March proved to be another breakthrough month for the cryptocurrency market, with spot volumes on the 10 largest exchanges growing by an average of 119% compared to March, responding to Bitcoin’s historical highs, which tested levels above $73,000.

Trading activity among investors on the largest centralized platforms reached levels not seen since May 2021. The record-breakers over the past year, on the other hand, grew two, three, or even six times.

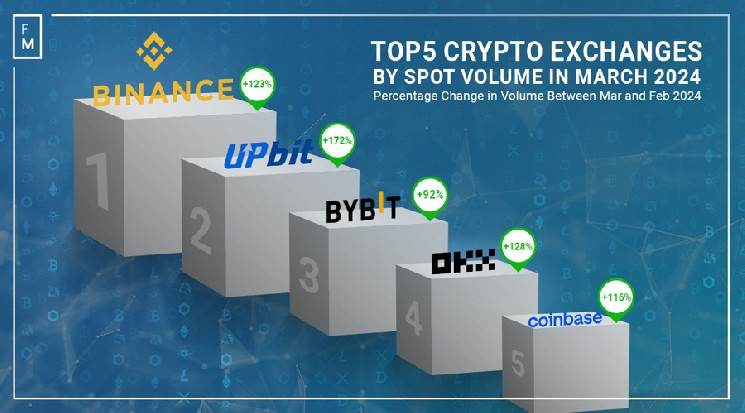

In March, Bitcoin closed its seventh consecutive month of uninterrupted growth, adding another 17% to its value and setting a new all-time high. As a result, the volumes of the most popular cryptocurrency exchanges grew dynamically, increasing on average by more than 100% compared to February.

“I believe that crypto, in general, is gaining more momentum as it finds increased use cases, shifting regulatory landscape and positive price action which indicates price recovery,” Vivien Lin, Chief Product Officer at BingX, commented for Finance Magnates. “With spot trading on the rise, we can use this a good indicator of newer entrants to trading since it is one of the most straightforward strategies.

“The combined spot and derivatives trading volume on centralized exchanges rose 92.9% to a new all-time high of $9.12tn, as traders flocked to the markets while Bitcoin also reached new all-time highs,” commented CCData in its newest market report.

