Bitcoin has resumed a slow climb upward after a recent period of consolidation, briefly breaking back above the $106,000 mark earlier today. At the time of writing, the cryptocurrency is trading at $105,383, reflecting a 0.8% increase over the past 24 hours.

While this upward move has not sparked a major breakout, analysts are paying close attention to on-chain and market structure indicators that suggest a cautiously balanced environment.

On-Chain Data Points to Equilibrium, But Demand Wanes

According to CryptoQuant analyst Darkfost, the market currently lacks extreme signals of profit-taking or panic. In a recent analysis, Darkfost explained that realized profits over a seven-day moving average remain below $1 billion.

This is in line with figures observed during the market correction in late 2024 and significantly below peaks seen in early 2025. The analyst suggests that the current realized profit levels point to a market that is not under pressure from large-scale investor exits, supporting the ongoing consolidation.

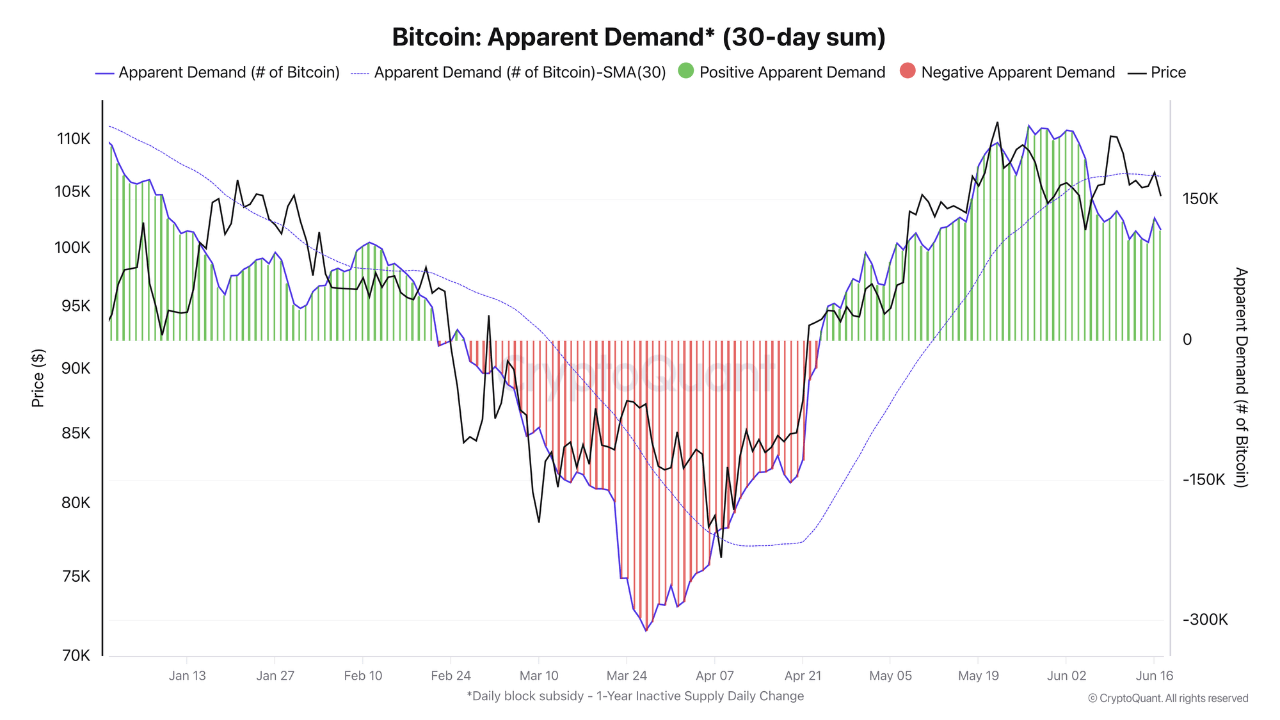

In the same report, Darkfost also discussed how a decline in demand may be limiting further upward momentum. By analyzing the ratio of new supply to the supply held inactive for over a year, the study observed that while demand remains positive, it has been weakening since Bitcoin’s local high in May.

