Cardano (ADA) has reclaimed the $1 mark for the first time since April 2022, marking a significant milestone in its recovery. Over the past 24 hours, ADA surged more than 25%, reaching a high of $1.09.

This remarkable rally has sparked optimism among traders and analysts, with many suggesting that the current momentum could be the start of a much larger price movement.

Expert analysis and market dynamics

Notably, crypto trading expert Ali Martinez highlighted that Cardano’s recent rally mirrors its previous bullish cycles. Over the past three weeks, ADA has surged nearly 200%, driven by robust on-chain activity, technical indicators, and significant whale participation.

Martinez points out that these factors indicate sustained bullish momentum, suggesting the possibility of further price gains.

One of the key drivers of ADA’s surge has been whale accumulation. Wallets holding between $1 million and $10 million ADA have doubled their holdings over the past month, pushing large transaction volumes to over $22 billion per day.

This accumulation phase reflects strong confidence among major investors, which historically signals the potential for extended upward movements.

Key support levels

While ADA is now trading at $1.08, analysts emphasize the critical importance of the $0.80 support level, which laid the foundation for the current rally.

On-chain data reveals that 48,000 addresses accumulated approximately 1.2 billion ADA between $0.78 and $0.80, creating a robust price floor.

This accumulation phase has now translated into a solid base, allowing ADA to climb above $1 with confidence. Maintaining this foundation provides strong downside protection should the market face any corrections.

With Cardano firmly above $1, analysts are now eyeing higher resistance levels. Over the longer term, historical price patterns suggest that ADA could climb as high as $6, provided it sustains its bullish momentum.

Trading Shot’s analysis also aligns with this bullish outlook, highlighting that ADA is poised for further upward continuation after forming a one-day golden cross, its first since November 2023. This significant technical signal suggests a strong shift toward bullish dominance, with the next key target set at $1.40.

Derivatives market and investor sentiment

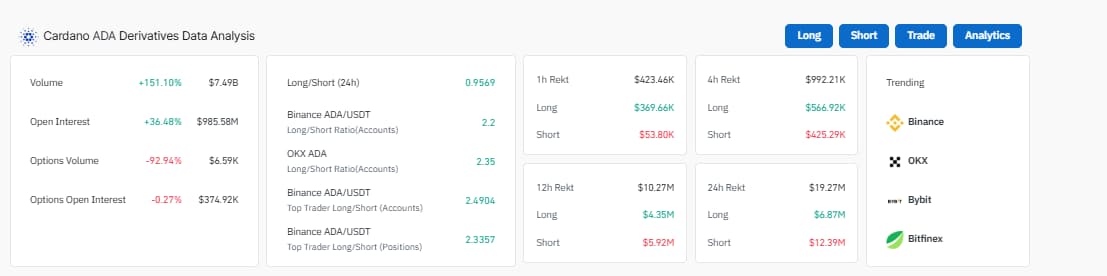

ADA’s bullish case is further supported by a surge in derivatives market activity. According to data from CoinGlass, trading volume has surged by 151.10% to $7.49 billion, reflecting heightened market participation and enthusiasm.

Open interest has also risen by 36.48%, reaching $985.58 million, suggesting increased confidence among traders opening new positions.

Long/short ratios on major exchanges such as Binance and OKX reinforce this sentiment, with ratios of 2.2 and 2.35, respectively, showing that long positions far outweigh shorts.

Top trader activity on Binance mirrors this trend, with long positions dominating accounts at a ratio of 2.4904 and positions at 2.3357.

Additionally, liquidation data reveals that over the past 24 hours, short liquidations of $12.39 million have far exceeded long liquidations of $6.87 million, suggesting a short squeeze that often propels prices upward.

With Cardano gaining traction across leading platforms, the data signals robust bullish momentum, making it an attractive opportunity for investors and traders seeking short-term gains.

Moreover, social media discussions around Cardano are at an 11-month high, as noted by data from Santiment.

Over the past 17 days, Cardano has tripled its market cap, demonstrating extraordinary growth and renewed enthusiasm among investors. Recently, ADA recorded over $165 million in realized trader profits, the highest in eight months. This surge in social and market activity signals growing community engagement and optimism about Cardano’s long-term potential.

More bullish projections

Adding to the optimism, analyst Av_Sebastian observes that ADA appears primed for further gains. While the RSI at 84.60 suggests ADA is overbought, hinting at a possible short-term pullback, the newly established support levels at $0.90 and $0.80 provide stability.

The breakout from the bullish triangular pattern indicates potential upward continuation, with $1.25 as the next target.

ADA price analysis

At press time, Cardano was trading at $1.08, with a one-day gain of 24%. On the weekly chart, ADA remains up 41%, highlighting its strong recovery and bullish potential.

As Cardano sustains its upward trajectory, analysts are closely watching for further breakouts, suggesting the current rally could signal the start of a more extended bullish cycle.

Featured image via Shutterstock

Read the full article here