With the near-passage of the GENIUS Act and a host of companies announcing stablecoin initiatives, stablecoin-related assets have been on a tear.

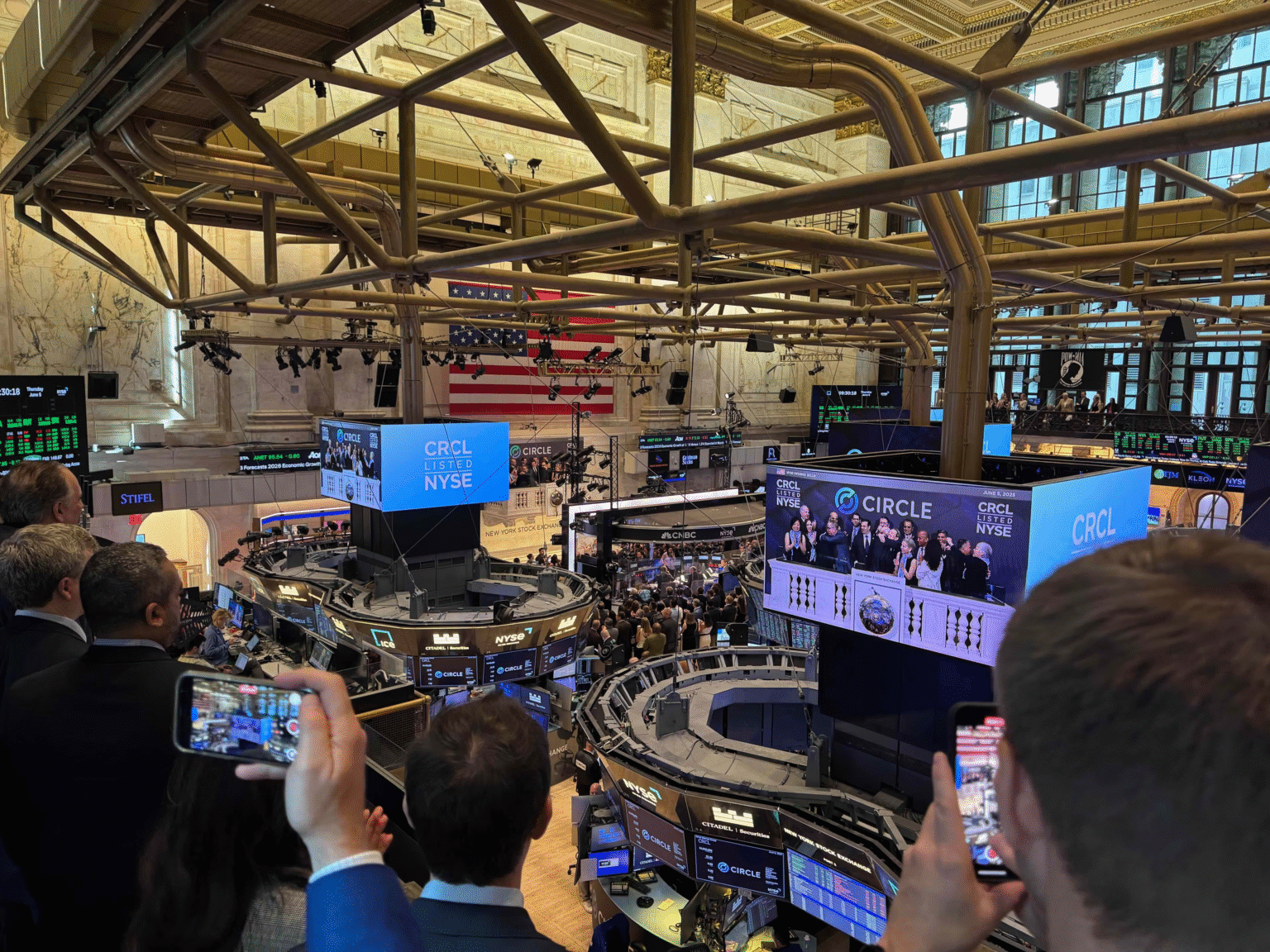

Circle, issuer of USDC, has seen its stock rise about 500% since its debut on June 5. This week, the company was valued at a staggering $77 billion, which is well above the total market cap of USDC itself (about $62 billion).

Bullish signals for stablecoins were all around:

CRCL is now the most popular foreign stock in South Korea.

The leading stablecoin issuer, Tether, has so much spare cash it can afford to have a determinative stake in Juventus, an Italian soccer team.

Coinbase, which actually makes more money from USDC than Circle, has seen its stock rise to its highest level in four years.

Even Euro-backed stablecoins, long a forgotten cousin of USD coins, are surging. Combined, they’re up 44% on the year, led by Circle’s EURC.

Stablecoins are the “quiet winners” from prediction markets like Polymarket.

And so on.

Traditional payment giants, like Mastercard and Visa, have been responding to stablecoin mania by making a flood of announcements of their own. Mastercard announced new tie-ups with Moonpay, Chainlink and Kraken this week.

Amid all the stablecoin news, we still had space for plenty of other topics.

SEI surged as well (albeit on stablecoin news).

The Federal Reserve officially said crypto no longer carried “reputational risks” for banks, leaving them to provide all the financial services they want for crypto companies.

World Liberty Financial, the Trump family vehicle, reversed a promise to make its token non-transferable.

In the summer months, sometimes it can feel like nothing much is happening. Not this year; crypto doesn’t wait for anyone.

Read the full article here