ARK Invest, the cryptocurrency-friendly asset manager founded by prominent Bitcoin bull Cathie Wood, is taking the first profits from its exposure to stablecoin issuer Circle just 11 days after its public launch.

On Monday, ARK offloaded 342,658 Circle (CRCL) shares worth $51.7 million from its three funds, according to a trade notification seen by Cointelegraph.

The sale marks the first divestment of ARK’s CRCL shares since Circle debuted public trading on the New York Stock Exchange (NYSE) on June 5.

ARK acquired about 4.49 million shares of Circle common stock on the first day of trading, valued at $373.4 million at the closing price.

Circle among the top ARK’s holdings

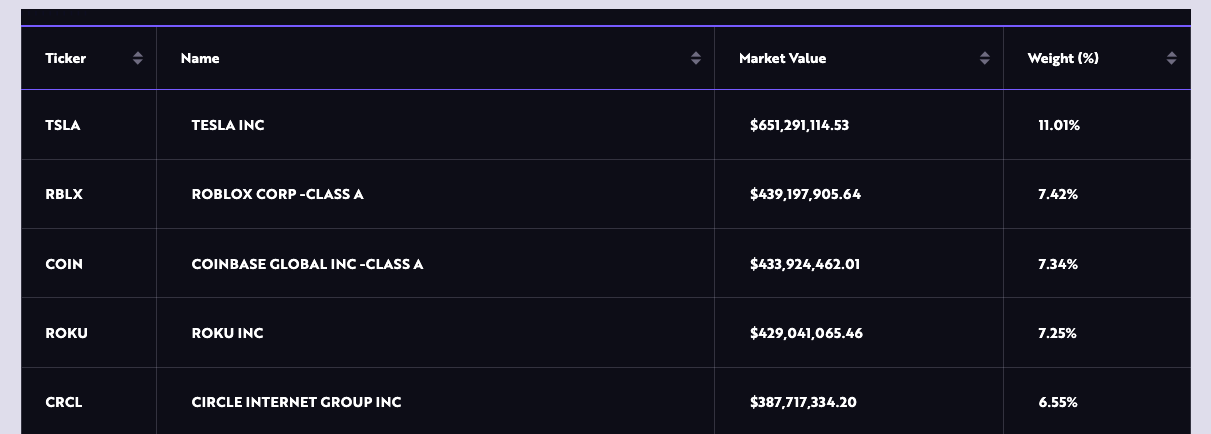

Following the sale, Circle remains one of the ARK’s top holdings across all three funds, including the ARK Innovation ETF (ARKK), ARK Next Generation internet ETF (ARKW) and ARK Fintech Innovation ETF (ARKF).

ARKK, the largest ARK fund with assets under management (AuM) of $5.6 billion, holds the largest CRCL position at $387.7 million, accounting for roughly 6.6% of its total assets.

ARKW holds $124 million CRLC shares, or 6.7% of its total assets, following Coinbase with a weight of 6.8%. ARKF, the smallest fund among the three in AUM, holds $72 million CRCL shares, or 6.7% of its assets.

ARK among early interested investors

ARK was among the early investors that indicated their interest in buying up to $150 million in Circle shares before its launch on the NYSE. The company increased its purchase volume following multiple initial public offering (IPO) upsizings in response to massive demand from investors.

On June 9, ARK’s research associates said that the success of Circle’s initial public offering highlighted that stablecoins have seen a shift in public perception of the crypto industry.

Related: Arthur Hayes says to trade new stablecoin IPOs like a ‘hot potato’

“Applying Hernando de Soto’s framework, stablecoins are continuing the property rights revolution that Bitcoin launched,” the analysts wrote, adding:

“Bitcoin made financial property rights possible with smartphones. Stablecoins are advancing the cause with a less volatile asset and more utility across blockchains and financial platforms.”

ARK Invest founder and CEO Wood is known as a major Bitcoin (BTC) bull. In February 2025, she predicted that Bitcoin may reach $1.5 million by 2030 amid rising institutional adoption and growing demand for BTC as an asset class.

Magazine: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight

Read the full article here