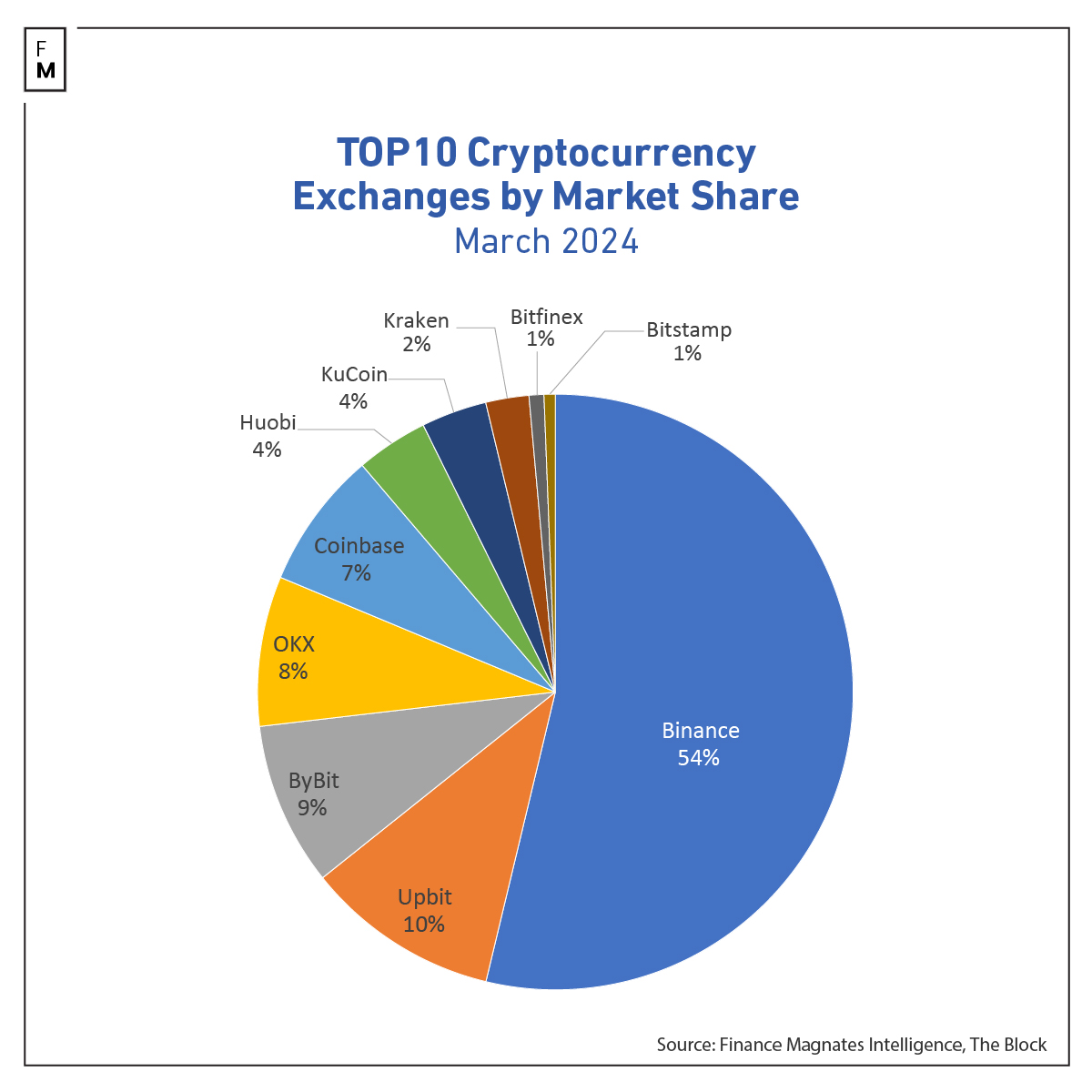

The undisputed leader of this list remains the Binance cryptocurrency exchange, whose volume increased to $1.13 trillion from $506 billion reported in February, an increase of 123%. Binance’s market share thus gained one percentage point and increased to 54%, Upbit accounted for 11% of all activity, ByBit for 9%, and OKX ranked fourth with 8%.

“Spot trading volumes continue to outpace the derivatives markets, with volumes rising 108% to $2.94 trillion, the highest monthly figures since May 2021,” added CCData.