This suggests that although the market is absorbing existing selling pressure, fresh buying interest is not strong enough to trigger a new rally. As a result, the market appears to be in a state of temporary equilibrium, a phase where both sellers and buyers are relatively inactive.

Bitcoin Traders Brace for Volatility in a Crowded Range

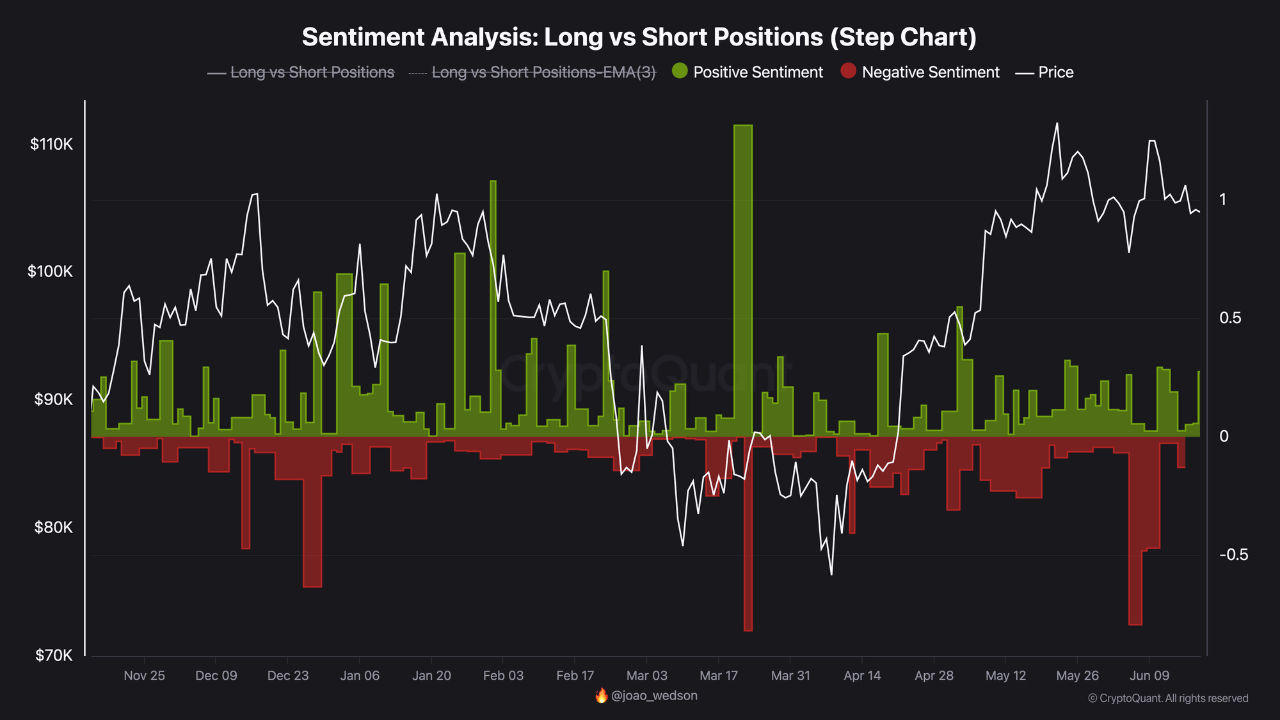

Another CryptoQuant analyst, BorisVest, echoed the sentiment of a tightly contested market by analyzing Binance order flow and position data. He noted that Bitcoin has traded within a range of $100,000 to $110,000 for nearly a month.

Within this band, both long and short positions have been building, and traders are watching the extremes of this zone closely. According to BorisVest, any breakout beyond $110,000 or drop below $100,000 could set the tone for the next significant price movement.

The $100K–$110K price range has become a battleground for both bulls and bears. BorisVest observed that short positions are currently increasing, indicating that a significant portion of market participants expect a downward correction.

However, he also pointed out that when shorts dominate, the risk of a sudden reversal, known as a short squeeze, becomes more likely. This behavior is consistent with recent funding rate trends, which show a fairly balanced distribution of long and short bets.

Featured image created with DALL-E, Chart from TradingView

Read the full article here