Bitcoin price today:$68,800

- Bitcoin recovered slightly on Tuesday as Donald Trump took the poll lead.

- US spot Bitcoin ETFs registered an outflow of $541.10 million on Monday.

- Grayscale’s report highlights the cross-asset returns seen in October mirror the trends usually associated with a “Trump trade.”

Bitcoin (BTC) slightly recovered to around $68,800 on Tuesday, following a shift in the United States presidential race that saw former President Donald Trump regain the lead, after US spot Bitcoin ETFs experienced an outflow of over $540 million on Monday. Grayscale’s report highlights that cross-asset returns in October reflect trends typically seen in a “Trump trade”. This includes growing positions in the dollar, crypto, and expectations of higher Treasury yields, which gained momentum as Trump’s lead in prediction markets strengthened ahead of the election.

Donald Trump takes the lead as Bitcoin recovers in parallel

Bitcoin price recovered slightly on Tuesday, putting Donald Trump back in the lead after prices dropped amid significant outflows of $541.10 million from spot ETFs on Monday, according to Coinglass data. “This coincided with a poll showing Harris’s narrow lead in Iowa on Monday,” says QCP’s report.

Moreover, as discussed in the previous article, the crypto crowd has perceived Trump’s proposals as being a bit more specific and extensive than Harris’s.

Total Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

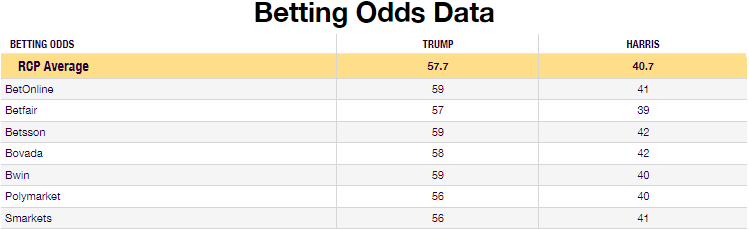

According to an analyst at FXStreet, “On the day of the US presidential election, PredictIt has Donald Trump back in the lead, albeit with a small margin. Other platforms point to much stronger odds for Trump to win. RealCelarPolling’s average for betting odds currently has Trump at 57.7 and Harris at 40.7.”

Meanwhile, polls suggest the race will be much closer than betting odds suggest. The TIPP poll has Trump and Harris tied at 48 points nationwide, the Ipsos poll has Harris leading by two points, 50 vs. 48, and the Atlas Intel poll has Trump having a one-point lead, 50 vs. 49, as per RealClearPolling.

Grayscale’s report suggests that while it’s challenging to assess directly whether financial markets are pricing in a higher probability of a Trump victory, cross-asset returns observed in October align with patterns typically seen in a “Trump trade,” as shown in the graph below.

“The ‘Trump trade’—encompassing long positions in the dollar, crypto and bets on higher Treasury yields— gained traction leading up to the election, buoyed by Trump’s lead in prediction markets. However, a Harris victory could potentially reverse these gains, triggering significant overnight market swings,” says QCP’s Capital report.

From a macro perspective, the US Dollar appreciated and the Chinese Yuan depreciated, perhaps reflecting higher perceived tariff risks. Similarly, bond yields increased (bond prices declined) and the price of gold increased, which could reflect expectations for larger budget deficits and more inflation under a Trump presidency. However, Bitcoin appreciated 9.6% during the month and was among the better-performing assets on a risk-adjusted basis.

“The former president has enthusiastically embraced Bitcoin and crypto, so its appreciation could reflect expectations of a pro-Bitcoin regulatory environment. Moreover, Bitcoin, like gold, may be responding to potential macro policy changes under a Trump presidency,” says the report.

October Risk-Adjusted Returns chart. Source: Grayscale

The report also explains that the outcome of the US election could have a major impact on the digital assets industry. The next president and Congress may take up crypto-specific legislation and change tax and spending policies that affect broader financial markets.

Grayscale Research highlights that a change in the Senate’s control could be particularly relevant for crypto, given the Senate’s role in confirming presidential appointments of key regulators, such as the chairs of the Securities and Exchange Commission and the Commodity Futures Trading Commission (CFTC).

“Moreover, specific candidates from both parties have expressed support for crypto innovation. Regardless of which party is in control, Grayscale Research believes that comprehensive bipartisan legislation could be the best long-term solution for the digital assets industry in the United States,” says Grayscale.

Bitcoin Price Forecast: Shows signs of recovery

Bitcoin price faced rejection around its all-time high (ATH) of $73,777 on October 29 and declined 6.65% in the next six days. However, it recovers slightly on Tuesday after finding support around $67,000 on Monday.

If BTC fails to recover and continues to decline, it may retest the key psychological level of $66,000.

The Moving Average Convergence Divergence (MACD) indicator further supports Bitcoin’s decline, signaling a bearish crossover on Sunday’s daily chart. The MACD line (blue line) moved below the signal line (yellow line), giving a sell signal. The indicator also shows rising red histogram bars below the neutral zero line, suggesting that Bitcoin’s price could experience downward momentum.

However, the Relative Strength Index (RSI) on the daily chart is currently at 55 after bouncing off the neutral level of 50 on Monday, indicating some signs of recovery in bulls. If the daily RSI closes below the neutral level, it would suggest increasing bearish momentum and could significantly weigh on Bitcoin’s price.

BTC/USDT daily chart

If BTC breaks and closes above the October 21 high of $69,519 level, it could rise to retest its ATH at $73,777.

Read the full article here