Key points:

-

Bitcoin performs an anticipated $108,000 liquidity grab as shorts get punished.

-

BTC price targets include a return to all-time highs in the short term.

-

Geopolitical concerns refocus on the Russia-Ukraine conflict as Middle East tensions calm.

Bitcoin (BTC) built on its Middle East ceasefire relief bounce at the June 25 Wall Street open as price upside liquidated shorts.

Bitcoin traders eye highs after $108,000 liquidity grab

Data from Cointelegraph Markets Pro and TradingView showed daily gains nearing 2% as BTC/USD reached $108,182 on Bitstamp.

Now up $10,000 versus local lows seen just three days prior, Bitcoin impressed traders, who began to prepare for a fresh attack on all-time highs.

“Bulls are in control,” popular commentator Matthew Hyland summarized in part of an ongoing analysis on X.

#BTC past $106.5k

$109k next

Bulls are in control https://t.co/mp3zBsQwX9 pic.twitter.com/Ibsaupn3YE

— Matthew Hyland (@MatthewHyland_) June 25, 2025

Earlier, Cointelegraph reported on expectations that price action would shift to take liquidity both above and below, with $108,000 and $103,000 the key levels in play.

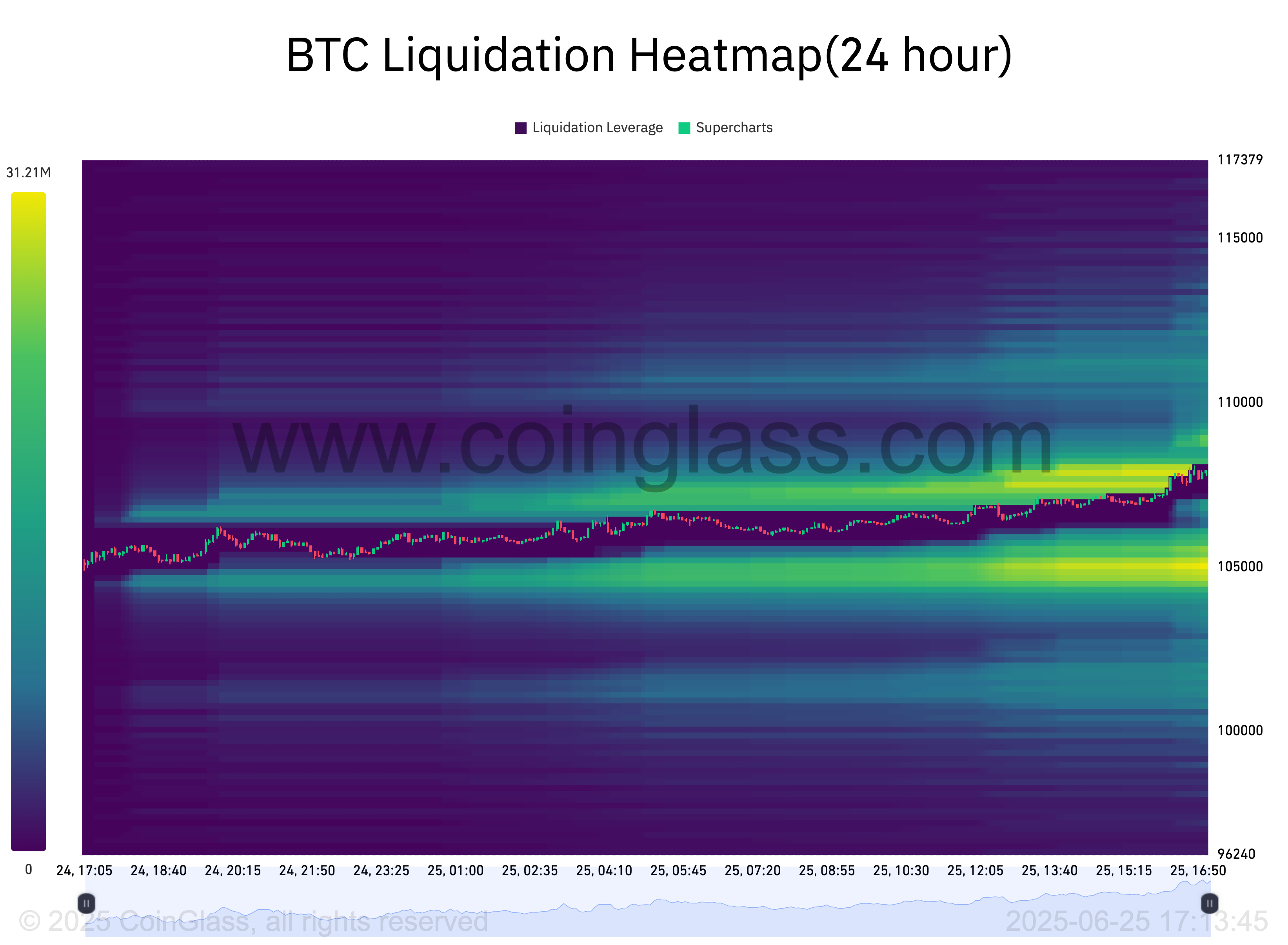

The latest data from monitoring resource CoinGlass confirms that most high-leverage liquidity is being taken with the latest move higher.

“If we start showing signs of LTF exhaustion, this is an area BTC could have a LTF rejection,” popular trader Killa noted in part of an X reaction, referring to low-timeframe price activity.

Other bullish signals came from Ichimoku Cloud analysis, with popular trading account Titan of Crypto reporting a breakout from the Kumo Cloud.

“If it clears the Fair Value Gap (FVG), the next stop could be $111K,” it predicted alongside an explanatory chart.

“Geopolitical volatility” focuses back on Russia

With further Middle East surprises absent, risk assets enjoyed modest relief on the day, with the S&P 500 and Nasdaq Composite Index up 0.2% and 0.5%, respectively.

Related: $92K dip vs ‘short-lived war’ — 5 things to know in Bitcoin this week

In its latest bulletin to Telegram channel subscribers, trading firm QCP Capital nonetheless cautioned that macro risks remained on the horizon.

“Concerns around a potential NATO-Russia flashpoint are building, as European defence officials warn of the risk of armed conflict within five years,” it reported around the ongoing NATO summit in The Hague.

QCP forecast that markets would face conflicting signals over long-term stability going forward.

“In this environment, the traditional risk premium is shifting from a hedge to a baseline assumption,” it concluded.

“With macro, military and monetary crosscurrents colliding, the market’s ability to discount geopolitical volatility is being tested like never before.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here