. The last time inflows reached this level was on May 22, when Bitcoin ETFs recorded $934 million in inflows. This surge is a clear indicator of rising confidence among institutional investors.

Despite the market’s volatility, institutional support remains strong. Last week’s inflows suggest that even in times of uncertainty, large investors are continuing to place their faith in Bitcoin. This trend points to a broader, long-term institutional commitment to Bitcoin despite short-term price fluctuations.

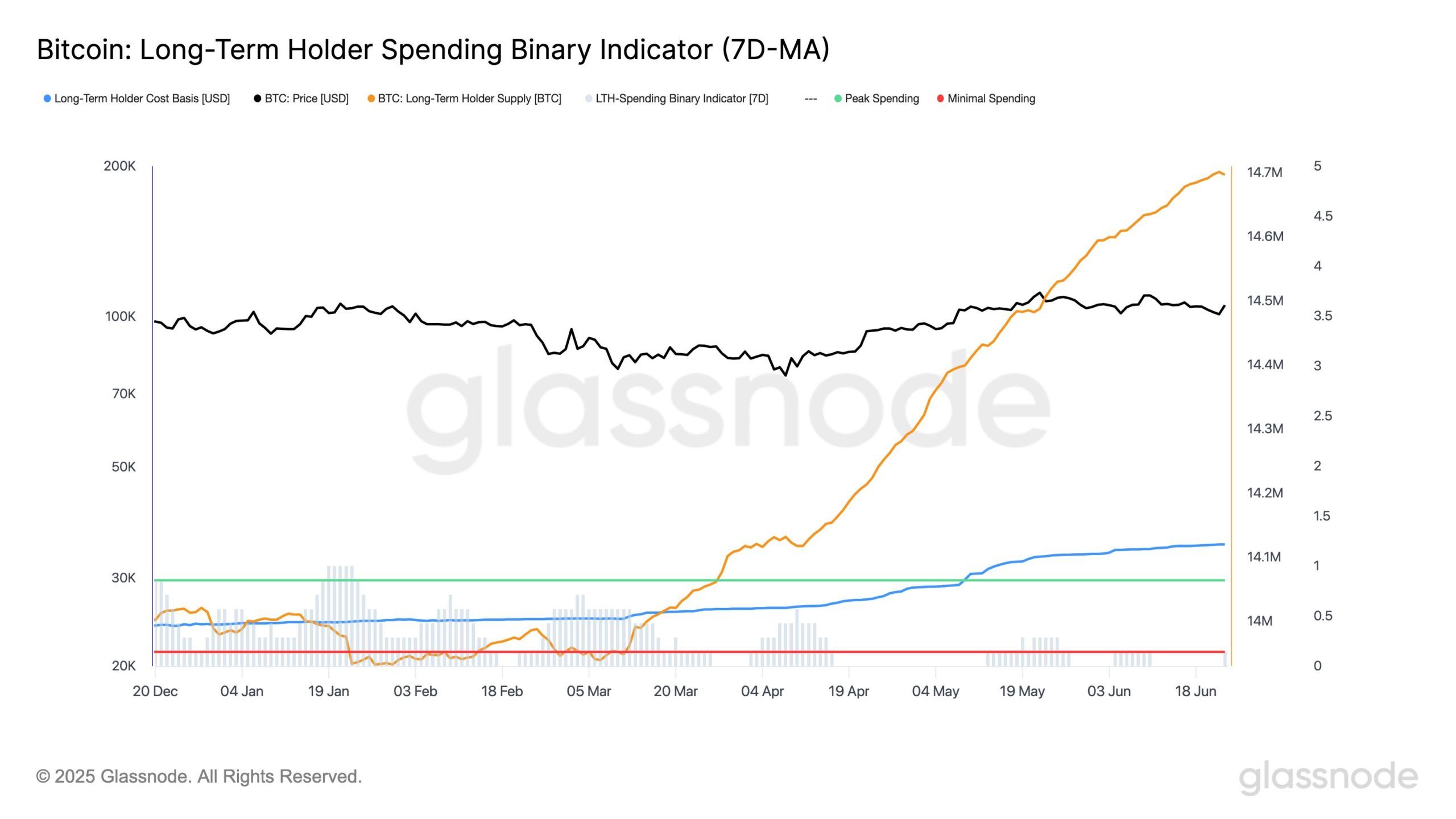

Bitcoin’s Long-Term Holder (LTH) Spending Binary Indicator shows minimal spending for the first time since June 10. With LTH supply nearing an all-time high of approximately 14.7 million BTC, this indicates continued conviction among seasoned investors. These long-term holders are reluctant to distribute their holdings, signaling a strong belief in Bitcoin’s long-term potential.

