Ethereum (ETH) is firmly on the radar of the world’s largest asset manager, and they’re buying. A lot. Every day.

Indeed, BlackRock has been buying Ethereum every single day for more than two weeks straight, and they don’t seem to be slowing down.

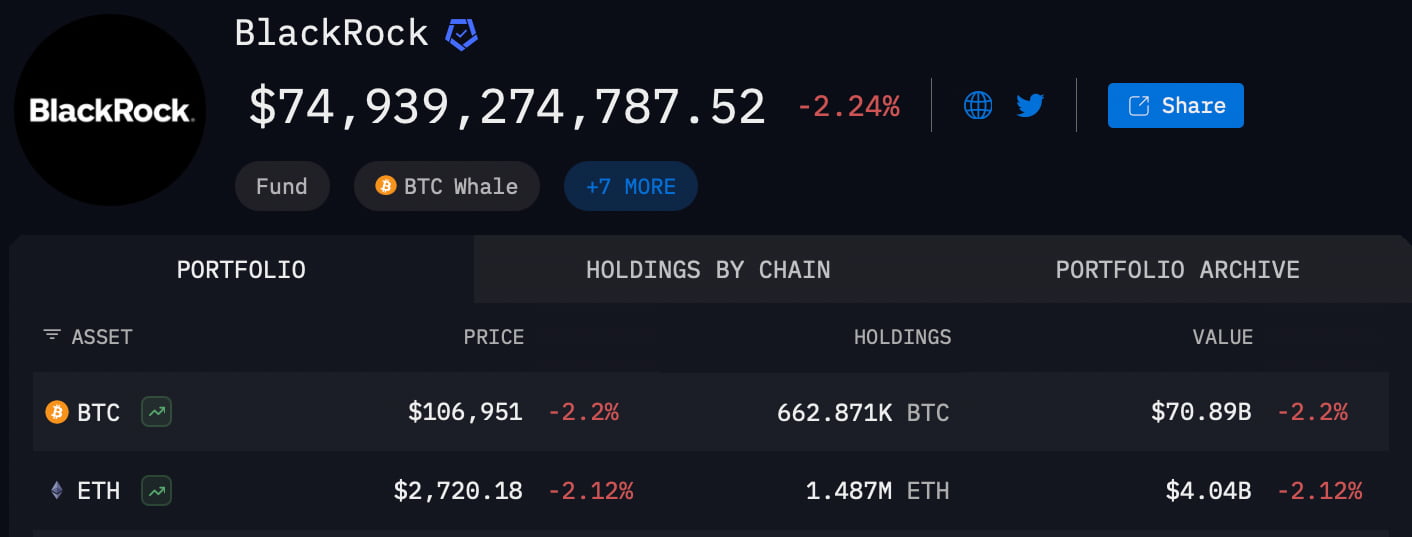

According to fresh data from Arkham Intelligence (June 11), BlackRock has scooped up a total of $570 million worth of ETH over the past two weeks. The buying spree is notable not just for its size, but for its consistency: BlackRock has purchased Ethereum daily for over two weeks, a pattern rarely seen from a player of this size.

At the time of writing, Ethereum is trading at $2,733, and BlackRock now holds around 1.487 million ETH, currently valued at $4.06 billion. While this is still smaller than its massive Bitcoin position — BlackRock holds 662,871 BTC, worth roughly $70.98 billion, the pace of its ETH accumulation is turning heads.

BlackRock is buying up ETH

So why is BlackRock doubling down on Ethereum right now? The timing is key. Ethereum has been gaining institutional traction amid the push for an ETH ETF approval and growing interest in staking and tokenization use cases. Meanwhile, ETH’s role in powering the next wave of decentralized finance is strengthening.

For some, this signals a broader shift in how large institutions view the crypto landscape. Bitcoin remains the flagship, but Ethereum’s versatility, powering smart contracts, DeFi, and tokenized assets is making it an increasingly attractive long-term bet.

As the market watches for the next big catalyst, all eyes will be on whether BlackRock continues this aggressive ETH accumulation streak in the weeks ahead.

Featured image via Shutterstock

Read the full article here