Key takeaways:

-

Bitcoin AVIV Ratio remains below historical peak levels, indicating a potential climb above $330,000 before a cycle top is confirmed.

-

Over-the-counter Bitcoin holdings are down significantly in 2025, pointing to strategic accumulation by Strategy, Metaplanet, BlackRock and others.

Bitcoin (BTC) price has had a rocky month, but recent analysis indicates that BTC could surge another 300% this cycle. Technical analyst Gert van Lagen’s X post highlights the AVIV Ratio, a metric that compares Bitcoin’s active capitalization (money in motion) to its total invested capitalization (realized capital, excluding miner rewards).

Historically, when the AVIV Ratio crosses its +3σ mean deviation, it has signaled a cycle top. For example, BTC was $1,200 in 2013, near $20,000 in 2017, and around $69,000 in 2021. Currently, the AVIV Ratio’s level remains below these past peaks, suggesting Bitcoin could climb to at least $330,000 this cycle, before the +3σ mean deviation condition is met.

The AVIV Ratio offers a unique lens on market dynamics, reflecting investor activity versus locked-in value. A spike indicates heightened trading or profit-taking, often preceding major price movements. Van Lagen’s analysis ties this to Bitcoin’s cyclical nature, where post-ATH rallies have historically delivered significant gains. However, its predictive accuracy lacks validation in varying market conditions, and volatility remains a wildcard.

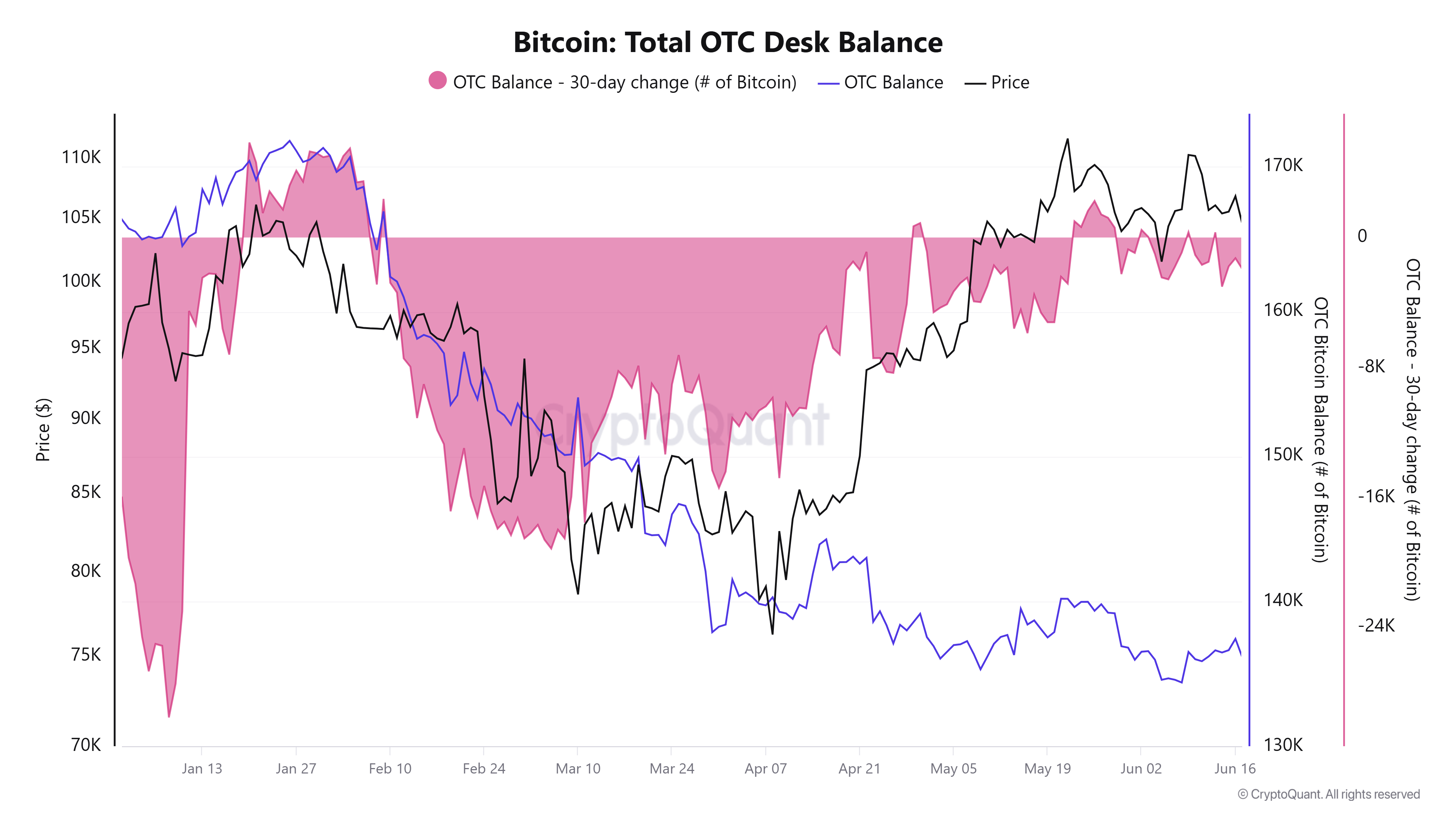

Adding to the narrative, data from CryptoQuant reveals a notable shift: Bitcoin holdings on over-the-counter (OTC) desks have dropped from 166,500 to 137,400 in 2025. This decline suggests large investors are moving holdings off exchanges, potentially signaling reduced selling pressure or a shift toward long-term storage.

