Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

The recent Movement Foundation (MOVE) token meltdown, where a market maker seemingly dumped millions of tokens immediately after listing, is yet another case study in web3 market dysfunction. Crypto is rooted in innovation and technical rigor, but too often, it lacks something more fundamental: operational and financial maturity.

You might also like: Hackers keep exploiting audited DeFi protocols: What’s missing? | Opinion

Most web3 tokens are launched by teams with strong technical ability, but less financial experience or discipline. These are teams of engineers and visionaries—builders with deep protocol expertise but little understanding of capital markets, liquidity mechanics, or go-to-market execution. As a result, token launches are often rushed, chaotic, and dangerously underplanned.

Critical elements like tokenomics, liquidity provisioning, and post-launch market behavior are often treated as secondary concerns—or worse, left to “figure out later.” And while a project’s code might be secure and the community energized, these financial blind spots turn what should be pivotal milestones into credibility-shattering misfires.

Setting baseline standards for launches

Crypto doesn’t need to reinvent the wheel. It just needs to adopt a few baseline standards that bring professionalism and predictability to the token launch process.

Token launches need to be treated as market entry events, not just celebratory milestones. Every token launch team should have someone responsible for financial modeling and market execution—whether that’s a full-time hire, a trusted advisor, or a strategic partner—and projects should develop detailed strategies for liquidity, investor communications, token release schedules, and post-launch support. Clear narratives and economic guardrails are not luxuries—they’re launch requirements.

It’s also critical that projects implement accountability mechanisms such as real-time dashboards to monitor launch performance and formal postmortems to identify what worked and what didn’t. Launches should not happen in a fog of war. They should be measurable, reviewable, and repeatable.

Projects must make better use of existing resources. There are already tools, platforms, and experienced service providers built to support a launch strategy. Too many teams either ignore these entirely or engage with them too late.

Crypto’s lack of financial discipline—and how it’s holding projects back

The standard go-to-market process in traditional finance has been honed over centuries, and private companies that make the transition to become publicly traded companies must adhere to rigorous requirements after achieving a certain degree of maturity. Whereas sophisticated institutions guide this process in traditional markets, no such guides exist within the web3 ecosystem.

In traditional markets, no product goes to market without a CFO, a pricing strategy, and a coordinated plan for investor engagement. Yet in crypto, we regularly see projects go live without anyone with financial experience involved in the process.

Part of the problem is structural. Unlike equity IPOs, which are supported by legions of bankers, underwriters, and investor relations professionals, token launches often unfold in an institutional vacuum. There are a few trusted intermediaries. No underwriting syndicates. No standardized playbooks. Just small teams––or even individuals––trying to bootstrap their way through the most economically consequential event in their project’s lifecycle.

The consequences are predictable: many projects lack any clear ownership over financial modeling or token emissions; liquidity provisioning is often treated as an afterthought, with no coordination between exchanges, market makers, or the core team; and little attention is paid to handling price volatility and guiding investor expectations post-launch.

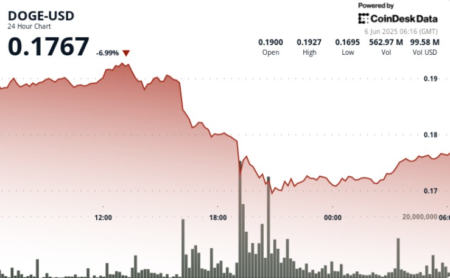

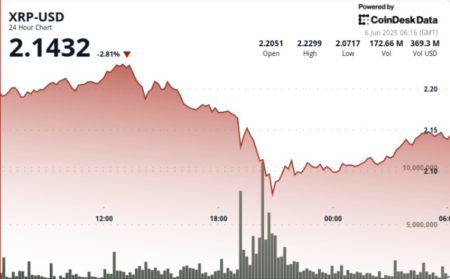

This results in launches with confusing token allocations, erratic price behavior, and fragmented liquidity, eroding public trust in crypto. Supporters lose money, projects lose momentum, and the industry as a whole takes repeated reputational hits.

Predatory advisors are a symptom of a broken system

The vacuum of professional support available to crypto founders has created fertile ground for a cottage industry of predatory “advisors.” These self-anointed experts position themselves as gatekeepers, promising introductions, guidance, and exposure, but rarely delivering results. They demand oversized fees or token allocations in exchange for little more than vague advice and a few recycled talking points. Their attention is scattered across dozens of projects, and their primary goal is resume building—not long-term outcomes.

Scan their social bios and you’ll see an endless list of tokens they’ve “advised,” regardless of whether those tokens have actually succeeded. These players offer no lasting value, functioning mainly as a parasite siphoning capital away from a project’s ecosystem, but in an environment devoid of real infrastructure, they’ve found a way to thrive. And that’s the problem: when your industry lacks credible standards, grift starts to look like guidance.

The imperative to mature: Poor planning smothers the industry at large

Crypto is no longer a sandbox. Billions in capital are at stake, institutional investors are watching, and regulators are carefully examining the space. The industry is in the spotlight, and if it wants to make a good impression, it needs to improve—fast.

We cannot afford to keep launching projects like it’s still 2017. Without better practices, crypto will continue to hemorrhage talent, capital, and public trust. Good projects will fail for preventable reasons. Bad actors will exploit confusion to grift communities. And builders will walk away, disillusioned by a system that rewards hype over substance.

Worse still, the current system distorts valuations across the industry, preventing capital from being effectively allocated. Projects with shaky fundamentals often outperform stronger competitors simply because they executed a slicker launch. Meanwhile, more robust protocols struggle to gain traction, not because of flaws in the product, but because of missteps in the rollout. Beyond being inefficient, it’s anti-meritocratic, and capitalism can’t function properly in this distorted environment.

As crypto teeters on the edge of mainstream adoption, these inadequate market dynamics become an existential concern. The next wave of adoption won’t come from retail gamblers chasing memecoins. It will come from institutions, enterprises, and builders who expect strong fundamentals. If tokens are unable to demonstrate strong fundamentals and functioning markets, they will never come at all.

‘Growing pains’ are no longer acceptable

With institutions pouring into crypto and major political figures embracing crypto-friendly platforms, the opportunity for web3 to step into the mainstream has never been greater. But if we don’t raise our standards, we risk squandering that opportunity. The world is watching. And what they see right now is chaos.

If web3 wants a seat at the global financial table, it must prove it deserves one. That means treating every token launch not as an art project or product reveal, but as a financial product rollout. With the right people, tools, and systems in place, we can stop launching into disorder—and start building a more credible, stable, and trusted ecosystem.

Read more: Rethinking money in the web3 era: From capital to code, narrative, and moral design | Opinion

Shane Molidor

Shane Molidor is the founder and CEO of Forgd, a token advisory and optimization platform that provides seamless access to essential tools for blockchain projects.

Read the full article here