Hedera Hashgraph (HBAR) has been the subject of significant market speculation as a bullish technical pattern suggests a price target of $0.39 for the week. With the token currently trading around $0.314, this projection represents a 26% price surge, contingent upon the market’s ability to break through key resistance levels and maintain bullish momentum.

Hedera Bullish Pattern in Play

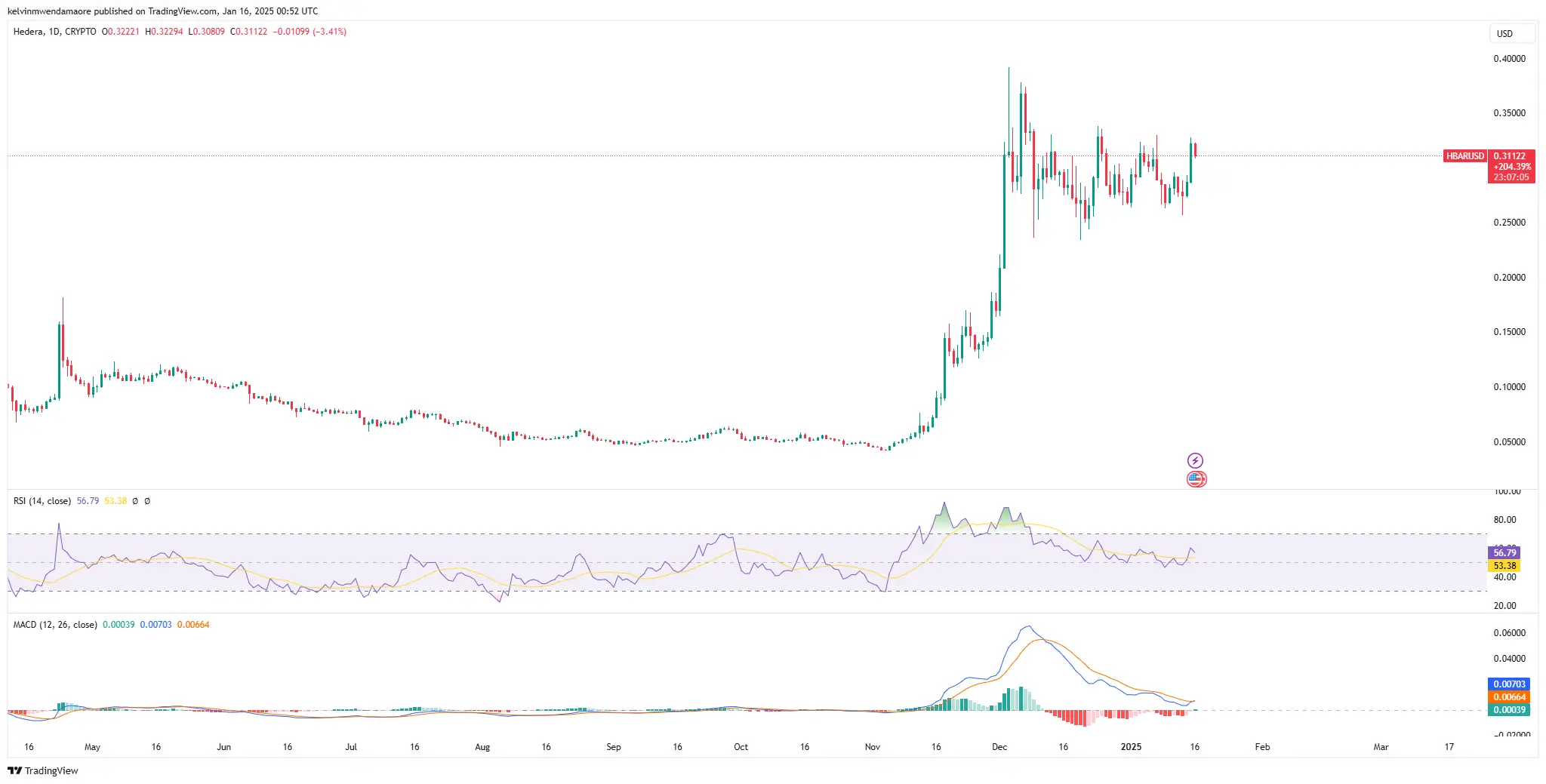

The daily chart for the HBAR token reveals a symmetrical triangle formation, a classic continuation pattern that signals likely breakout scenarios. Notably, the triangle’s apex aligns with increasing trading volumes, reinforcing the likelihood of a decisive price movement in the coming days.

The upper resistance trendline converges at approximately $0.34, while support holds near $0.26. The Fibonacci 1.0 extension at $0.391 serves as the bullish target for this week, aligning with the token’s broader uptrend. The resistance zone, marked by the +1/8 Overshoot level at $0.317 and the +2/8 Extreme Overshoot at $0.341, will be critical hurdles for bulls.

A successful breach of these levels could propel HBAR toward $0.39, the ultimate bullish target. Conversely, support levels at $0.292 and $0.268, reinforced by the 8/8 Ultimate Resistance and 7/8 Weak Stop & Reverse levels, provide a safety net for the token. If bearish pressure takes hold, Fibonacci retracement levels at $0.258 and $0.217 may come into play, acting as further downside support.

HBAR’s Indicators Confirm Bullish Momentum

The technical indicators on HBAR’s daily chart bolster this bullish case. The cryptocurrency recently bounced off the Fibonacci 0.618 retracement level at $0.258, affirming the health of the uptrend. Murrey Math lines also highlight $0.317 as a pivotal short-term resistance, and breaking this level could set the stage for further gains.

Moreover, increasing trading volumes near the triangle’s apex support the likelihood of a breakout, as such volume trends have historically preceded significant price movements. Not to be left out, the MACD and RSI indicators provide additional evidence supporting the possibility of HBAR’s bullish breakout.

This is apparent as the MACD exhibits a bullish crossover, with its MACD line at 0.00703, slightly above the signal line at 0.00664, showing increasing buying momentum. Furthermore, the histogram has transitioned into positive territory, indicating that bullish sentiment is gaining traction.

Historically, such crossovers in the MACD have preceded notable price surges for HBAR, suggesting that the token could be primed for a move toward the $0.39 target. Similarly, the RSI stands at 56.79 below the overbought threshold of 70, hinting at ample space for further uptrend before the token encounters intensified selling pressure.

This mid-level RSI reading reflects a healthy balance between buyers and sellers, with a slight tilt toward bullish dominance. A gradual climb in the RSI over the past few days suggests increasing demand for HBAR, which aligns with the symmetrical triangle pattern, indicating a possible breakout.

However, potential roadblocks remain. Broader cryptocurrency market sentiment, particularly Bitcoin’s performance, could influence HBAR’s price trajectory. A downturn in the crypto market could hinder HBAR’s bullish momentum. Additionally, selling pressure near $0.35 may act as a supply zone, requiring strong buyer conviction to sustain the rally.

Read the full article here