The declining balances at OTC desks this year stem from strategic accumulation by institutional investors, led by Strategy’s aggressive buying, and new entrants like Metaplanet, which has amassed 10,000 BTC, alongside robust net inflows into the spot Bitcoin ETFs, which total $128.18 billion in net value. BlackRock’s crypto portfolio also holds more than $70 billion in BTC, which sums up the current intent of major investors in the market.

📊MARKET UPDATE: #BlackRock added another $250 million in #Bitcoin on June 17 — marking six straight days of buying, now totaling $1.4 billion.

Its current $BTC holding is valued at over $70 billion. 🤯

(h/t: @arkham) pic.twitter.com/JmjNAu2kDY

— Cointelegraph Markets & Research (@CointelegraphMT) June 18, 2025

Related: 25% Bitcoin price rally set to follow today’s correction if history repeats

Power law puts Bitcoin price target between $220,000 and $330,000

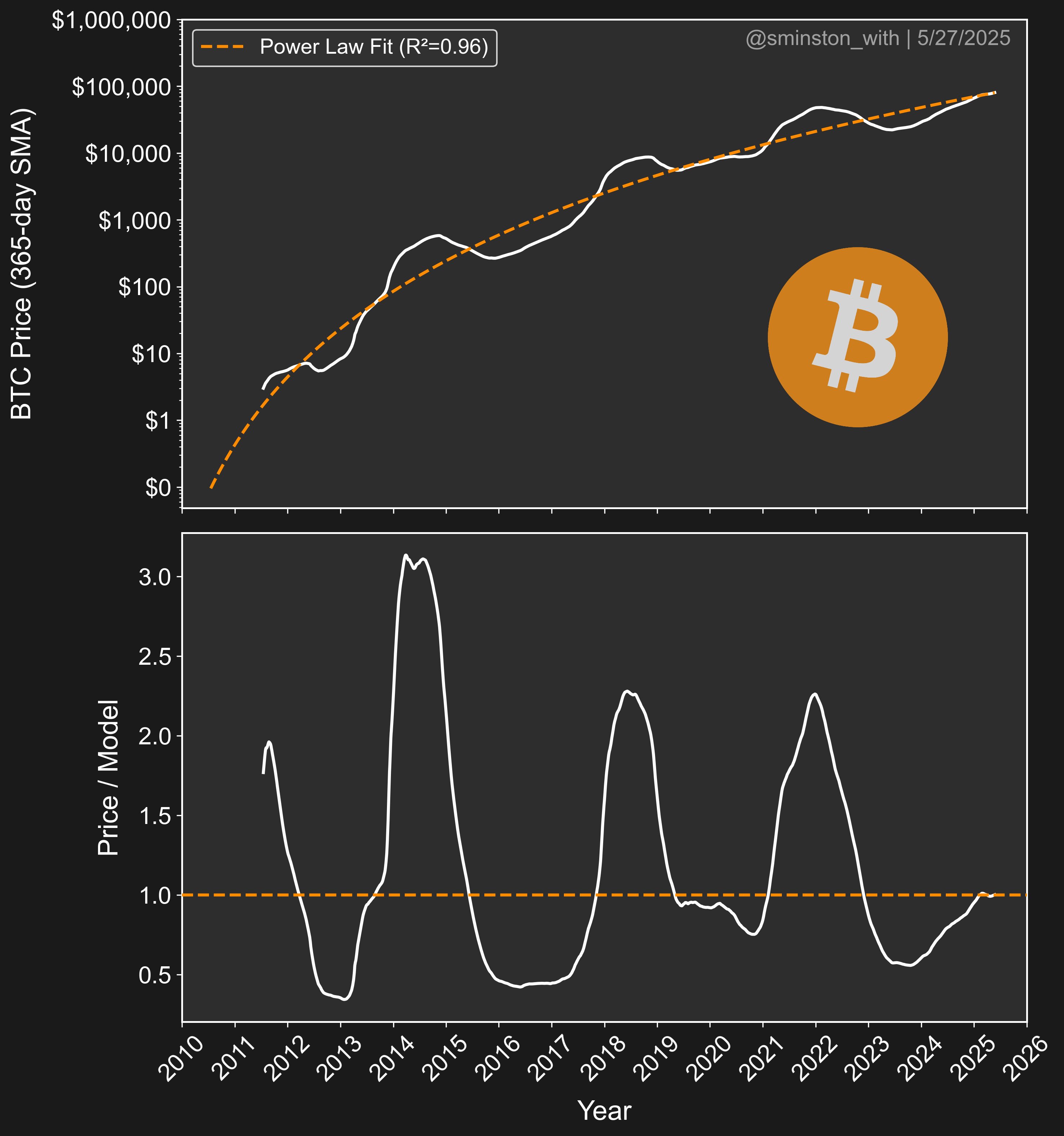

Similar to Van Lagen’s $330,000 price target, another study by Bitcoin researcher Sminston With outlined a comparable cycle top for BTC. With’s analysis leverages a 365-day simple moving average (SMA) aligned with a power law model (R²=0.96), projecting Bitcoin’s price could reach $220,000 to $330,000 in this cycle.

Currently trading around $104,000, BTC would need a 100% to 200% surge to hit these levels, consistent with historical peaks where prices doubled or tripled above the power law trendline.

With’s model challenges assumptions of diminishing volatility, showing Bitcoin’s price cycles retain significant swings, as evidenced by steady deviations from the trendline. While optimistic, the researcher cautions that the analysis draws from only four market cycles, urging skepticism.

Likewise, Cointelegraph reported that a list of 30 bull market peak indicators from CoinGlass suggests Bitcoin could climb to $230,000, with none signaling a cycle top despite BTC reaching $112,000. Metrics like Pi Cycle Top and MVRV show the bull market has room to run, supporting With’s optimistic outlook.

Related: Bitcoin below $100K now ‘less likely’ as BTC price eyes liquidity at $106K

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here