Quick Take

Data from Trading Economics shows the United States economy grew at an annualized rate of 1.6% in the first quarter of 2024, falling short of the forecasted 2.5% and slowing down from the previous quarter’s 3.4% growth. Despite the slower pace, the economy continues to expand in an already overheated environment, with inflation persisting above the target level.

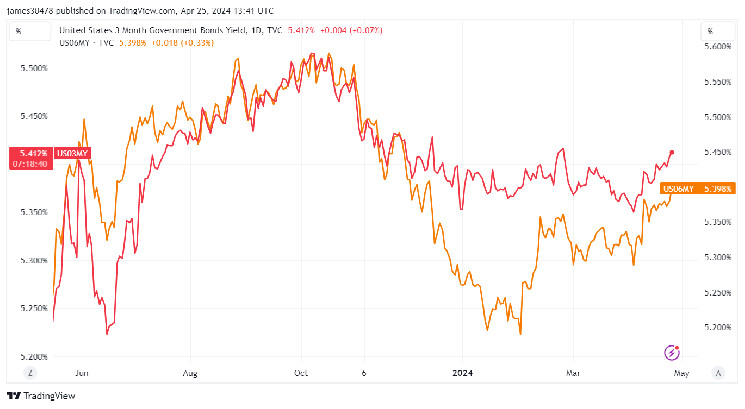

US bond yields rose in response to the economic data, with the 2-year Treasury yield surpassing 5%. The front end of the yield curve, particularly the 3-month and 6-month yields, are now hovering around 5.4%. With the current federal funds rate at 5.25% to 5.5%, the market is not anticipating rate cuts for at least six months.

The CME FedWatch tool tracks futures markets and suggests that investors expect no rate cuts until July, followed by a single cut in September and a pause for the remainder of the year. This outlook marks a significant shift from the beginning of the year when markets were pricing in around six rate cuts.

As a result of the economic news, Bitcoin (BTC) is trading at approximately $63,300, while US equity markets have declined by more than 1%.

Read the full article here