XMR decisively retained gains from the primary support mark of $100 and gained momentum in the past sessions. The XMR crypto has sustained gains near the 100-day EMA mark.

Additionally, a double bottom formation was noted, which has the neckline hurdle around $150, close to the 200-day EMA mark. If bulls succeed in splitting the range, a much-awaited bull rally can be seen ahead.

At press time, XMR traded at $133.56 with an intraday drop of 1.89%, reflecting neutrality. It has a monthly return ratio of 16.20% and a yearly return ratio of 13.20%.

The pair of XMR and BTC is at 0.00217 BTC, and the market cap is $2.47 Billion. Analysts are neutral and suggest that the XMR price may glimpse bullish momentum ahead and will soon cross the upside mark of $150.

XMR Gained Pace Amidst the LocalMonero Shutdown: Here’s a look:

Last week, LocalMonero, a peer-to-peer trading platform, said in a statement that- it has disabled all new sign-ups and order posting activity. However, it will take around six months to finish the entire procedure.

Hey everyone,

After almost 7 years of operation, we have made the difficult decision to close our platform.

The winding-down process begins today, and finishes 6 months from now. Our support will be available for help throughout this period.

Read more:https://t.co/66gqe5HFpc

— LocalMonero (@LocalMoneroCo) May 7, 2024

Amidst this statement, the Monero (XMR) price noted an uptick and surged over 17% in the last 10 trading sessions.

Price Action Hints Buyer Accumulation

Since the beginning of this month, the Monero (XMR) price has been on a recovery track and has retained momentum. The XMR crypto is close to crossing the 200-day EMA mark and exists near the $150 mark.

For weeks, the crypto asset persisted in delivering the lower low sequences, but signs of trend reversal were witnessed, and a fresh bull wave was noticed.

Source: TradingView

The Monero (XMR) price has crossed the 100-day EMA mark, highlighting the buying momentum in the last sessions. Going forward, price recovery with a spurt in trading volume indicates investor speculation. The intraday trading volume rose over 23.89% to $40.70 Million.

The Momentum indicator (Relative Strength Index) curve retained the midline region, stood near 55, and showcased a positive divergence.

Surge In Transaction Count

As the month passed, the transaction count bars on the charts displayed a consistent incremental move.

Last month, the value was nearly 22k, which soared to 37k, highlighting a significant increase in the transaction count over the last few sessions.

Source: Messari

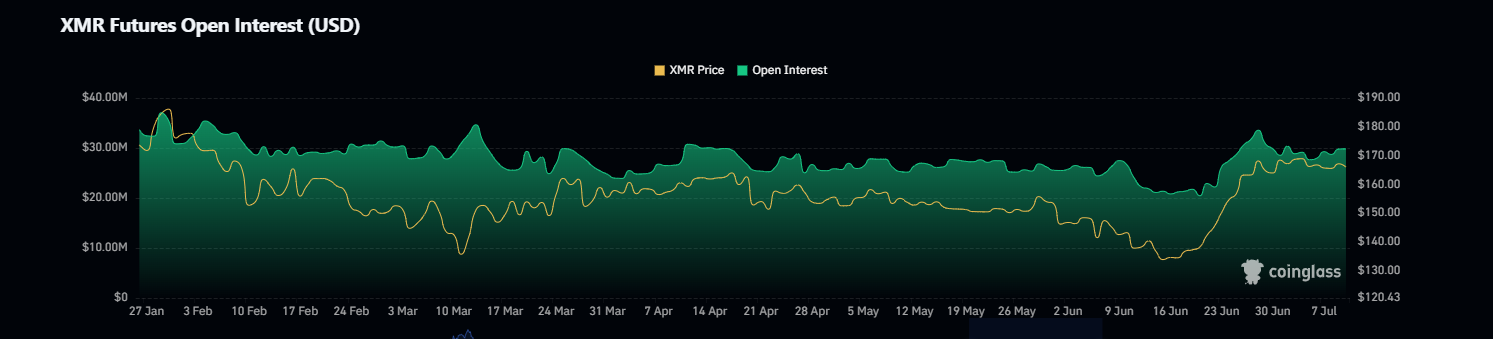

Futures Data Highlights Short Covering

This week, the sellers have covered their positions and a cut over 2.82% in the open interest (OI) was noted.

Source:coinglass

The immediate support levels for XMR are $128 and $120, while the key upside hurdle is around $140, followed by $150.

Conclusion

The Monero (XMR) coin may soon replicate a trendline breakout and surpass the round mark of $150. Moreover, fresh volume buying was noted, and buyers are eager to enter the trade.

Disclaimer

The views and opinions stated by the author or any other person named in this article are for informational purposes only and do not constitute financial, investment, or other advice.

Read the full article here