Cardano (ADA) price climbed 193.65% over the last 30 days and 37.82% in the past week. Despite this impressive rally, indicators suggest that ADA’s uptrend may be losing steam. The ADX, which measures trend strength, has dropped from over 60 to nearly 45, signaling weakening momentum even as the uptrend remains intact.

With whale accumulation stabilizing and prices approaching key EMA levels, ADA faces a critical moment that could lead to either a test of its highest price since 2021 or a potential 48% correction if bearish pressure grows.

ADA Uptrend Appears to Be Losing Steam

Cardano ADX currently sits at nearly 45, having declined from over 60 just a few days ago. The ADX, or Average Directional Index, measures the strength of a trend, with values above 25 indicating a significant trend and values above 40 suggesting a very strong one.

Although an ADX of 45 still reflects strong momentum, the drop from 60 signals a weakening in the trend’s intensity, even if the direction remains unchanged.

Currently, ADA is in an uptrend, supported by its directional indicators. The decline in ADX suggests that while the uptrend remains strong, the bullish momentum has begun to lose some of its strength. If the ADX continues to drop, it could indicate that the current uptrend may flatten or reverse if selling pressure grows.

However, with an ADX still well above 25, the trend remains meaningful, and Cardano price is likely to retain its bullish bias for the near term unless further weakening occurs.

Cardano Whales Stopped Accumulating

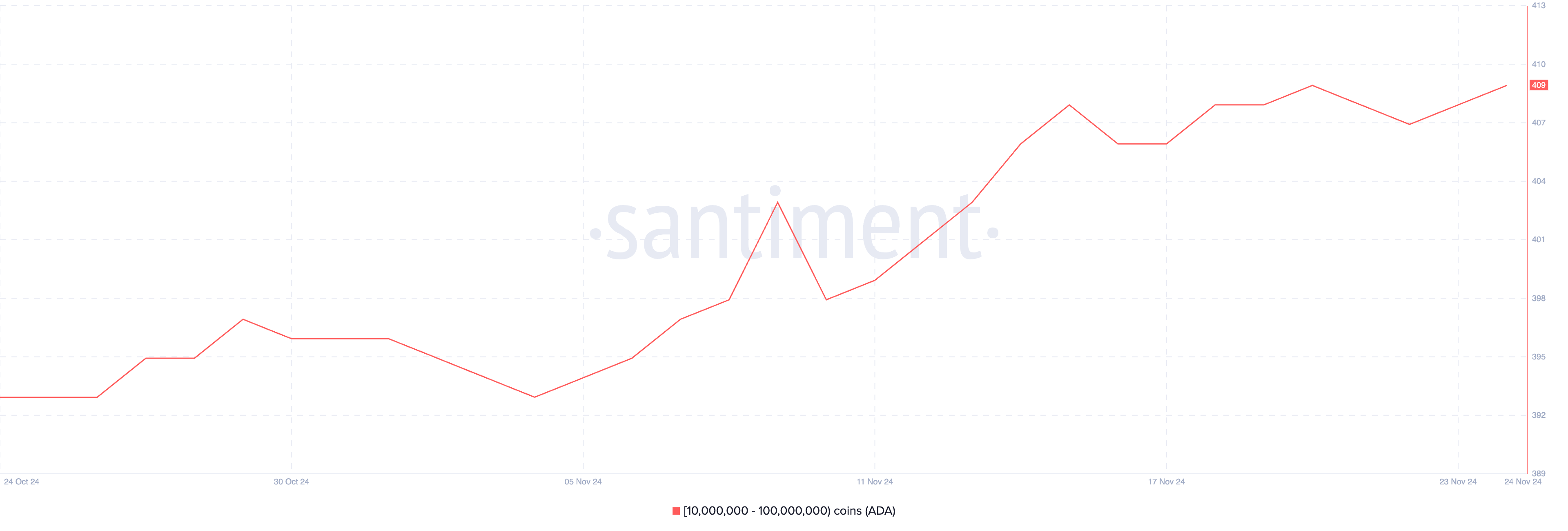

Whales began accumulating Cardano heavily starting November 10, with the number of wallets holding between 10,000,000 and 100,000,000 ADA increasing from 398 to 408 by November 15. Tracking whale activity is crucial because these large holders often have the power to influence market trends significantly.

Their buying behavior can indicate growing confidence in the asset and potentially fuel price surges, while their selling may trigger downward pressure.

Since November 15, the number of these whale wallets has stabilized, hovering between 407 and 409. This consistent accumulation suggests that whales are holding onto their positions, reflecting a neutral to bullish sentiment.

If whales maintain their holdings without significant additions or reductions, ADA price may experience less volatility, with the market awaiting new catalysts for the next directional move.

ADA Price Prediction: Highest Price Since 2021 Or a Strong Correction?

Cardano EMA lines continue to reflect a bullish setup, with short-term lines positioned above long-term ones. However, the current price is no longer significantly above the short-term EMA lines, indicating that the bullish momentum has weakened.

This proximity suggests that the uptrend is losing strength, and the ADA price is approaching a critical point where it could either rebound or dip below these lines, signaling a potential trend shift.

If the uptrend regains strength, ADA price could test levels above $1.155, potentially reaching $1.16, its highest price since March 2021. However, as indicated by the declining ADX, the current uptrend is losing intensity, increasing the likelihood of a reversal.

Should the trend turn bearish, ADA’s closest support lies at $0.519, which would represent a significant 48% correction from current levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here