The monthly active users of Aptos crypto showed exponential growth throughout the year, culminating in a striking surge in Q1 2025.

Starting from a modest base in Q1 2024, there was a consistent uptrend. A significant jump was observed in the last quarter.

The active user base rose from around 2 Million in the first quarter of 2024 to an impressive 10 Million by the end of the year. And that culminated into nearly 11 Million by Q1 2025.

This phenomenal growth indicated Aptos’s scalability and efficiency.

APT monthly active users | Source: Token Terminal

The rising user count reflects heightened on-chain activity and possibly increased adoption rates across various applications. Which in turn hints at Aptos’s growing importance in the web3 landscape.

Predictively, if this trend continues, Aptos crypto could see sustained or increased interest, bolstering its position in the market. Potentially, it would influence the platform’s valuation and appeal to new projects and investors.

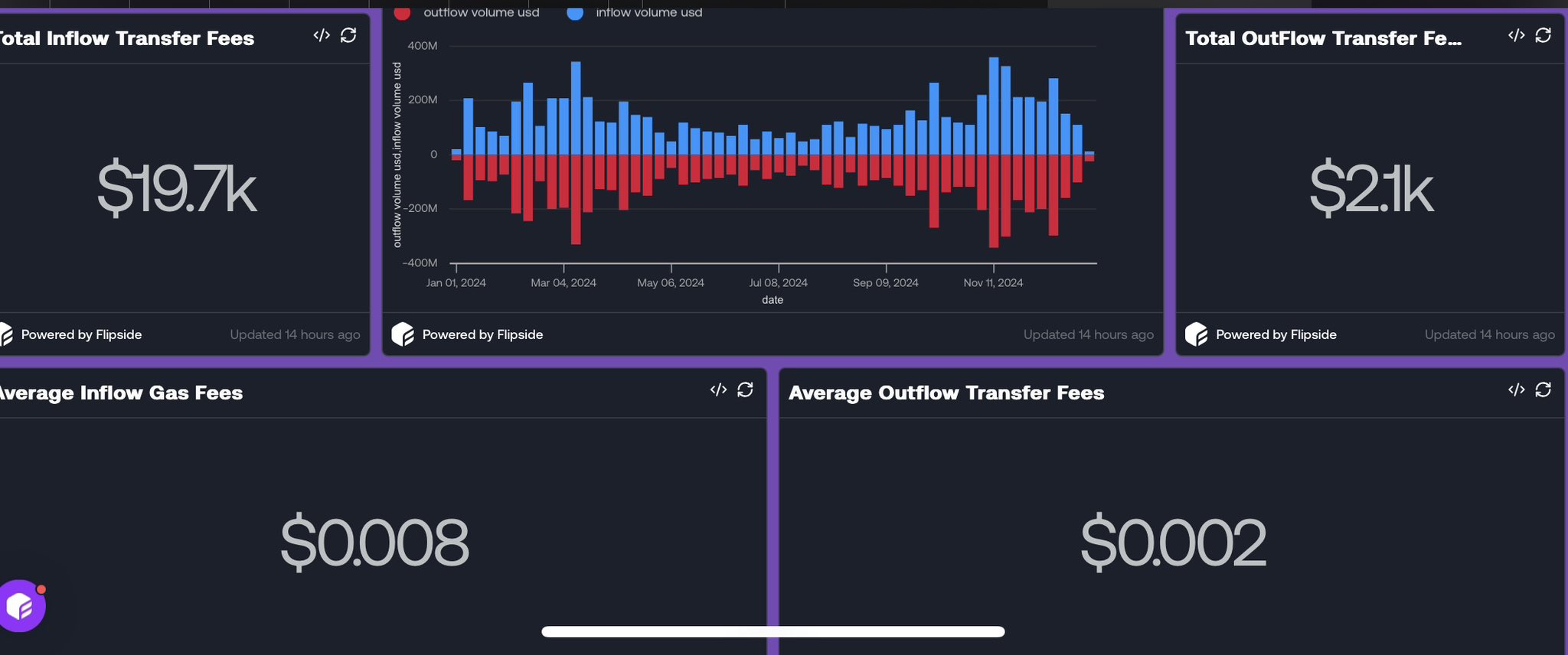

Also the disparity in fees associated with inbound versus outbound transfers of APT tokens on the Aptos blockchain.

There was $19.7K incurred for inflow transfers at an average gas fee of $0.008 per transaction, while outflows totaled $2.1K with a minimal fee of $0.002 per transaction.

Aptos blockchain fees | Source: X

This pattern suggested significant cost efficiency, particularly in outbound movements, likely a strategic maneuver by major stakeholders optimizing token transfers.

The fee structure could influence token utility and attractiveness, potentially fostering greater adoption and uptrend in response to enhanced cost-effectiveness on the blockchain.

