Key points:

-

Bitcoin joins US stocks in shrugging off Middle East tensions — something analysis says shows belief that the conflict will soon end.

-

In a surprise turn, oil and gold face losses amid a lack of interest in safe havens.

-

BTC price action has a new CME futures gap to fill, with a target of $104,000.

Bitcoin (BTC) avoided fresh losses at the June 23 Wall Street open amid belief that the Middle East conflict would soon end.

Bitcoin embraces odds of “short-lived conflict”

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD acting around $102,000, up 0.7% on the day.

After hitting its lowest levels since early May, Bitcoin caught a bid near the cost basis of short-term holders at $98,000.

Amid a major escalation of Middle East tensions with the involvement of the US, market commentators were on edge, fearing a fresh wave of losses as Wall Street returned. In the event, however, the opposite began to play out — stocks and Bitcoin gained, while gold tracked sideways and oil fell 1%.

For trading resource The Kobeissi Letter, the message from markets was clear.

“If we told you Iran’s Parliament would vote to close Hormuz (pending Iran’s Security Council approval), which controls 20% of global oil and gas, and oil and natural gas prices would be DOWN, you’d likely call us crazy,” it argued in part of ongoing analysis on X.

“But, that’s exactly what just happened, with oil prices going from up +5% to down -0.2% and natural gas prices now down -1.1%.”

Kobeissi added that even US President Donald Trump’s rhetoric over a change of government in Iran had failed to spark a run to safe-haven gold.

“As we have reiterated, the world is NOT on the brink of World War 3,” it concluded.

“Markets continue to expect a short-lived conflict.”

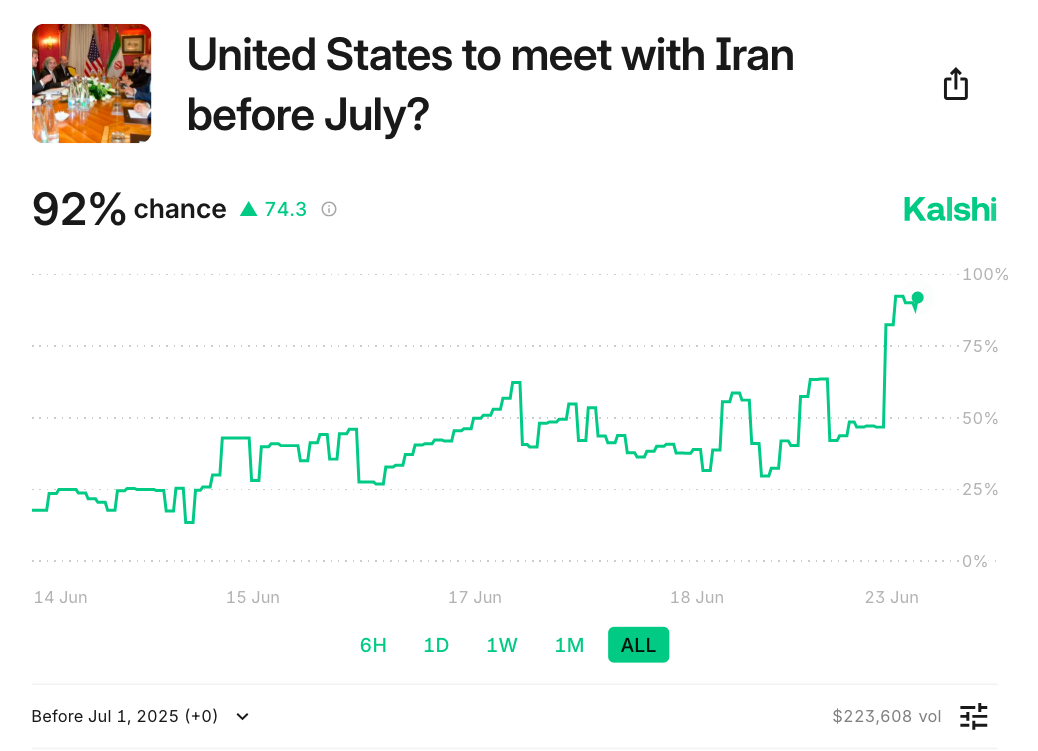

Informal prediction platforms likewise heavily favored a swift de-escalation, with Kalshi showing 92% odds of US-Iran diplomacy beginning before next month.

In its latest bulletin to Telegram channel subscribers, trading firm QCP Capital flagged technical signals underscoring investor confidence.

“Put skew remains elevated through September, but the strong spot bounce and compression in frontend vols signal that investors are largely dismissing broader contagion risks for now,” it reported.

“The same tone is echoed in traditional markets. US stock futures, oil and gold initially reacted to the headlines, but have since retraced to Friday levels. This suggests that investors are interpreting the situation as a regional flashpoint rather than a global risk event.”

BTC price “holding strong for now”

Bitcoin traders, meanwhile, saw grounds for cautious optimism over the local BTC price bottom being in.

Related: $92K dip vs ‘short-lived war’ — 5 things to know in Bitcoin this week

“Bitcoin is holding strong for now. I think this week will be very interesting,” popular trader Crypto Caesar told X followers on the day.

Fellow trader Merlijn described a “textbook” inverse head-and-shoulders pattern playing out on BTC/USD.

Everyone’s calling for Bitcoin to hit $60K.$BTC fear is loud.

But the chart is painting a different story.

This is a textbook Inverted Head & Shoulders.Classic structure. Classic reversal.

You either spot it early… or fade the breakout. pic.twitter.com/ieLupBifuF

— Merlijn The Trader (@MerlijnTrader) June 23, 2025

Referring to the “gap” left in CME Group’s Bitcoin futures market at the weekend, trader Daan Crypto Trades eyed the potential for a relief rally continuing toward $104,000.

“Opened up with a large ~4K CME Gap today. Over half of that has already been filled with the full gap fill sitting up to $103.6K,” he noted in part of an X post on the topic.

“Generally we’ve seen gaps fill early in the week when they have been created over the past few months.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here