Cardano’s price has posted a 3% uptick in the last 24 hours, trading higher as the broader crypto market rebounds from recent lows.

The total crypto market capitalization has climbed over 2% today, with major altcoins like ADA gaining momentum. With bullish sentiment gradually coming back across the markets, ADA is poised to maintain its rally in the short term.

Cardano Breaks Out of Downtrend

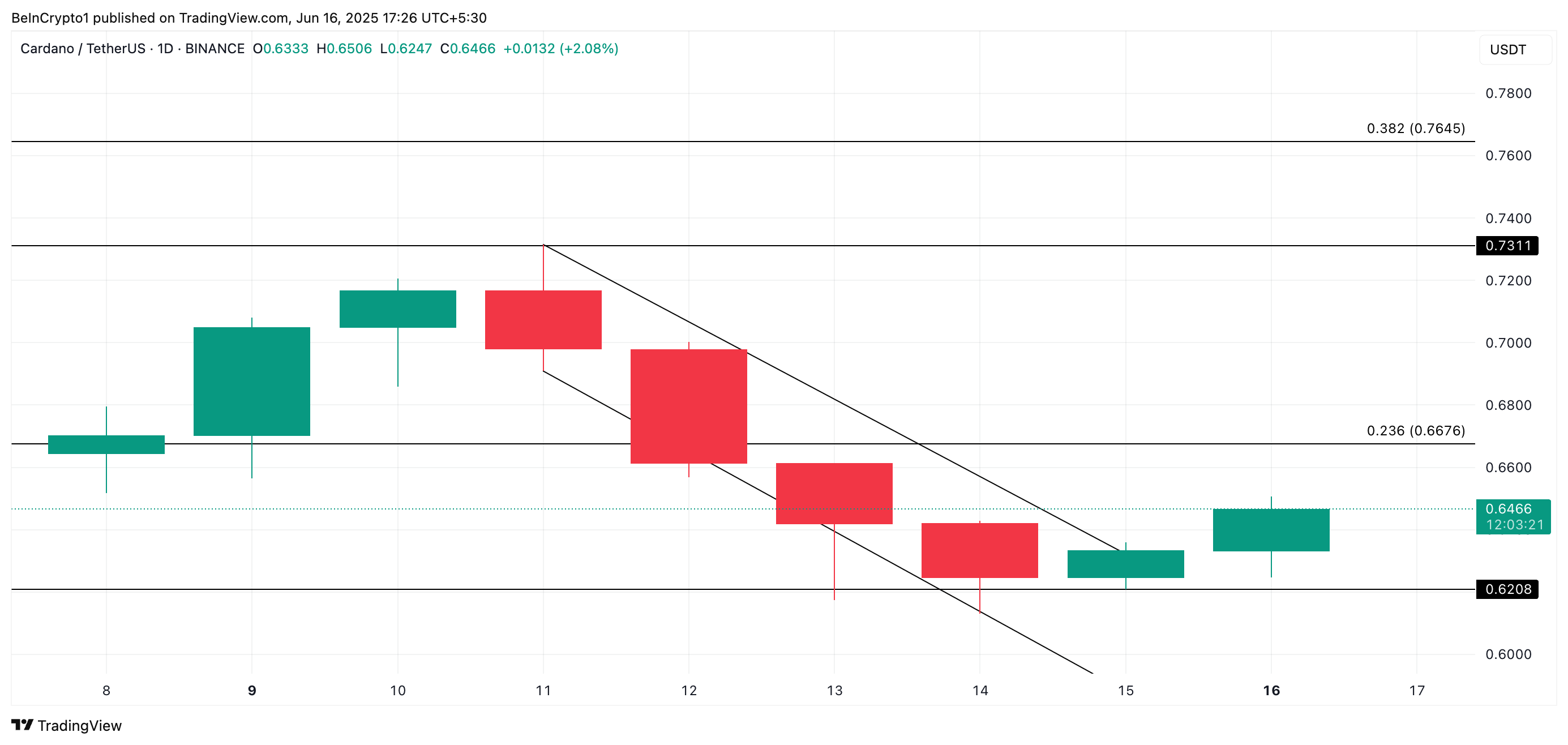

ADA’s 3% rebound over the past day has pushed its price above the descending channel that kept its price in a downtrend between June 11 and 15.