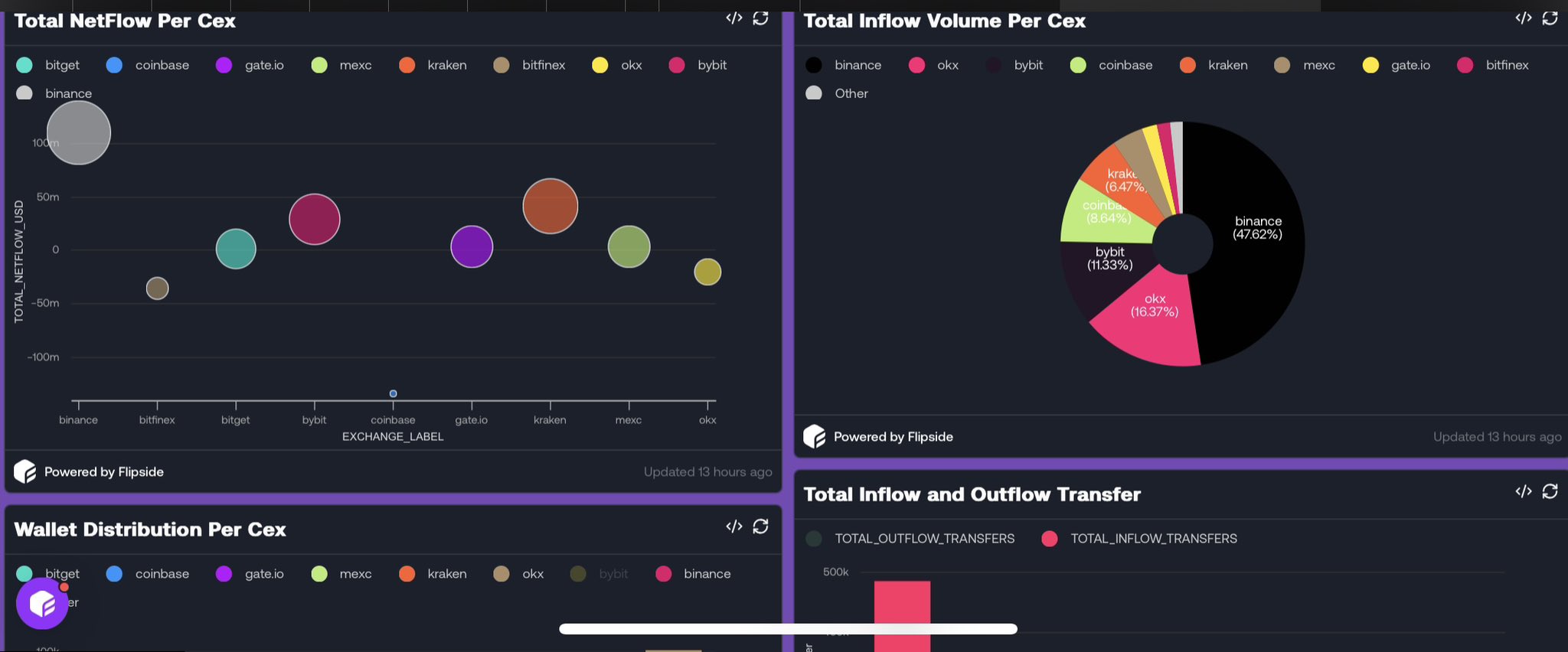

Aptos Crypto Inflows/Outflows on Exchanges

Aptos showed a stark contrast in inflow and outflow dynamics across various centralized exchanges (CEXs). This notably highlighted Binance’s dominant role in inflows, accounting for 47.6% of the total.

This substantial volume established Binance as a key accumulation hub for Aptos. Robust buying interest was critical for price stability and potential appreciation.

OKX, leading the outflows, indicated it might be a preferred platform for users liquidating or transferring their holdings, possibly to different wallets or for trading on other platforms.

This activity could introduce selling pressure on Aptos crypto, affecting its price negatively in the short term.

High inflow volumes at Binance, combined with the significant market share of inflows it commands, could bolster the price.

That is if the buying pressure outweighs selling actions reflected by outflows primarily from OKX. These patterns suggest that Binance could drive up the price by accumulating more APT.

At the same time, the actions on OKX and other exchanges with significant outflows need monitoring as they could counterbalance or even undermine these upward trends.

Aptos Weekly Price Action

Aptos crypto formed a symmetrical triangle over recent weeks. During this period, APT exhibited signs of consolidation, with price movements hinting at an upcoming decision point.

The formation suggested a potential breakout which could propel prices above the $20 mark if sustained buying pressure emerged.

Notably, APT price touched a low near $10.42 and later rebounded, testing resistance levels that converged around the $21.97 high seen previously.

This pattern indicated uncertainty but also a buildup of potential energy as traders align on value perception at these key levels.

APT/USD weekly chart | Source: Trading View

Historically, such patterns have often preceded significant rallies once a clear breakout or breakdown occurs.

For Aptos crypto, a decisive move above the upper trendline of the triangle could have validated bullish sentiment, potentially setting the stage for further gains as speculated in historical and real-time analysis.

Conversely, failure to breach this resistance could have led to a retest of lower support levels. And the pattern would be maintained until a clearer trend emerged.

This analytical perspective aligned with the noted potential for Aptos, suggesting that its strategic positioning within the broader crypto market and inherent volatility could lead to significant price movements.

Read the full article here