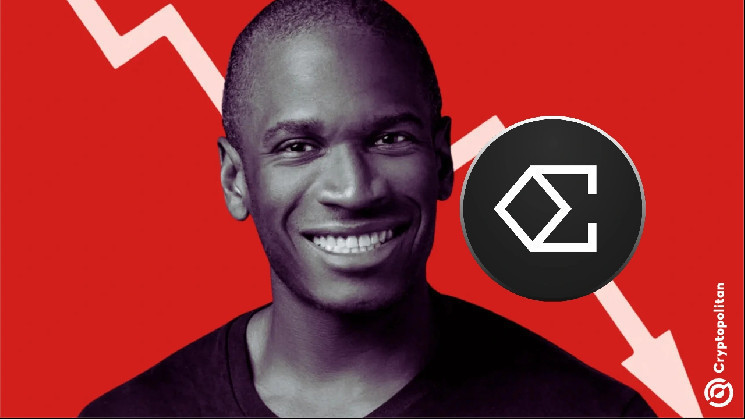

Arthur Hayes, former CEO of BitMEX and one of crypto’s most infamous market players, just pulled off a move that has the entire community talking. He dumped $8.4 million worth of Ethena’s ENA tokens on Binance, just two hours after praising the project in a tweet.

Between November 26 and 28, Arthur quietly built up a position of 16.79 million ENA tokens at $0.67 per token, worth $11.21 million at the time. And now, he’s cashing out while the token sits at $0.7015, netting a tidy profit of $7.7 million.

Arthur still holds 9.96 million ENA, valued at $11.7 million, with 7.94 million staked. His current holdings have already delivered an overall profit of $8.71 million—up 78%.

Ethena’s wild ride: Price spikes, tweets, and chaos

ENA has been on a rollercoaster ride, partly thanks to Arthur. Before his dump, the token surged over 25% in a week, hitting $0.7015 on December 21, fueled by rising demand and speculation.

On Twitter, he wrote, “I could nitpick some things, but a very impressive rundown on Ethena Labs. If you are a DeFi protocol and you haven’t integrated USDe or sUSDe, you are f—ing up.”

His comments section has descended into chaos. People are calling him a clown and bringing up allegations of insider trading and market manipulation. This is not the first time Arthur has faced these accusations.

Ethena’s synthetic dollar, USDe, has been a key selling point for the platform. In one week, it generated a jaw-dropping 67% yield for stakers, making traditional stablecoins like Tether look outdated.

You can’t deny that Arthur’s endorsement added credibility to the project, even if his actions later rattled confidence. But don’t get it twisted—this wasn’t charity. Arthur knows how to cash out when the timing’s right, as we’re seeing.

Arthur’s history and BitMEX’s dirty laundry

Arthur’s reputation as a sharp trader comes with a side of legal baggage. BitMEX was once a powerhouse in crypto derivatives trading, but it also faced accusations of running an “Insider Trading Desk.”

Allegedly, employees had “God Access” to accounts, letting them profit off private customer data. Critics say this turned the market into a playground for insiders while leaving ordinary traders exposed.

If that wasn’t enough, BitMEX has also been accused of manipulating index prices on low-liquidity exchanges to trigger liquidations. The accusations painted a picture of a company willing to crush its own users for a buck.

Arthur and his co-founders got hit with lawsuits and regulatory scrutiny. The Commodity Futures Trading Commission (CFTC) and the Department of Justice (DoJ) charged them with violations of the Bank Secrecy Act, alleging that BitMEX “facilitated illegal trading and lacked proper anti-money laundering protocols.”

A U.S. court refused to dismiss a class-action lawsuit against BitMEX in April, keeping allegations of price manipulation and insider trading alive as of press time.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap

Read the full article here