As the crypto market continues to navigate its intricate patterns, the rivalry between Ethereum (ETH) and Bitcoin (BTC) remains a focal point for traders and investors alike.

Recent analysis suggests a power struggle between Ethereum and Bitcoin in the coming month. Can ETH regain its bullish price action against BTC in May?

Analyzing ETH/BTC: Traders’ Insights on Crypto Price Trends

Ethereum recently reclaimed a critical trading range, suggesting strong support at approximately 0.049 in its pairing with Bitcoin (ETH/BTC). This recovery is pivotal as it indicates Ethereum’s resilience and potential for upward movement if it maintains above this threshold. Crypto trader DaanCrypto shows that ETH is still trading in a range with BTC.

“Besides that, I’m not overcomplicating things.” DaanCrypto Added.

ETH/BTC Weekly Price Chart. Source: X

Analysts keenly observe these levels, suggesting that simplicity in trading strategies might be the best approach.

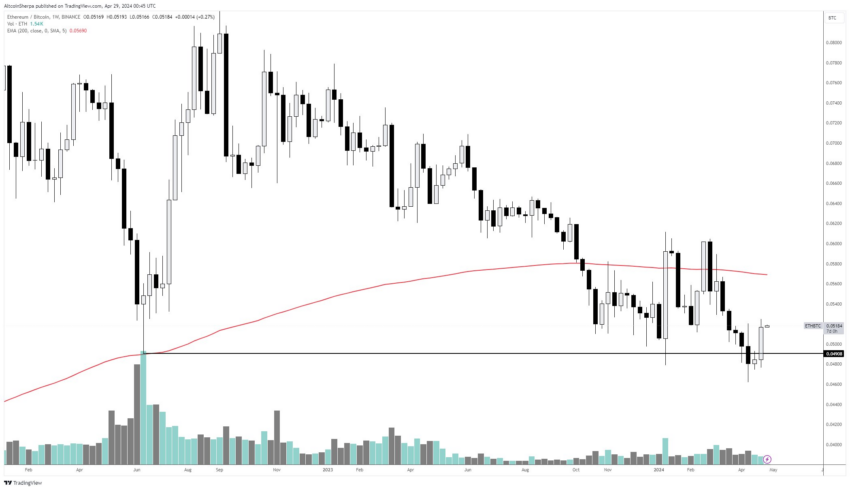

Contrastingly, the sentiment around Bitcoin’s current trajectory is more uncertain. Observers like AltcoinSherpa express skepticism regarding a solid reversal, hinting that while some upside might be visible short term, it’s premature to declare a bottom.

“I think that we see a bit more upside in the short term but not banking on this being the ‘bottom’ quite yet.” Altcoin Sherpa noted.

ETH/BTC Weekly Price Chart. Source: X

This cautious stance is echoed by others who note Ethereum’s promising volatility and trading volume, which could play in its favor against Bitcoin’s relatively recent but unexciting market performance.

Read More: Ethereum ETF Explained: What It Is and How It Works

Further adding to Ethereum’s narrative are speculations around regulatory impacts, particularly discussions about the SEC’s influence on market dynamics. With Ethereum’s capability to capitalize on these regulatory outcomes—through ETF rejections or approvals—its price could benefit significantly from the resultant trading volatility.

Anbessa added commentary on a potential ETH ETF approval or denial as possibly being the catalyst for what occurs next.

“Does SEC trying to shake you out before the reversal?” Anbessa stated.

Additionally, the trader stated that while the downside target on ETH/BTC has been hit, it could restest support before seeing more upside.

“we could still see another retest of support and consolidate a few months. Solid volatility to profit from ETF denial and later approval insidor trading before it gets send. SL unchanged.” Anbessa concluded

ETH/BTC 2-Week Price Chart. Source: X

ETH/USD Pair Also Showing Lack of Bullish Momentum

Yet, not all signals are bullish. Observations from market watchers like ColdBloodShill note that Ethereum has struggled to “stick a landing” in recent months, facing challenges in sustaining a consistent upward trajectory. Such insights are crucial as they underscore the ongoing challenges and the competitive edge required to outshine Bitcoin truly.

Read More: Ethereum (ETH) Price Prediction 2024/2025/2030

ColdBloodShill’s chart shows how ETH has failed to hold key support and essentially turned it back into resistance. The chart again indicates a potential for more downside to the $3,100 area.

ETH/USD Price Chart. Source: X

While Ethereum shows promising signs of possibly outperforming Bitcoin in May, the crypto market’s inherent unpredictability means outcomes remain fluid.

The battle between Ethereum and Bitcoin is not just about prices and technicals but also how broader market dynamics, including regulatory news and economic indicators, influence these two leading cryptocurrencies.

Read the full article here