When LTHs choose to hold and accumulate, the liquid supply of Bitcoin decreases, creating a natural supply squeeze. If demand rises during these periods, prices can be pushed higher. Historically, moments of minimal long-term holder selling, such as late 2020 and post-March 2020, have set the stage for explosive price rallies.

BTC Price Needs To Breach Some Barriers

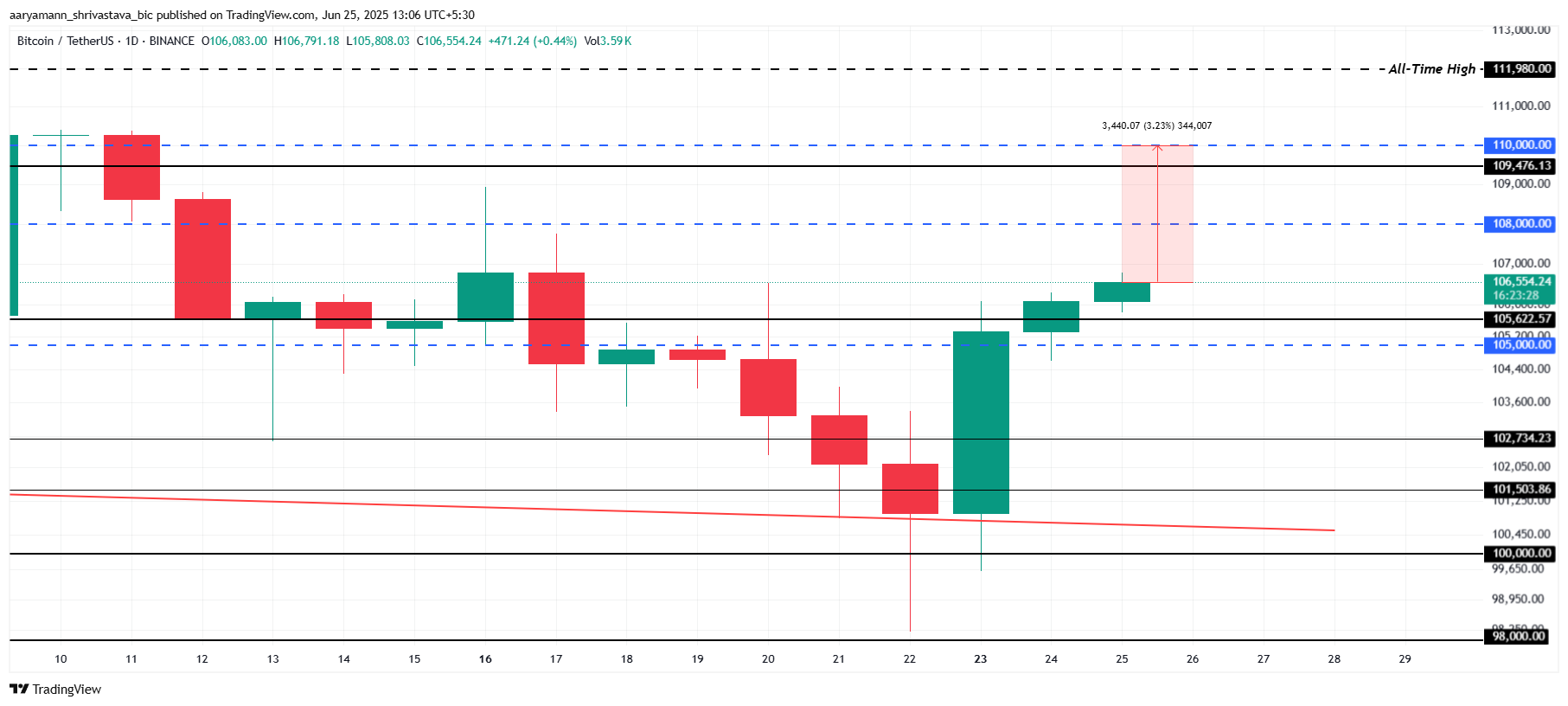

Bitcoin’s price is currently at $106,554, just 3.2% away from reaching the significant psychological price point of $110,000. To make this move, however, Bitcoin must first secure $105,662 as a support level. This support is critical for establishing the foundation for further gains.

If Bitcoin manages to bounce off this support, it could push past the $108,000 resistance level. Successfully breaking through this threshold would provide Bitcoin with the necessary momentum to continue rising toward the $110,000 mark. This would indicate a continuation of the bullish trend, likely attracting more institutional interest.

However, if market conditions reverse or investors decide to sell, Bitcoin could fall below the $105,662 support, potentially slipping below $105,000. If this occurs, the bullish thesis would be invalidated, and Bitcoin would face further downward pressure, indicating a shift in market sentiment.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here