Exchange-traded funds (ETFs) have become increasingly popular among retail investors in the US, with usage surging from 31% in 2018 to 47% in 2023 and expected to surpass 50% by 2025. According to a study by Broadridge Financial Solutions, Millennials and Gen-Z investors are increasing their market share and redefining investment trends by opting for self-directed investing.

The investment landscape in the United States is undergoing significant changes, driven primarily by younger generations who are embracing new strategies and tools. Since 2018, there has been a notable rise in self-directed investing, with 23% of all assets now managed through online discount brokerage platforms, up from 14%.

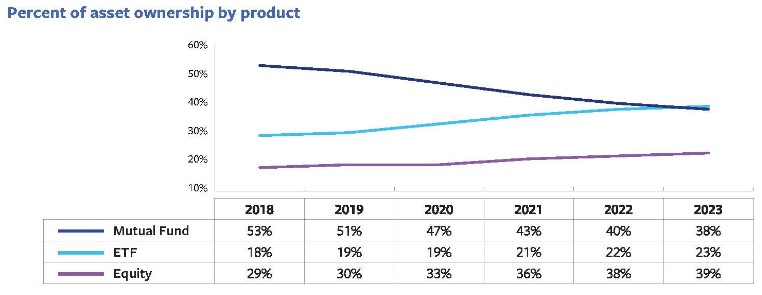

This trend is not confined to younger investors; high-net-worth individuals also prefer self-directed channels, with nearly 25% of their assets in this category. This shift highlights a broader trend among investors who are increasingly favoring ETFs and U.S. equities over mutual funds.

For the first time, mutual fund assets dropped below equity assets in individual portfolios, with ownership declining from 72% in 2018 to 62% in 2023. The count of Millennial investors has increased by nine percentage points since 2018, and they are on track to overtake Gen-X investors.

This demographic shift is accompanied by an increase in the average number of investments held by Millennials, growing from six in 2018 to ten in 2023. The democratization of investing is further evidenced by the rising share of investors without a college degree, now exceeding 50%.

Gender Dynamics in Investing

Another intriguing finding from the study is the comparison of median assets between male and female investors. Female investors now hold higher median assets than their male counterparts, with $52,105 compared to $50,271 for men. This development suggests a shift in the financial empowerment of women and highlights the growing participation of women in the investment landscape.

The appeal of mutual funds is waning, particularly among younger investors. Boomers still allocate the highest proportion of their assets to mutual funds (39%), but younger generations are increasingly looking towards alternative options such as ETFs and equities. Since 2018, Gen-Z’s equity asset ownership has doubled, Millennials’ ownership has more than tripled, and Gen-X has seen significant increases as well.

The study also highlighted the correlation between education and asset ownership. Investors with only a high school degree held significantly fewer assets ($28,332) compared to those with college ($73,044) or graduate degrees ($148,399). Despite the rise of self-directed investing, this gap underscores the ongoing disparity in financial outcomes based on educational attainment.

Read the full article here