Twelve cryptocurrencies will unlock nearly $300 million in previously non-circulating supply this week, raising concerns as sales could intensify. Among these unlocks, three projects alone will release over $220 million, to which traders and investors should give special attention.

The cryptocurrency investing game has changed in the past few years, highly weighted toward venture capitalists (VCs) and vesting contracts. With that, scheduled token unlocks gained increased importance in this market’s dynamics as they can directly pressure prices downwards.

In the next seven days, twelve cryptocurrencies will unlock $291.59 million, of which 75% will come from three projects. Finbold retrieved this data on September 29 from the TokenUnlocksApp platform, actively monitoring scheduled and linear unlocks.

Notably, the three most significant unlocks will happen on Sui (SUI), Optimism (OP), and ImmutableX (IMX). Each unlock represents 2% to 2.5% of their circulating supply, potentially flooding the market with early investors’ exit liquidity.

Sui (SUI) to unlock over $105 million in October

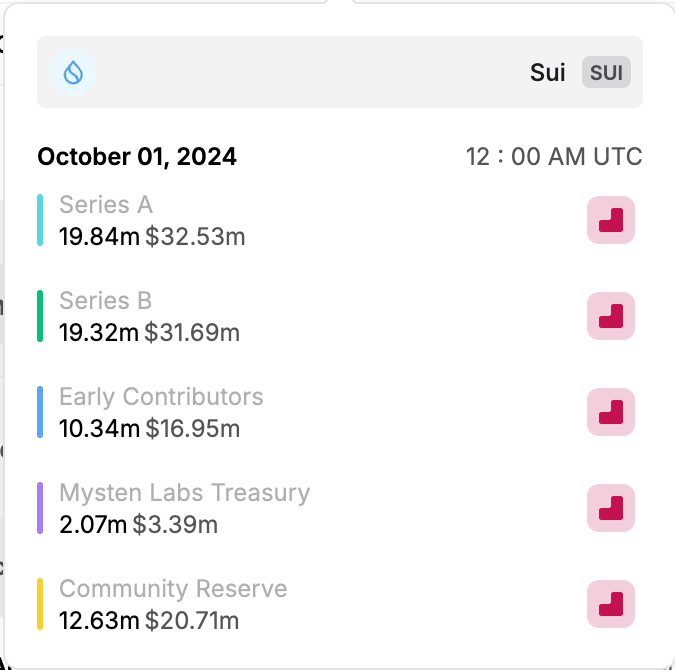

First, Sui contracts will unlock 64.20 million SUI on October 1, currently worth $105.28 million, at $1.63. This amount represents 36% of all unlocks this week and 2.4% of Sui’s circulating supply.

According to the schedule, Series A and B private investors will receive 39.16 million SUI, worth $64.22 million. These entities are likely to strategically sell the unlocked vesting contracts in the following days to realize the earlier investment.

The remaining 39% of all released SUI this week will be distributed to “Early Contributors,” the Mysten Labs Treasury, and a community reserve controlled by Mysten Labs.

Optimism (OP) and ImmutableX (IMX) unlocks this week

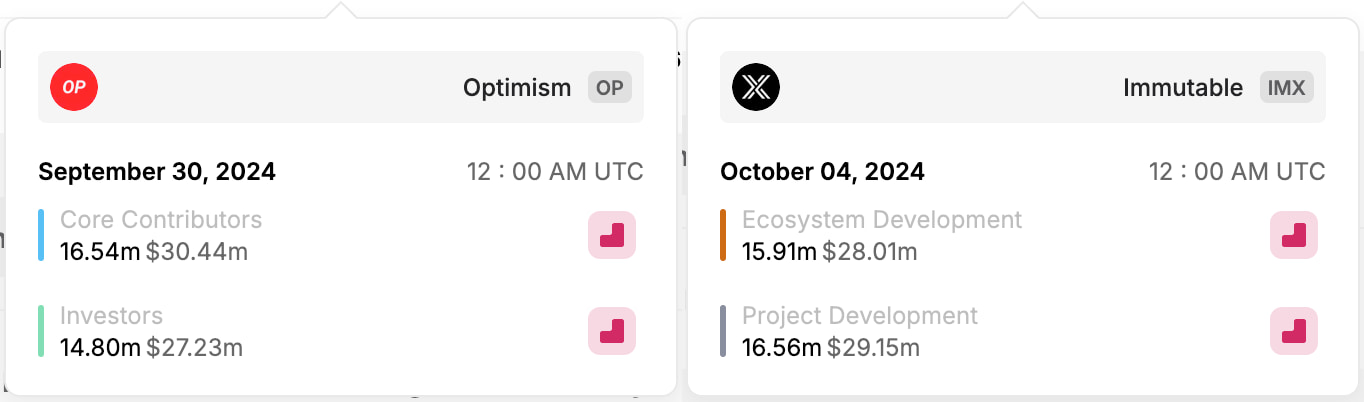

Next, Optimism and ImmutableX will each unlock approximately $57 million of 31.34 million OP and 32.47 million IMX.

Optimism will be the first, with its unlock scheduled for September 30, while ImmutableX will do it on October 4. Both will distribute the tokens almost equally between two subgroups each. Namely, “Core Contributors” and “Investors” for Optimism, and “Ecosystem Development” and “Project Development” for ImmutableX.

Overall, cryptocurrency tokens have been used to fundraise startups and give early investors easy exit liquidity. This is a far different dynamic than first- and second-generation blockchains, which brings advantages and disadvantages.

Justin Bons, for example, believes the crypto market is “dominated by predatory VCs,” as Finbold reported in June. The founder and CIO of Europe’s oldest cryptocurrency fund explained how it completely changed the game of investing in cryptocurrencies.

So, while the exit liquidity is welcomed by highly capitalized institutional players who can participate in private rounds, retail investors are mostly punished by entering projects with plenty of incoming unlocks as they become the exit liquidity.

For this week, traders and investors should closely monitor SUI, OP, and IMX, ideally avoiding big exposures as sales occur.

Read the full article here