Ethereum (ETH) has been trading within a broad consolidation range of $2,800 to $4,000 for nearly 10 months, signaling a phase of market indecision.

Notably, an analysis by CredibleCrypto suggests this range could be an ideal entry point for investors, as Ethereum gears up for a potential breakout.

Ethereum’s consolidation phase

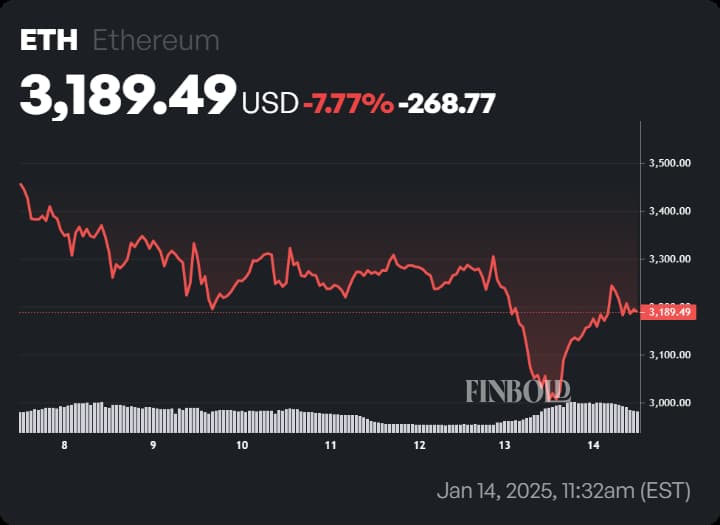

Currently trading near $3,189, Ethereum is positioned just above the lower boundary of its 10-month consolidation range. After briefly climbing to a local high of $3,716, Ethereum has undergone a correction, which analysts see as part of a broader accumulation process.

This extended sideways movement is seen as a precursor to a bullish move, aligning with historical patterns observed before major price rallies in the cryptocurrency market.

CredibleCrypto has identified the high timeframe (HTF) demand zone between $2,400 and $2,800 as the ‘ultimate buy zone.’ This region is considered a critical support level where downside risks are minimal, and the potential for substantial upside is strong.

“I don’t think you can go wrong picking up some ETH at the HTF demand zone at range lows if/when we get there. This is the region between $2400-$2800.This is the ultimate buy zone on ETH”

Historically, such zones within accumulation phases have served as launchpads for significant bullish trends, and Ethereum appears to follow a similar trajectory.

ETH breakout potential and price targets

The consolidation phase suggests that Ethereum is building momentum for a breakout above the $4,000 resistance level.

A successful breach of this range could see Ethereum targeting its prior all-time high of $4,891, with the potential to surpass this level as the market gears up for the next bull cycle.

Echoing this sentiment, Crypto Patel identifies an accumulation zone between $2,900 and $3,150, which has already been tapped.

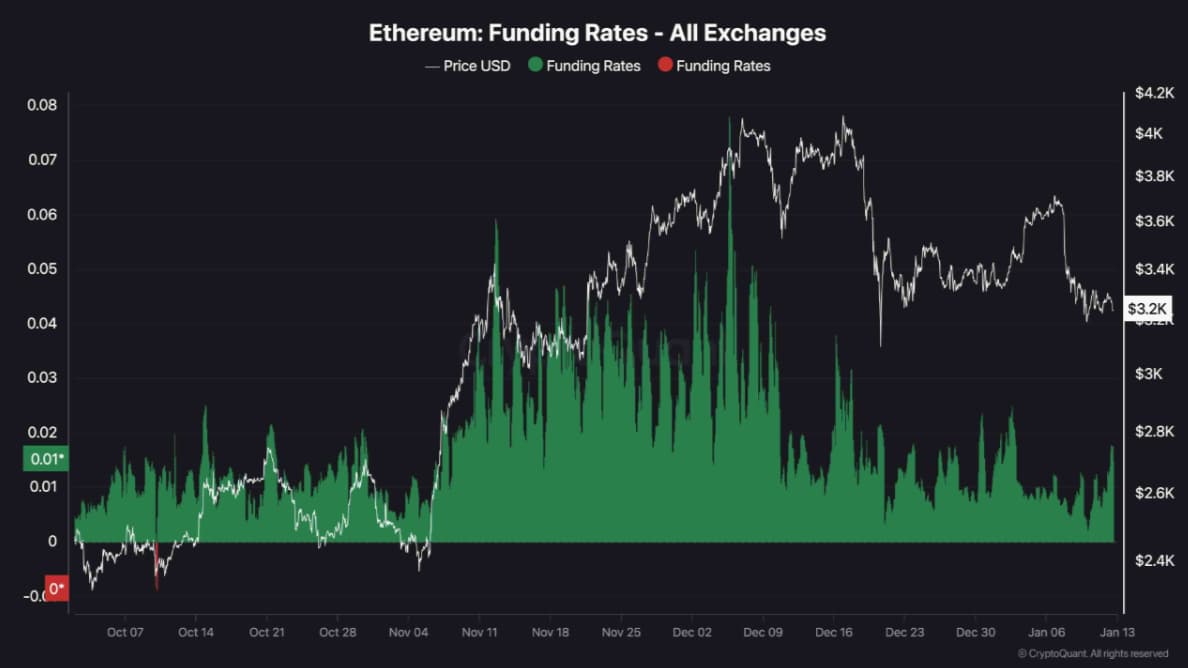

However, as Ethereum approached the critical $3,000 support level, funding rates began to recover.

A bullish spike in the metric indicates renewed buying interest, with traders starting to open long positions in anticipation of a price rebound.

If this trend continues, it could signal growing demand and the likelihood of a sustained rebound from the $3,000 support. However, if the recovery in funding rates stalls or reverses, it could pave the way for renewed bearish sentiment and a deeper correction.

Ethereum (ETH) price analysis

At press time, Ethereum was trading at $3,189.49, posting a daily gain of over 4%. However, the cryptocurrency remains down by more than 7% on the weekly chart.

Despite the recent volatility, strong support zones, recovering market sentiment, and bullish technical setups suggest Ethereum’s current price action presents a compelling opportunity for long-term investors preparing for its next potential rally.

Featured image via Shutterstock

Read the full article here