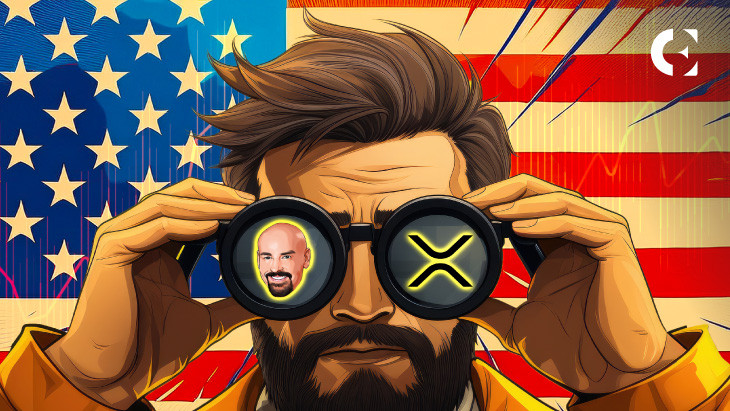

Crypto markets are closely monitoring Massachusetts today as attorney John Deaton challenges Senator Elizabeth Warren, in a Senate race that could shape the future of U.S. crypto policy. Deaton, a well-known pro-XRP attorney, opposes Warren’s proposed Digital Asset Anti-Money Laundering Act, a measure he claims would limit regular Americans’ ability to hold and self-custody Bitcoin and other crypto assets.

Deaton, who has represented XRP investors in the SEC lawsuit, argues that Warren’s bill would essentially restrict digital assets to banks and institutional investors, making self-custody inaccessible for the average person.

In a post on X, Deaton argued that Warren’s bill would only allow banks, hedge funds, and elites like “the Nancy Pelosi’s of the world” to own Bitcoin. He claims the bill would ban regular people from self-custodying Bitcoin in the U.S.

Notably, a victory for Deaton could block the bill’s progress, potentially preserving individual access to cryptocurrencies. However, if Warren retains her seat, she is likely to push forward with her legislation, signaling a more restrictive crypto regulatory environment.

Trump’s Potential Impact on XRP Markets

Adding to the market’s attention, Donald Trump’s 2024 presidential bid has highlighted crypto-related pledges that could reshape regulations. Trump has proposed establishing Bitcoin as a national strategic reserve, potentially positioning the U.S. government as a major Bitcoin holder.

Meanwhile, Ripple Labs remains under scrutiny from the SEC, which is challenging a recent ruling on the Programmatic Sales of XRP. Trump has also pledged to replace SEC Chair Gary Gensler, who has spearheaded regulatory actions against Ripple Labs and other crypto firms. A Trump presidency could lead to a more lenient regulatory environment for crypto assets.

For XRP, a Trump victory could bring the potential to target its 2023 high of $0.93, while a win for Warren and Vice President Kamala Harris could push XRP below $0.45. At press time, XRP is trading at $0.5108.

Bitcoin Market Faces Increased Volatility as Presidential Election Approaches

With the U.S. presidential election set for today, Bitcoin investors are bracing for heightened market volatility. After briefly approaching its all-time high last week, Bitcoin has since experienced a pullback to $66K but is currently trading at $68,545.40.

Market sentiment suggests that a Republican victory could positively impact Bitcoin, but uncertainty remains, contributing to fluctuating price dynamics.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here