MANTRA (OM) price has retested the 50-day EMA mark and was at its pivotal juncture. Recently, the altcoin hit a fresh all-time high of $1.62 and has retraced over 15%.

Currently, the positioning of the MANTRA token highlighted a bullish bias as it stays above the 61.8% Fibonacci retracement level. The token remained near the upper Bollinger band.

The ability of the OM price to break the recent ATH would signal a significant shift in its market trajectory. This could indicate a further bullish continuation to capture the $2 mark ahead.

– Advertisement –

The price retracement comes as its daily trading volume declined over 40%. That hinted at a lack of seller interest. Recently, MANTRA crypto has launched its mainnet. It aims to bring real-world assets (RWAs) on-chain, making a significant step in blockchain technology.

Despite the mainnet launch, the OM token’s price remained flat at around $1.37. It noted an intraday price decline of over 2.19% and a weekly surge of over 7.39%.

OM Price Analysis: Is a Surge Toward $2 Mark Next?

The technical analysis of OM crypto in the daily timeframe revealed a mixed cue. If the OM price exceeds $1.50, there is a likelihood of a significant upward movement toward the $2 mark.

It has retested the 50-day EMA mark and aims for a rebound. It has continued to surge within the rising wedge formation for the past few weeks. The short-term bullish trend was intact. Also, a rebound from the $1.30 mark is likely.

OM Price Chart | Source: TradingView

The Relative Strength Index (RSI) curve was close to the midline region, around 47. It mirrors a convergence of the signal line with the RSI line. It resembled indecisiveness among the market participants.

After a massive price rally of over 80% in the last three months, a minor profit booking at the higher levels was usual. However, the bull army maintained their upper hand and eyes to catch the $2 mark ahead.

MANTRA Bright Outlook: Analyst Weighs in on Favorable Factors

In a recent tweet on X, ImZiaulHaque highlighted multiple positive factors about the OM price. The current positioning of OM in Real World Asset (RWA) is considerable. With a Total Value Locked (TVL) of $5.95 Billion, experts weigh a bullish outlook.

https://twitter.com/ImZiaulHaque/status/1852974623794831432

OM crypto has strong fundamentals. Its mainnet was live, and 36% of the supply was staked. MANTRA uses the Cosmos SDK to build custom blockchains and IBC protocols for smooth communication across different blockchains. It boosts connectivity and interoperability.

The strategic partnership of MANTRA with Libra Capital and Google Cloud has guided the strong development activity in its ecosystem.

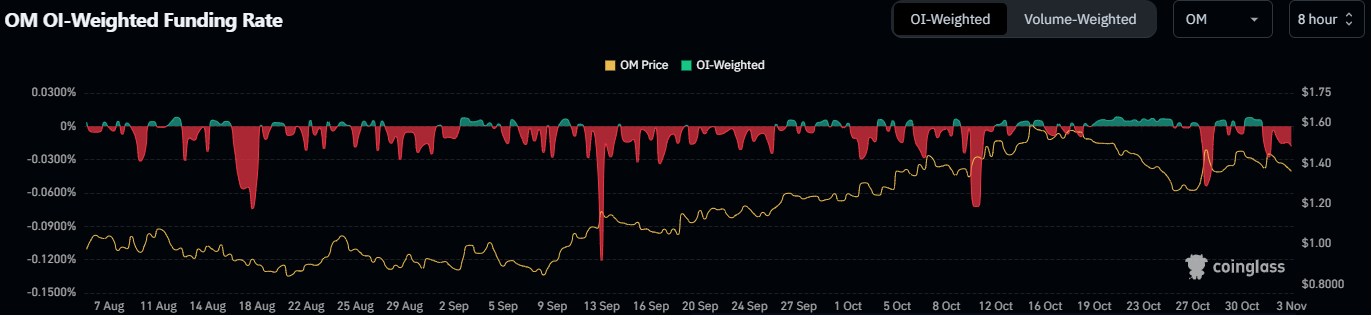

Futures Market Data Reveals Mixed Outlook

The OI-weighted funding rate stayed in the negative region, -0.0146% at press time. This negative reading highlighted that market participants were not confident buying the OM token. Also, significant demand for the short positions was highlighted.

Open Interest Data | Source: Coinglass

The Open Interest (OI) has dropped over 4.30% to $37.84 Million. It revealed a long, unwinding move over the past 24 hours. The immediate support zones for OM were $1.23 and $1.10. In contrast, the upside hurdles were $1.45 and $1.60.

Read the full article here