DeFi lending has hit several new milestones in June. While most of the market’s attention is on institutional investors accumulating Bitcoin, capital continues to flow steadily and quietly into lending protocols.

This trend creates opportunities for investors but also places growing responsibility on these protocols as they manage an increasing volume of funds.

Active Loans Reach All-Time High in June

According to data from DefiLlama, as of June, the total value locked (TVL) in lending protocols surpassed $55 billion, the highest level in DeFi’s history.

This figure includes all assets locked in DeFi lending platforms. It covers both assets deposited by lenders and collateral provided by borrowers.

Although TVL declined during the first three months of the year due to external concerns such as tariff wars, it quickly rebounded. The rising numbers reflect growing investor confidence in earning yield through lending.

In addition, data from Token Terminal shows that active loans reached $26.3 billion as of June 2025. This is the highest value ever recorded in the sector’s history. It represents the total value of loans borrowed by users from DeFi lending protocols.

The breakdown of active loans reveals that Aave dominates the market with $16.5 billion in active loans, over 60% of the total. Morpho ranks second with $2.2 billion, followed by Spark with $1.6 billion.

While Aave’s dominance shows strong user trust in the platform, it also means that any technical failure, security breach, or legal action against Aave could trigger a domino effect.

Booming Lending Demand Brings Growing Risk

The recent growth of high-yield stablecoins has helped attract more capital into lending protocols. Stablecoins like USDT, USDC, and DAI are designed to maintain a stable value. This reduces price volatility compared to crypto assets like ETH or BTC, making users feel more secure when lending or borrowing stablecoins.

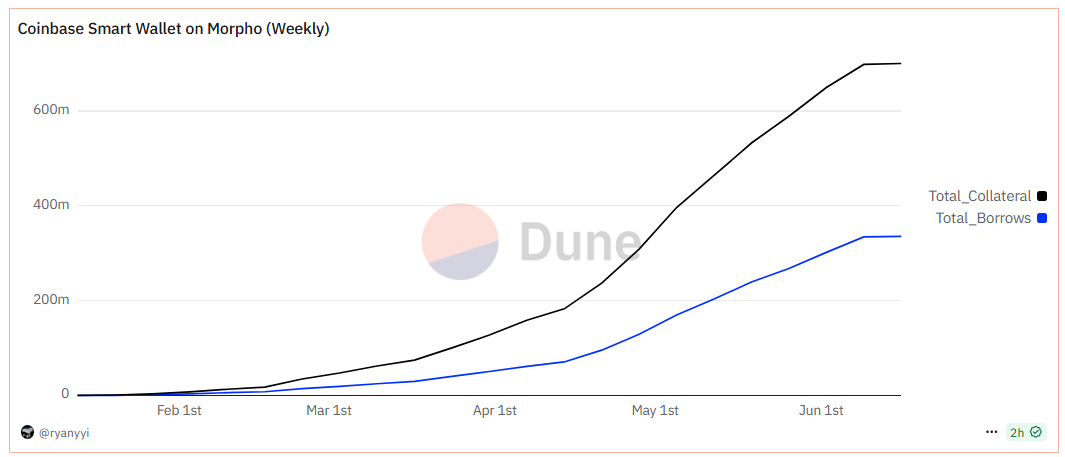

Recently, Max Branzburg, Head of Consumer Products at Coinbase, revealed that Coinbase users have borrowed $400 million in USDC at around 5% interest. This occurred within just a few months of launching the product.

One major concern is the risk of liquidation tied to loan-to-value (LTV) ratios. The LTV ratio measures the value of a loan against the collateral.

For example, Coinbase’s current LTV is 0.48. However, if the value of the collateral—typically cryptocurrencies—drops sharply, the LTV ratio can rise quickly. If it exceeds the 86% threshold set by Coinbase, the collateral will be automatically sold off to cover the loan, which could result in losses for the borrower.

Moreover, in a bullish market, investors often want to capitalize on the uptrend. They borrow funds from DeFi protocols to buy more crypto assets like Bitcoin and Ethereum. Many also use leverage to scale up their trades.

“Leverage is a double-edged sword, tread carefully crypto fam,” Investor Lil G commented.

As confidence rises, so does leverage. Any market drop of 10–20% could trigger a cascading effect. History shows that such sharp dips can still occur, especially during moments of sensitive or unexpected news.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here