Crypto cards are beating traditional banks in Europe when it comes to small purchases, with 45% of crypto-linked card transactions under 10 euros ($11.7) — a category where cash has historically dominated.

According to a report by CEX.IO shared with Cointelegraph, crypto card holders are showing spending patterns that mirror traditional bank card users while embracing online payments at a faster pace.

The report noted a 15% rise in newly ordered CEX.IO crypto cards across Europe in 2025, signaling growing interest as more Europeans turn to digital assets for everyday payments.

Furthermore, while European Central Bank data shows 21% of all card payments across the euro area are online, CEX.IO’s figures reveal crypto card users already conduct 40% of their transactions on the internet — nearly double the average.

Related: Kraken taps Mastercard to launch crypto debit cards in Europe, UK

Crypto cards used for everyday spending

Spending patterns show crypto cardholders are using their cards for everyday spending. According to CEX.IO data, groceries make up 59% of purchases, near the ECB’s 54% benchmark, while dining and bars account for 19%, above the average for in-person food and drink spending.

Notably, the average crypto card transaction sits at 23.7 euros ($27.8) compared to 33.6 euros ($39) for bank cards, based on Q1 2025 Mastercard data.

“What we’re seeing in Europe is that crypto card users aren’t just experimenting with new tech — they’re showing us what everyday spending might look like in a truly cashless future,” said Alexandr Kerya, vice president of Product Management at CEX.IO.

“With average card payment volume rising 24% in just the last month, this shift is clearly gaining momentum,” he added.

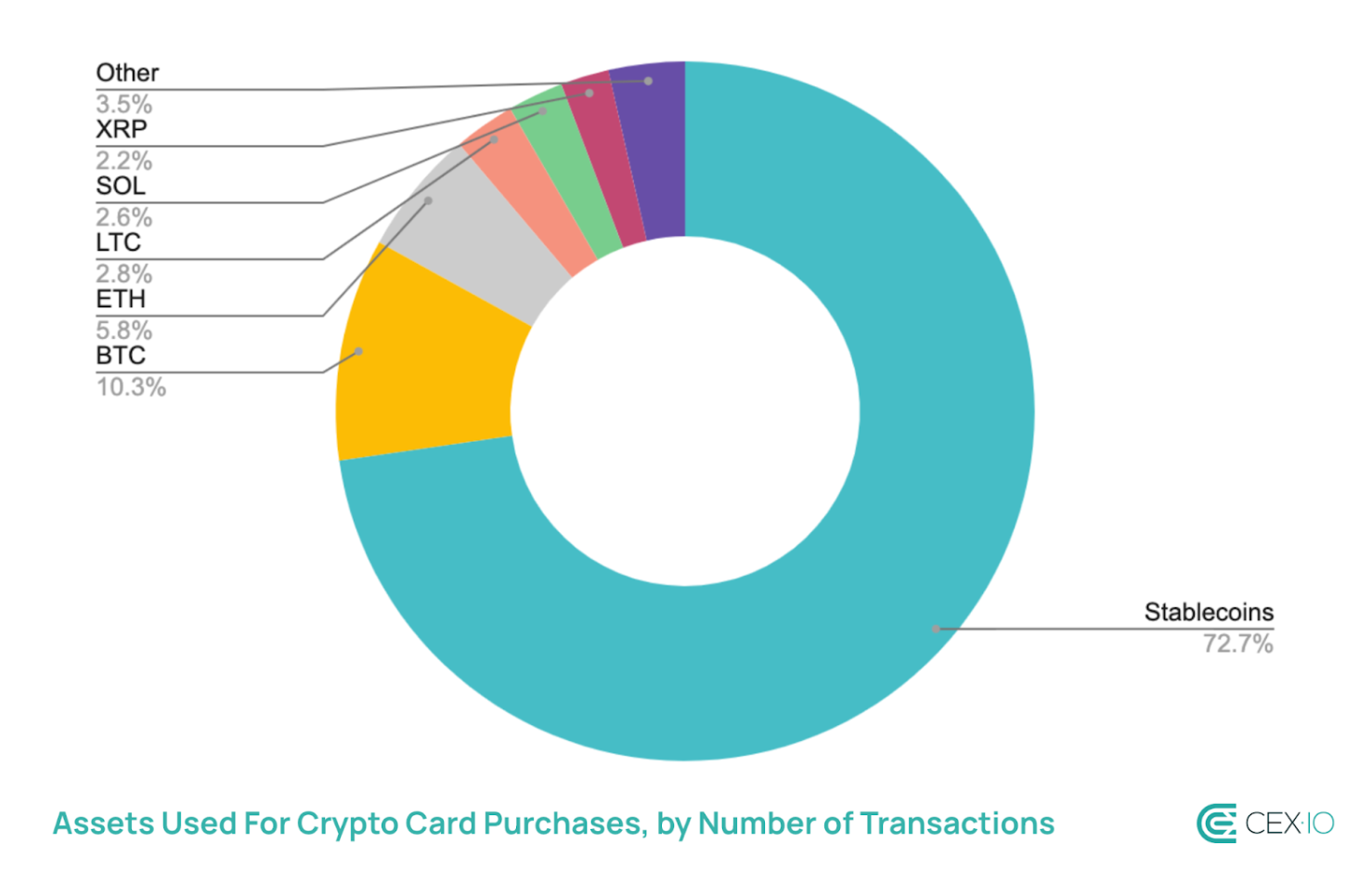

The data further shows that stablecoins power 73% of transactions, with other major cryptocurrencies like Bitcoin (BTC), Ether (ETH), Litecoin (LTC) and Solana (SOL) also being used for groceries, dining and transportation.

The trend is consistent across other providers. For instance, Oobit reported strong spending on everyday essentials among European users, while Crypto.com noted similarly high volumes in online shopping transactions.

Related: Floki, Mastercard launch 13-crypto debit card in Europe

Barclays to block crypto purchases on credit cards

Despite the surge in crypto card adoption, Barclays has announced plans to ban crypto transactions on its Barclaycard credit cards. The bank cited fears of customers falling into unmanageable debt due to crypto market volatility and highlighted the lack of investor protections in the sector.

Barclays explained that crypto asset purchases carry no recourse through the Financial Ombudsman Service or the Financial Services Compensation Scheme if something goes wrong, leaving consumers exposed.

Magazine: GENIUS Act reopens the door for a Meta stablecoin, but will it work?

Read the full article here