Dogecoin (DOGE) price is gaining momentum as it holds a key support level, with analysts predicting a potential surge toward $4.00. Technical indicators, Fibonacci retracement levels, and growing speculative interest are fueling bullish sentiment.

Dogecoin Price Breaks Out of Key Support, Targets Higher Levels

As viewed by the market analyst Ali, the Dogecoin’s price is currently standing above the upper trend line of the long-term ascending triangle pattern which is bullish.

Analyzing the weekly frame of DOGE and studying the Ali chart, it can be seen that DOGE is trading above the 0.786 Fibonacci retracement level $0.19-$0.25 which used to be quite resistant and now supports the price.

If DOGE persists in this level, analysts believe it will target even higher resistance levels of $0.50, $1.27. It could finally reach $4.00 though Fibonacci extension. The chart shows that the bulls are realistically holding above the channel. This means that the bullish trend is still intact as the coming weeks are most important.

Another observer, Market analyst Trader Tardigrade has also stated that the Dogecoin has been in an ascending channel since 2014. Further pointing to a long term upward trend. The double-bottom formation that can be observed on lower time frames adds to the argument about an upcoming rally.

Bullish Indicators Support Dogecoin Price Breakout

Relative Strength Index (RSI) stands at 60.61, which suggests growing buying pressure. However, RSI is still below the overbought level meaning there is still room for higher prices to push through before reaching a resistance level.

4-hour DOGE trading chart | Source tradingview

Also, the Moving Average Convergence Divergence (MACD) points to a positive trend since the MACD is above the signal line. This is normally a very bullish pattern suggesting that buying pressure is picking up. In addition, the histogram bars are rising, which supports the continued bullish trend in the market.

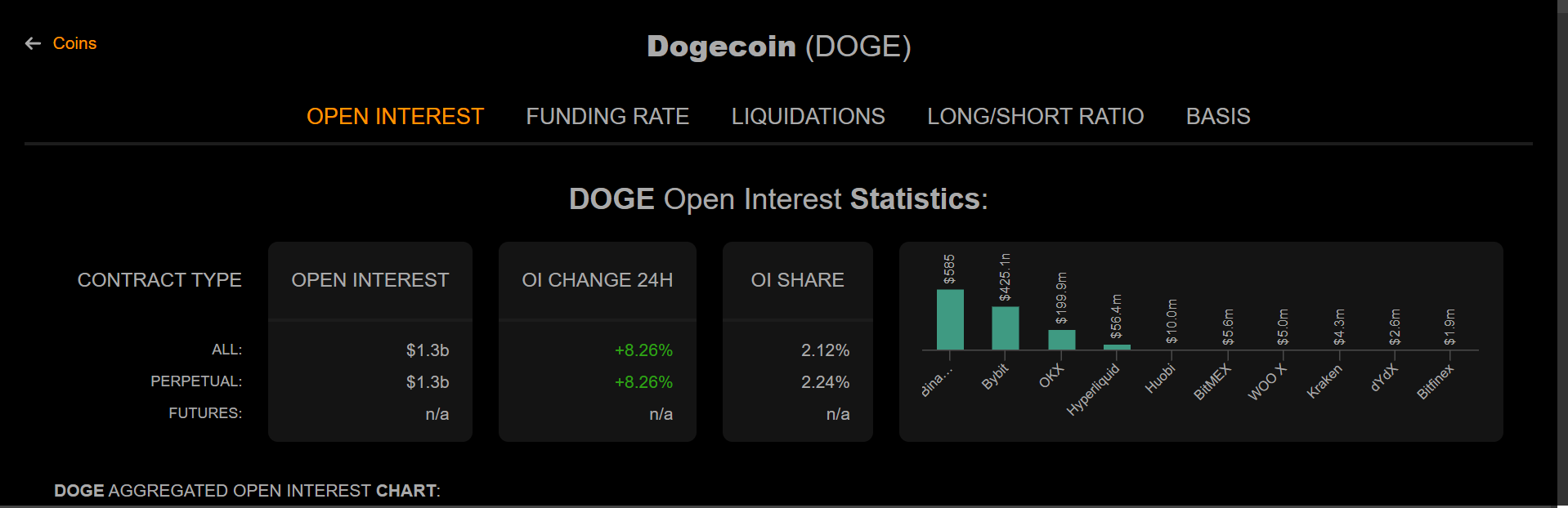

Dogecoin (DOGE) Open Interest Surges by 8.26%

OI of Dogecoin has risen by 8.26% over the last 24 hours and was recorded at about $1.3 billion in perpetually contracts. Open interest expresses the total amount of derivative contracts not yet closed and it is precious to understand the market and trader sentiment.

DOGE open interest chart

An increase in open interest indicates that more people are willing to hold long and short positions which may mean an increase in speculation among traders. This implies that greater open interest may lead to increased market volatility since more traders are engaged and can react to the prices.

Elon Musk’s D.O.G.E. Initiative Raises Eyebrows

Besides, Elon Musk and his newly launched ‘Department of Government Efficiency’ D.O.G.E.’ feature has fueled market speculations. Though the changes are irrelevant to the cryptocurrency, the branding continues the association of Musk and Dogecoin in the future developments.

The community has also put forward its opinion about how beneficial it could be if DOGE is adopted as the means to pay for products or services, including those related to U.S. Treasury services. If momentum continues to build, traders could see Dogecoin revisiting previous all-time highs, especially if wider market conditions remain favorable.

Read the full article here