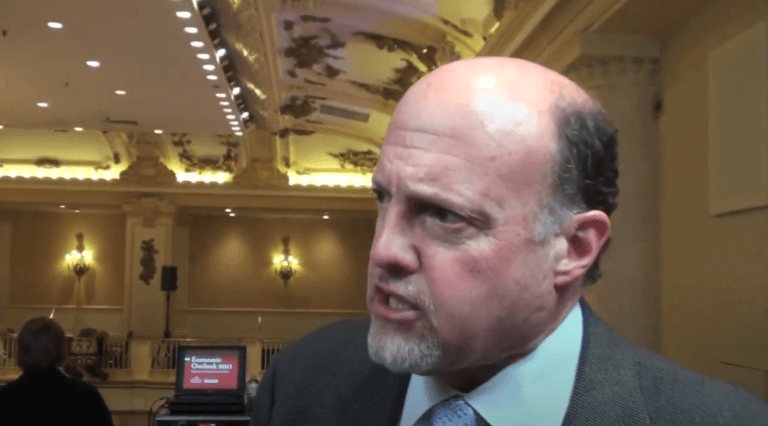

Jim Cramer, the outspoken host of CNBC’s “Mad Money,” took time on November 26 to address the public’s reaction to his recent comments about cryptocurrencies.

Opening with reflections on his recent series about market froth and excess, Cramer reminded viewers of the importance of securing gains in a volatile market. He urged investors to consider selling portions of their holdings to protect themselves from future losses, a strategy he described as essential in prudent investing. His advice comes from personal experience, as he admitted to committing the “sin” of turning gains into losses in the past.

However, the heart of his commentary was a response to criticism he received after recommending cryptocurrencies as part of a diversified portfolio. Addressing accusations of “calling the top” in crypto, Cramer dismissed the online backlash as “internet idiocy.” He clarified that his advocacy for crypto is not a new position, but one informed by a belief in its potential role as a hedge against economic instability, particularly in the face of mounting U.S. government debt.

Cramer pointed to historical fiscal missteps, such as the failure to issue long-term bonds during periods of low interest rates, as evidence of government inefficiency. He expressed concerns about potential drastic measures, like the hypothetical confiscation of assets, reminiscent of Executive Order 6102 under President Franklin D. Roosevelt, which required citizens to surrender gold. While he acknowledged that such scenarios are extreme, they highlight his broader skepticism about the government’s ability to effectively manage fiscal challenges.

This skepticism, combined with the enduring risk of political gridlock over debt ceilings, forms the basis of Cramer’s belief that assets like Bitcoin and Ethereum merit a place in portfolios. He sees them as safeguards against the unpredictable actions of policymakers, particularly as concerns about the national deficit continue to loom. While admitting there is no definitive proof that crypto can shield investors from economic turmoil, he described it as a “plausible story” and noted that in investing, sometimes a plausible story is enough.

Cramer concluded by reiterating his belief in holding both gold and crypto as part of a strategy to mitigate risk. Despite enduring criticism, he remained steadfast in his recommendation, pointing out that these assets are currently performing well, nearing all-time highs.

Read the full article here