This pattern emerges when an asset’s price forms lower highs and lower lows within two parallel downward-sloping trendlines, signaling a prevailing bearish trend. When an asset’s price breaks above the channel’s upper boundary, it indicates a potential trend reversal and the start of bullish momentum.

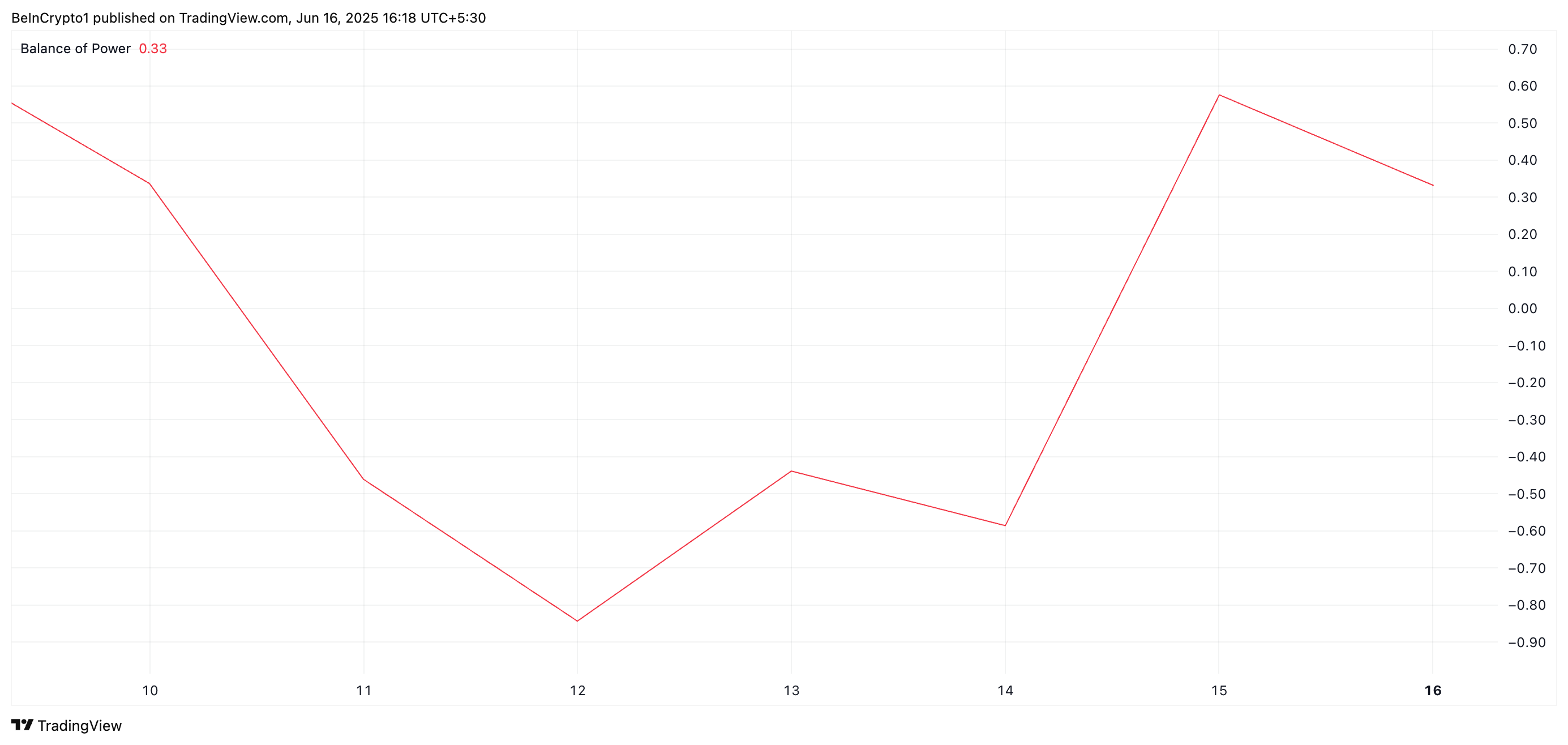

Readings from ADA’s Balance of Power (BoP) confirm the resurgence in bullish momentum. As of this writing, this indicator is positive at 0.33.

The BoP indicator measures the strength of buyers versus sellers in the market, helping to identify momentum shifts. When its value is positive, buyers are in control of the market and are driving newer price gains.

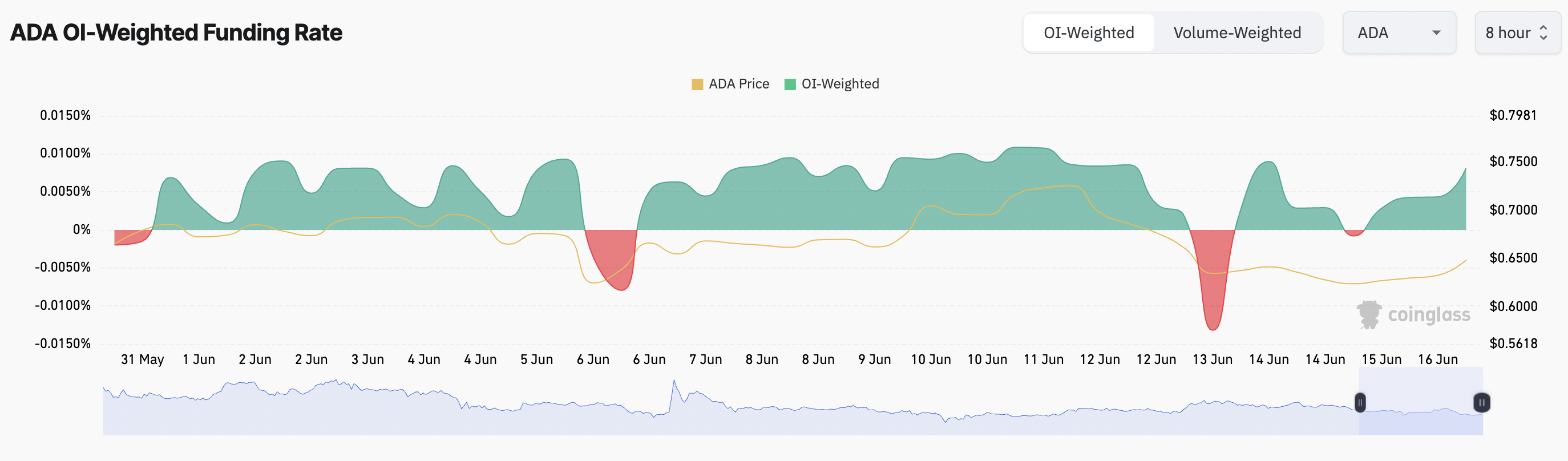

Moreover, this bullish sentiment persists among ADA futures traders, reflected by the coin’s positive funding rate. At press time, this is at 0.0081%, per Coinglass data.

The funding rate is a periodic payment between traders in perpetual futures markets to keep contract prices aligned with the spot price. A positive funding rate means long positions are paying shorts, indicating that bullish sentiment dominates and most ADA traders expect prices to rise.

Cardano Faces Key Test at $0.66

While ADA’s path to $1 remains uncertain, strengthening bullish momentum could see the coin break above resistance at $0.66 and target $0.73 in the mid-term.

If buy-side pressure continues to build at that level, the rally may extend toward $0.76.

However, a bearish shift in sentiment among Cardano buyers could push the price back down to $0.62, a level still back within the bounds of the previous descending channel.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here