Chainlink price broke above $17.70 on Friday May 24, to reach a 45-day peak as the whale investors on embarked on a LINK buying spree in reaction to Ethereum (ETH) spot ETF approval this week.

Chainlink overtakes Bitcoin Cash after Ethereum ETF Approval

Since the Ethereum ETF approval on May 23, crypto investors have been observed making conspicous moves to redirect capital towards ETH markets as well critical projects built on the Ethereum blockchain network.

Chainlink is widely regarded as a market leader providing the critical off-chain price feeds and other vital information needed by complex smart contracts to become the dominant form of digital agreement

The LINK token’s systemic importance to the crypto world and the Ethereum network has been brought to fore amid this major shift in investor preference this week.

The chart below shows the changes in market capitalization of Chainlink in comparison to Bitcoin Cash since the Ethereum ETF approval.

Chainlink LINK Price Valuation vs Bitcoin Cash BCH

At the eve of the SEC verdict, Chainlink market capitalization stood at $9.6 billion on May 22, trailing Bitcoin Cash’s valuation by over $230 billion.

But since the ETH approval on May 23, LINK price has surged 15% reaching a new monthly peak of $17.77 on May 24. Curiously, in comparison, Bitcoin Cash has only mustered a 5% upswing during that period.

Consequently, Chainlink market cap has now overtaken Bitcoin Cash, reclaiming the $10 billion valuation status, while BCH remains rooted at $9.75 billion at the time of publication on May 25.

Chainlink Whales Invested another $16M this week

Bullish swings in whale activity on Chainlink this week is another key indicator that underlines widespread investor preference for LINK and other Ethereum-hosted crypto projects.

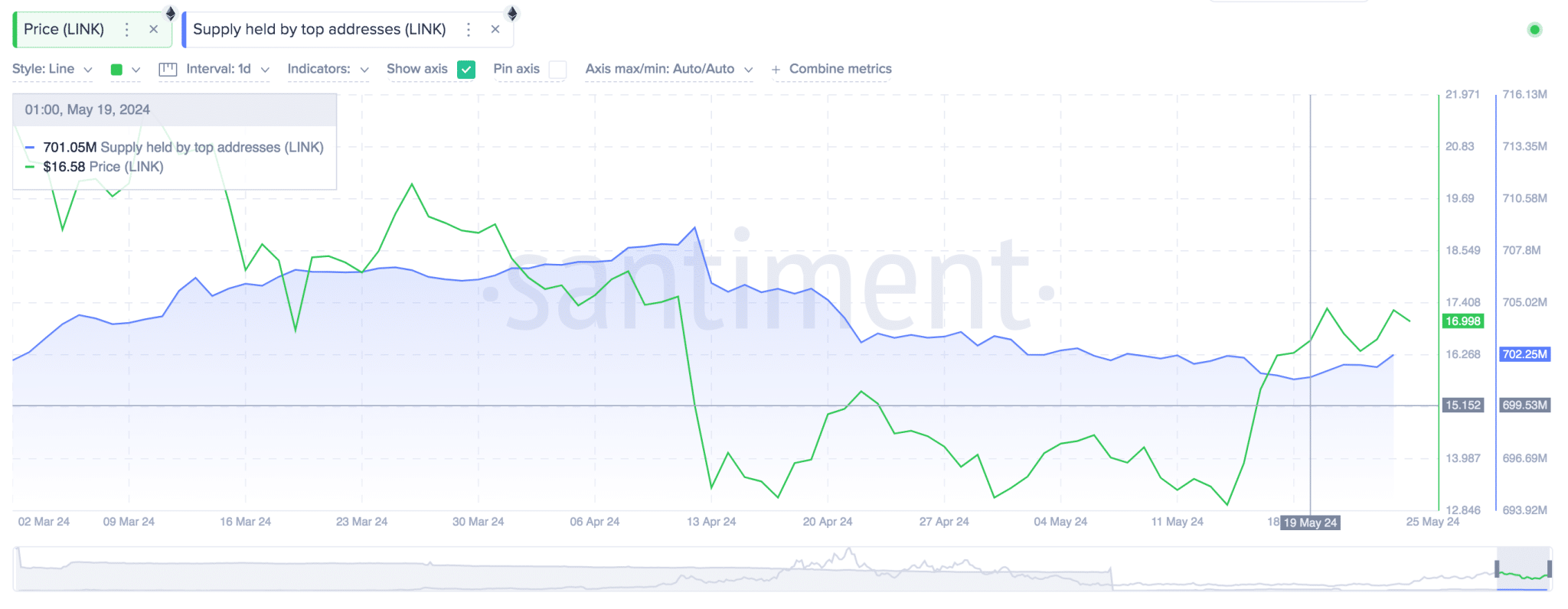

The Santiment chart below shows real-time changes in balances of LINK tokens controlled by the top 100 largest wallets.

Chainlink price vs LINK top 100 Investor Balances

Chainlink’s top 100 investors held a cummulative balance of 701.05 million LINK tokens at the start of the week on May 19. But as indicated by the blue trendline in the chart above the whale investors have rapidly acquired over 1.2 million LINK, to bring their balances to 702.25 million at the time of publication on May 25.

Valued at the current Chainlink prices of around $17 per token, this implies the whales investor over $18 million this week alone.

As many large institutional investors look to front-run the bullish impact of ETH ETFs inflows to the broader Ethereum blockchain ecosystem, Chainlink could witness more whale demand in the days ahead.

Chainlink Price Forecast: $20 target now in focus

Chainlink price is currently trading at $17, up 15% within the 48-hour timeframe. With the added market liquidity, and whale investors propensity for long-term holding, the $18 million buying frenzy this week could be the beginning of a LINK price ascent towards the $20 milestone.

Chainlink LINK price forecast

Looking at the historical accumulation trends, Chainlink price now faces a major resistance around the $17.50 level where, 8,190 active addresses had acquired 27.9 million LINK tokens.

If LINK price can establish a steady support base above this level, Chainlink price could reclaim the $20 territory for the first time since March 2024.

Read the full article here