Ethereum is facing a crucial resistance region, including the 200-day moving average and the descending wedge’s lower boundary.

The price action at this level is critical, as a potential rejection could lead to a decline toward the $2.5K threshold.

Technical Analysis

By Shayan

The Daily Chart

After rebounding from the $2.5K support region, Ethereum has experienced increased buying activity, leading to a minor surge. However, the price now confronts a significant resistance zone, which includes the 200-day moving average and the key $2.9K level.

This area is expected to be filled with supply, making it a challenging barrier for buyers to overcome. A rejection from this region could trigger another drop toward the $2.5K mark. Conversely, if Ethereum breaks above this threshold, a short-squeeze could occur, driving the price toward the $3K level.

The 4-Hour Chart

On the lower timeframe, ETH has been experiencing a period of low-volatility consolidation after breaking below the lower boundary of the descending wedge. This muted price action suggests that traders are awaiting a decisive breakout.

Presently, the asset is hovering just below a crucial resistance zone, defined by the 0.5-0.618 Fibonacci retracement levels, where increased selling pressure could emerge. However, if bullish momentum builds and the price surpasses this resistance, it could trigger a renewed upward surge. The short-term trend remains uncertain, with the next significant move hinging on how price action unfolds in the coming days.

Onchain Analysis

By Shayan

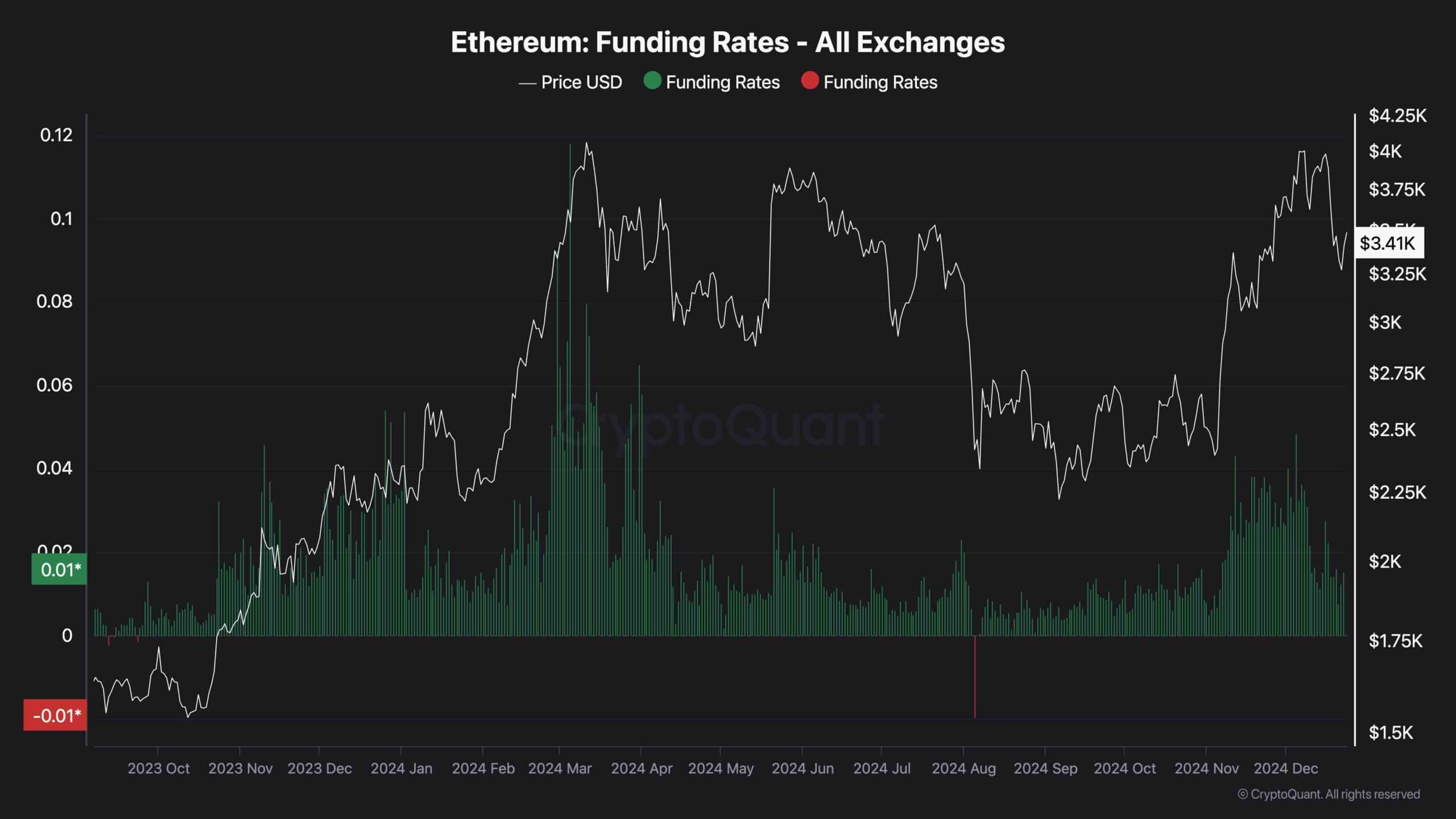

Historically, the futures market has played a crucial role in shaping Ethereum’s price movements. One key sentiment indicator in this market is the funding rate, which reflects the urgency of buyers or sellers in executing their trades.

As shown in the chart, funding rates have been trending downward amid recent market turbulence. This decline signals reduced activity in the futures market, indicating a lack of momentum for a strong, bullish move. If this trend continues, especially alongside persistent selling pressure around the $3K resistance, the market could see further declines, with sellers targeting the $2.5K level as the next key support.

Read the full article here