Record Annual Volume Growth, ByBit Up 600%

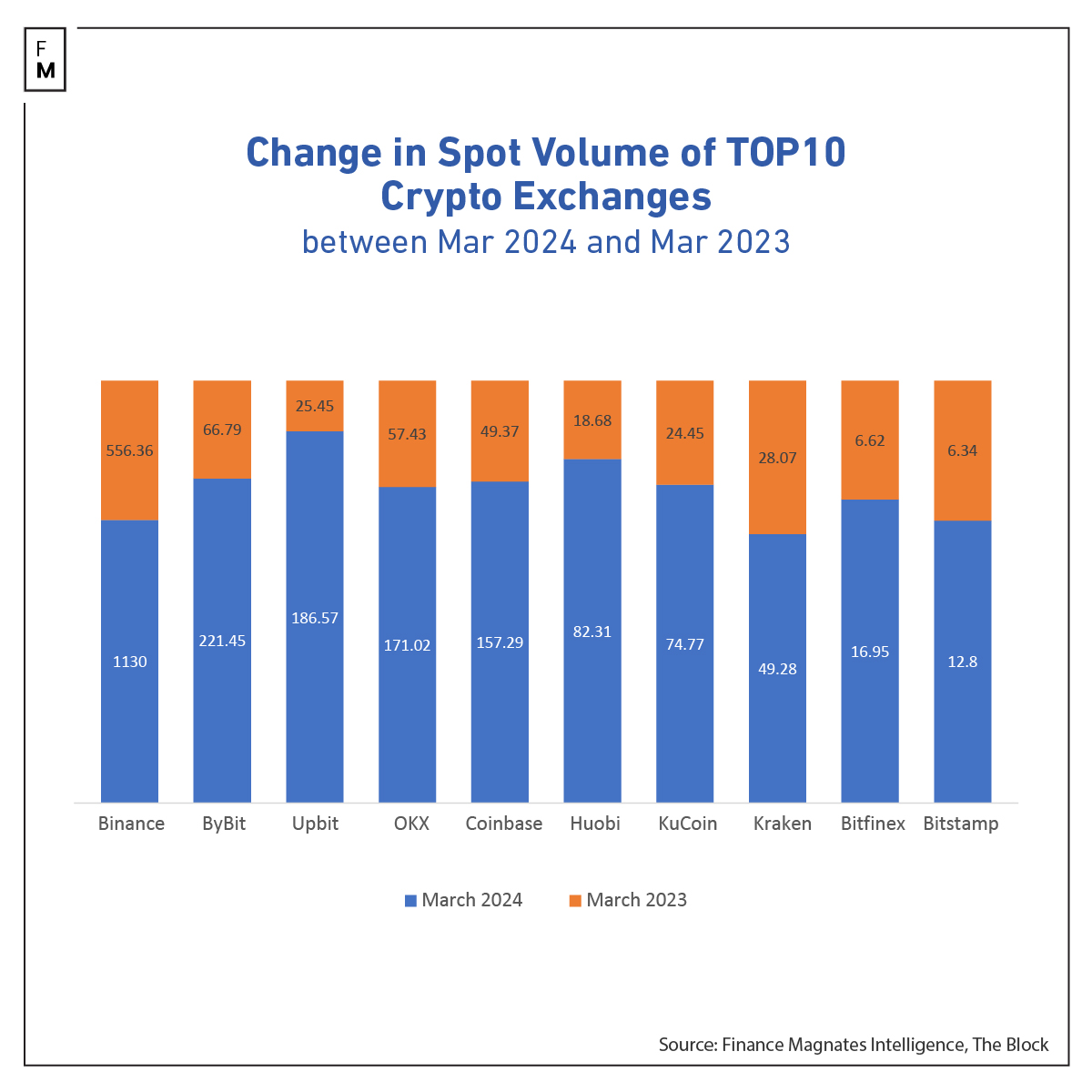

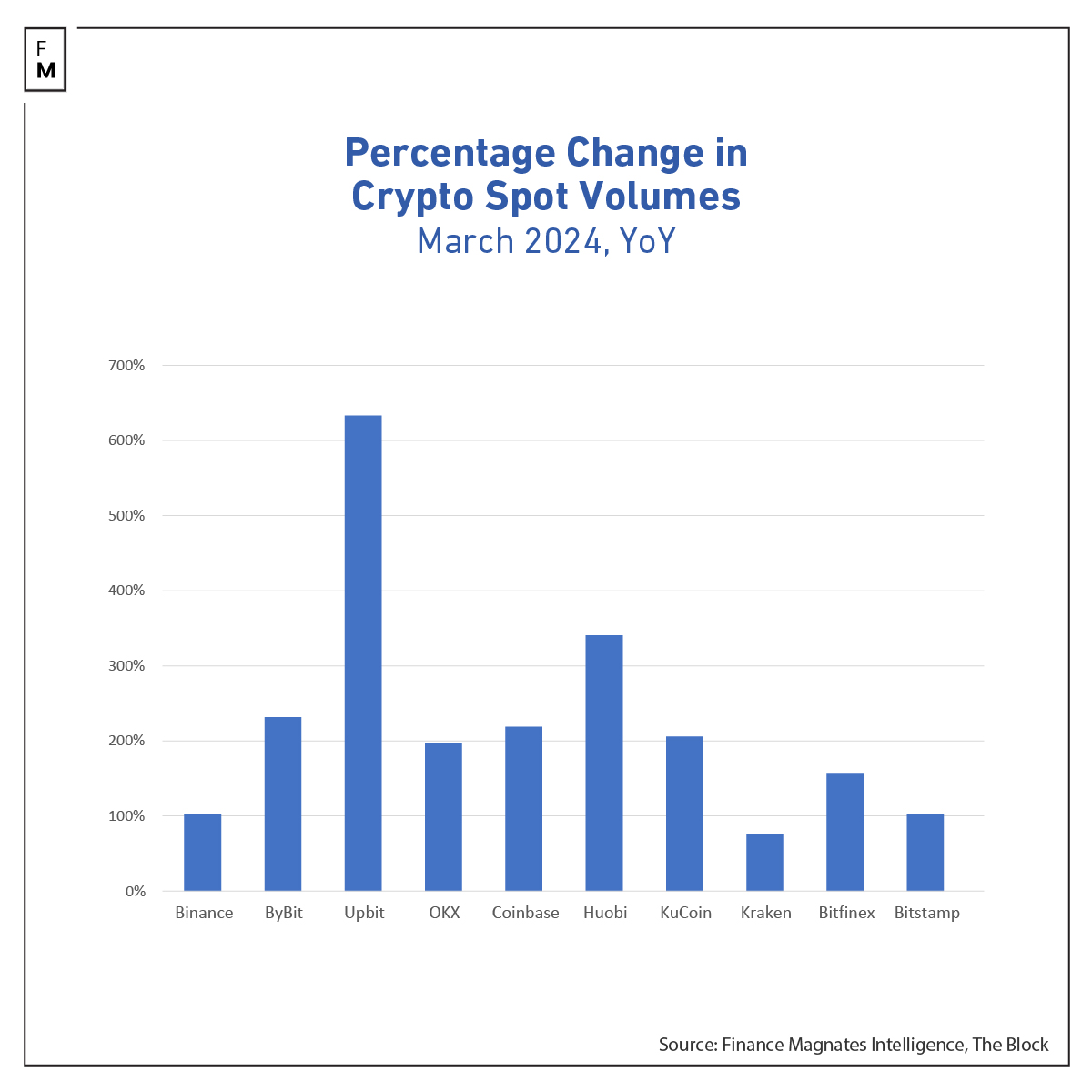

Although the monthly increases are impressive, the average annual increases were more than 150%, and the record-breakers gained much more.

“A resurgent cryptocurrency market has defied the naysayers who dismissed the rapidly evolving digital token space as nothing more than hype,” commented Aviessa Khoo, the Executive Director at Mercuryo Singapore.

Among them, the ByBit exchange recorded the largest development, with volumes growing 633% from $25 billion to $189 billion compared to March 2023. Huobi ranked second in this list, with growth amounted to 341% from $19 billion.

Upbit, Coinbase, and KuCoin volumes grew over 200% year-on-year (YoY). The remaining exchanges grew over 100%, with Kraken being the only exception. Its volume increased YoY 76% to $49 billion from $28 billion reported in March 2024.

The market is keenly anticipating the upcoming halving event, scheduled to occur in just two weeks. Historically, halvings have led to substantial increases in Bitcoin’s price, and analysts already speculate that it could soon hit six-figure prices. The increasing importance of the newly introduced crypto spot ETFs cannot be forgotten.

“The total market cap of crypto in general is predicted to rise greatly by end of year,” forecasted Lin. “With new institutional entrants, an upcoming halving and growing retail demand, these factors combined with a larger trader base make for building a healthy ecosystem.

Read the full article here