Cardano (ADA) is under pressure, down 4.5% in the last 24 hours as its trading volume also dropped nearly 19% to $640 million. Despite early-year outperformance against Bitcoin, ADA has lost momentum and is now down 26% year-to-date.

Whale activity has cooled, technical indicators have turned bearish, and price action remains stuck between key support and resistance levels. Without a broader altcoin rally or clear accumulation trend, ADA may continue to struggle for direction in the short term.

ADA Down 26% YTD Despite BTC Rally—Altseason Needed for Recovery?

Earlier this year, Cardano outperformed Bitcoin, showing signs of strength in the early stages of the market cycle.

However, that momentum quickly faded, and the correlation between the two assets began to weaken. While BTC is now up roughly 14% year-to-date, ADA has dropped nearly 26% since January 1.

This divergence highlights a shift in investor focus, as capital has favored larger, more established assets like Bitcoin while many altcoins, including ADA, have struggled to maintain traction.

Even as Bitcoin has gained momentum in recent weeks, ADA has yet to benefit meaningfully. This suggests that a rising BTC alone may not be enough to trigger a recovery for Cardano.

For ADA to mount a strong comeback, it may require a broader altcoin rally—possibly during a full-scale altseason in the second half of 2025.

However, with market uncertainty and capital rotation still favoring Bitcoin, there’s no clear guarantee that such a trend will materialize.

Cardano Outlook Weakens Amid Whale Caution

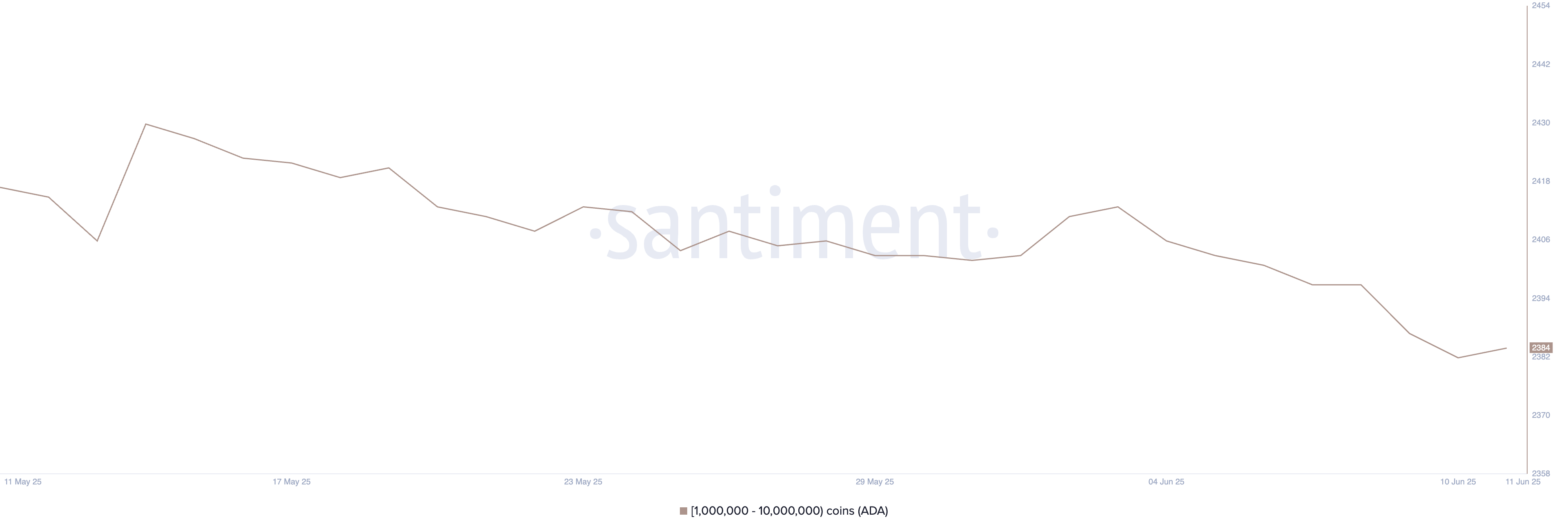

The number of Cardano whales—addresses holding between 1 million and 10 million ADA—currently sits at 2,384. That’s down from 2,413 nine days ago but slightly up from 2,382 just two days ago.

This recent movement suggests that while the broader trend has shown a mild reduction in large holders, some accumulation may have returned in the last 48 hours.

Monitoring whale wallets is important because these addresses often influence price through large buy or sell activity, and shifts in their behavior can signal changes in market confidence or strategic positioning.

Despite the small uptick, the overall drop in whale count over the past week may reflect caution or profit-taking among high-stakes holders.

Without strong accumulation from these entities, ADA may struggle to build sustained upside momentum, especially with broader market attention leaning toward Bitcoin.

A clear shift in whale accumulation or broader altcoin inflows would likely be needed for Cardano to regain traction.

The Ichimoku Cloud chart shows that ADA recently broke below the blue conversion line (Tenkan-sen) and is now trading below the red baseline (Kijun-sen).

The cloud ahead has turned green but remains thin, suggesting weak support for bullish continuation unless price re-enters and holds above it.

The price’s current positioning below both trend lines and the cloud indicates a bearish short-term outlook. For momentum to shift, ADA would need to reclaim the baseline and break through the cloud with strong volume and conviction.

ADA Range-Bound: Will It Fall 8% or Rally 13%?

Cardano price is currently trading within a narrow range, caught between a resistance at $0.707 and a support at $0.654. This consolidation zone sets the stage for a potential breakout—or breakdown—in the coming sessions.

If the $0.654 support is tested and lost, ADA could slide toward $0.618, marking a possible 8.6% correction from current levels.

Such a move would likely confirm bearish momentum and reflect broader market weakness or fading buyer interest.

On the flip side, if ADA manages to break above the $0.707 resistance, it could retest the next level at $0.731.

A confirmed breakout above that zone would shift the short-term trend bullish and open the door for a push toward $0.777—representing an upside of nearly 13%.

For that scenario to unfold, Cardano would need sustained buying volume and a reversal in current technical pressures. Until then, the price remains range-bound, with traders watching for confirmation on either side.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here