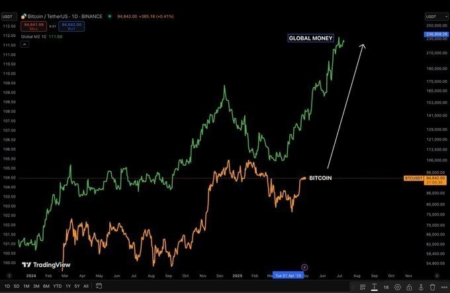

In an economic climate characterized by increasing monetary expansion and escalating geopolitical uncertainty, Bitcoin continues to gain momentum as a key financial asset. Recent developments highlight a structural shift toward digital assets, especially among institutional and corporate players.

On June 7th, James Wynn, a prominent whale trader in the crypto space shared an update that China has injected $139 billion worth of liquidity into its economy, which is a long planned move by the country. This event aligns with a broader global trend of central banks printing fiat money at unprecedented levels. Against this backdrop, Bitcoin is emerging as a digital hedge, steadily absorbing excess liquidity from fiat systems around the world.

CHINA 🇨🇳 JUST PRINTED $139 BILLION DOLLARS, ALL GOVERNMENTS WILL CONTINUE TO PRINT INFINITES AMOINT OF FIAT‼️

BITCOIN IS A GIGANTIC FIAT BLACK HOLE SUCKING IN ALL FIAT CURRENCIES FROM AROUND THE WORLD 🌎

CASH IS TRASH

BITCOIN IS 👑 pic.twitter.com/5zgWQsZXsZ— James Wynn (@JamesWynnReal) June 7, 2025

Institutional Demand Hits New Highs

According to data from CryptoRank, the number of large holders of CME Bitcoin futures has surged to an all-time high of 217. This marks a 36% increase since January, indicating steady accumulation by institutions. These participants are not reacting to short-term headlines but are building long-term positions.

Related: Bitcoin Rally Faces Headwinds as Matrixport Report Points to Weakening U.S. Economy

Furthermore, corporate entities are joining the fray. GameStop has reportedly added Bitcoin to its treasury, and Trump Media has raised $2.3 billion with plans to purchase Bitcoin. These developments signal growing confidence in Bitcoin as both a store of value and a strategic reserve.

Market Technicals Suggest a Breakout

Prominent market analyst Michaël van de Poppe notes that Bitcoin has reclaimed a crucial resistance zone. The price recently swept liquidity below $100,739 before rebounding sharply. This indicates that the market cleared stop-loss levels and attracted strong buyer interest. Technical indicators, such as volume and RSI, suggest bullish momentum.

Related: Corporate Bitcoin Holdings Surge to $85 Billion: What’s Fueling the Growth?

The key resistance level stands at $105,800. A confirmed breakout above this level could trigger a significant rally. This is due to a buildup of short positions and a demand imbalance in the market. However, failure to break above may lead to a retest of the $100,739 or even $91,770 support zones.

Liquidity taken and #Bitcoin has quickly approached the crucial resistance zone.

I think that we’ll break upwards in the coming week. pic.twitter.com/weDj1wTIq7

— Michaël van de Poppe (@CryptoMichNL) June 7, 2025

The trading volume for Bitcoin reached $22.3 billion in the past 24 hours. Its price has climbed to $105,502, reflecting a 0.70% daily and 1.29% weekly increase. With a circulating supply of 20 million BTC, the asset now boasts a market capitalization of over $2 trillion.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here